Access Payroll Tax Documents

Disover how to obtain full access to all payroll tax documents filed on your behalf.

Every tax document filed on your behalf can be found in your Dripos Web Dashboard.

Your tax documents are primarily split between company and employee tax documents.

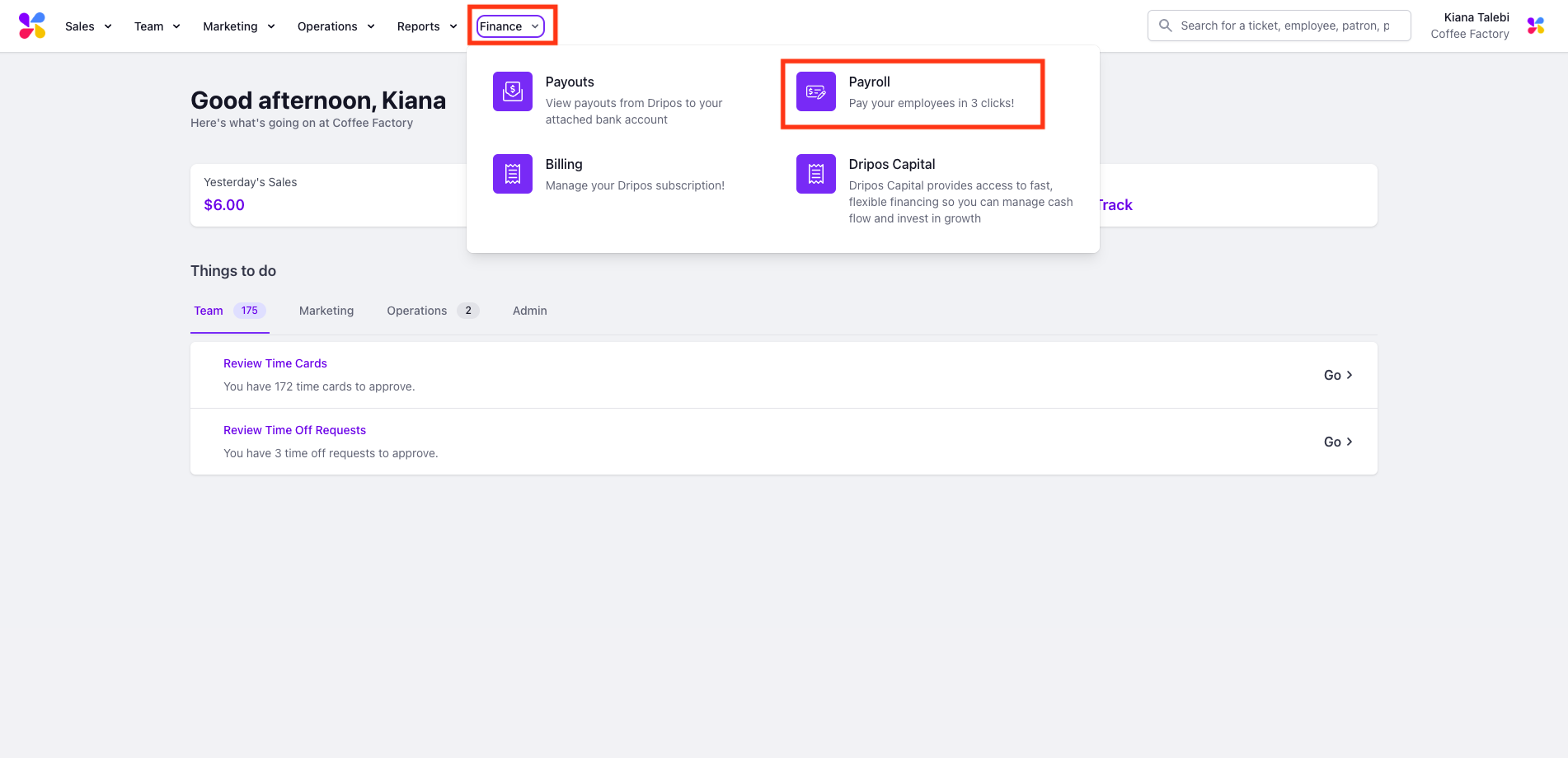

Access your Company Tax Documents on the Web Dashboard

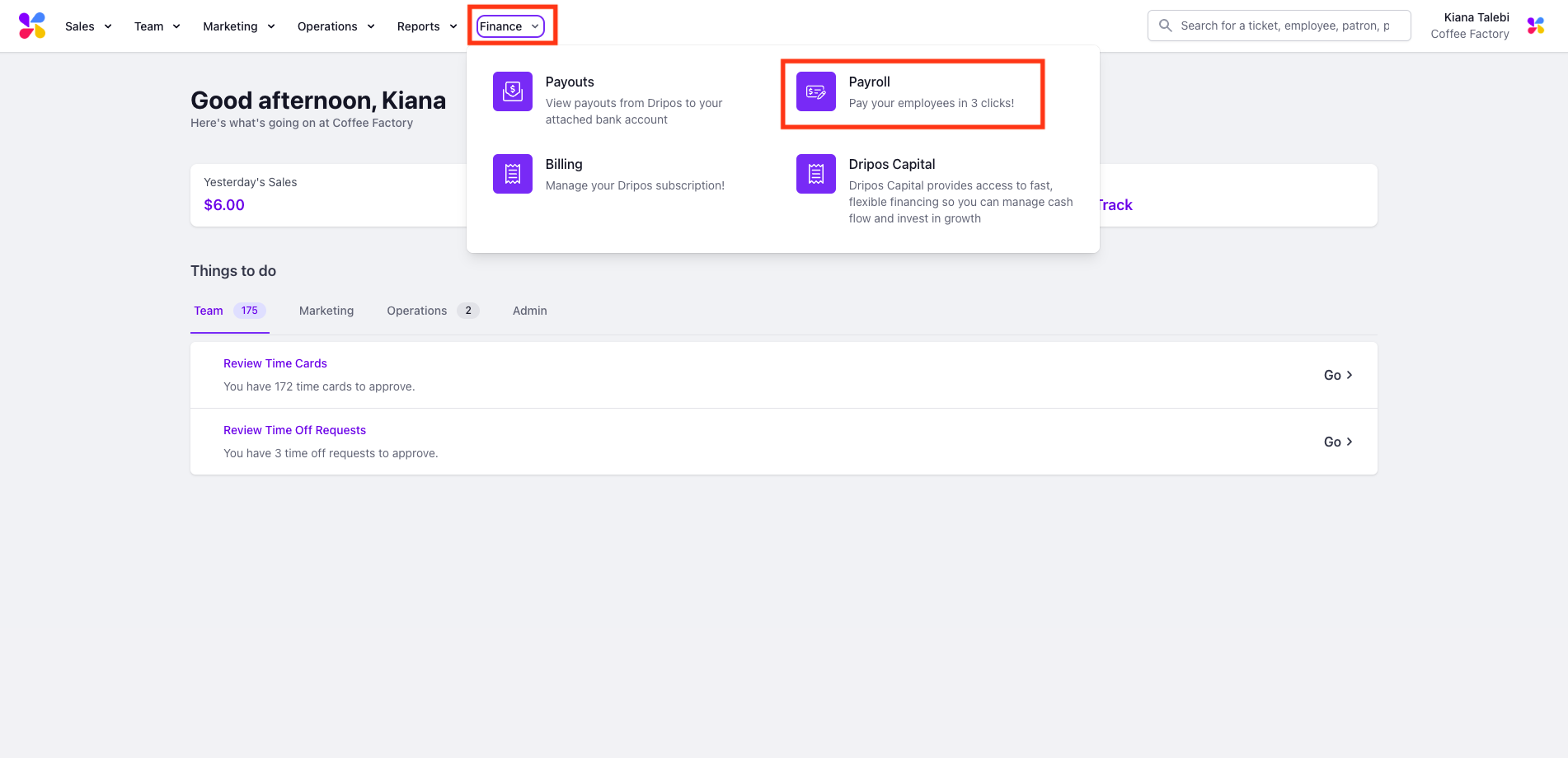

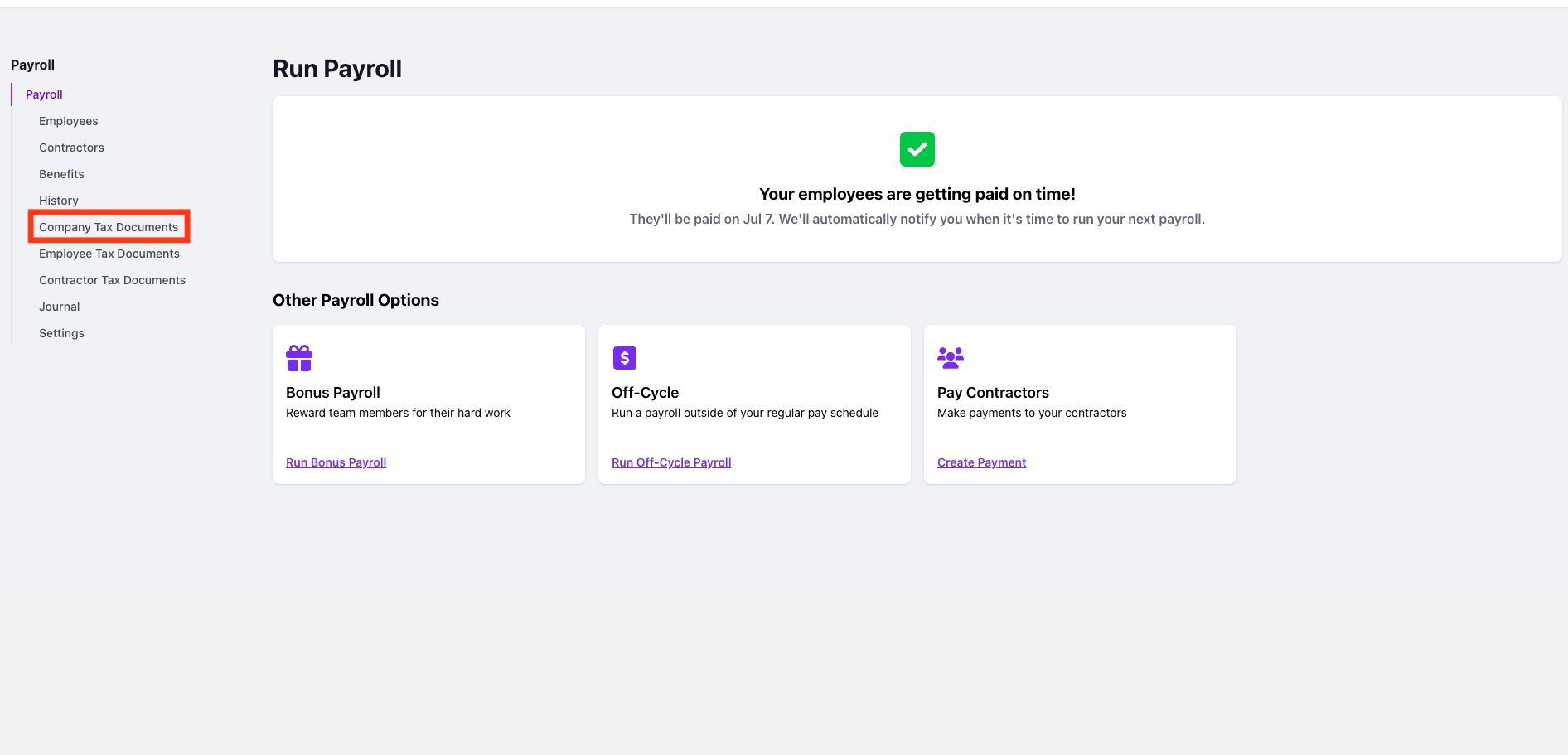

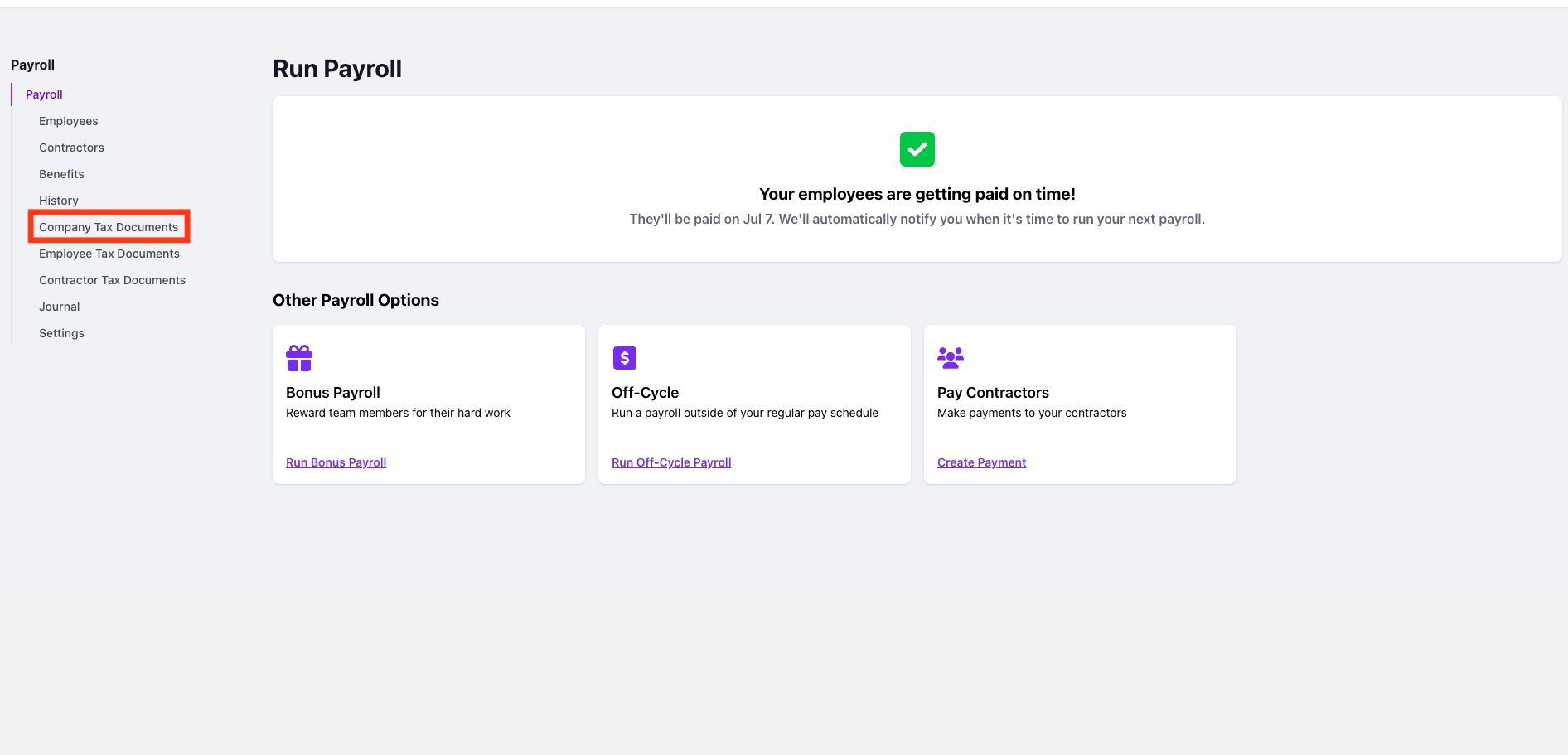

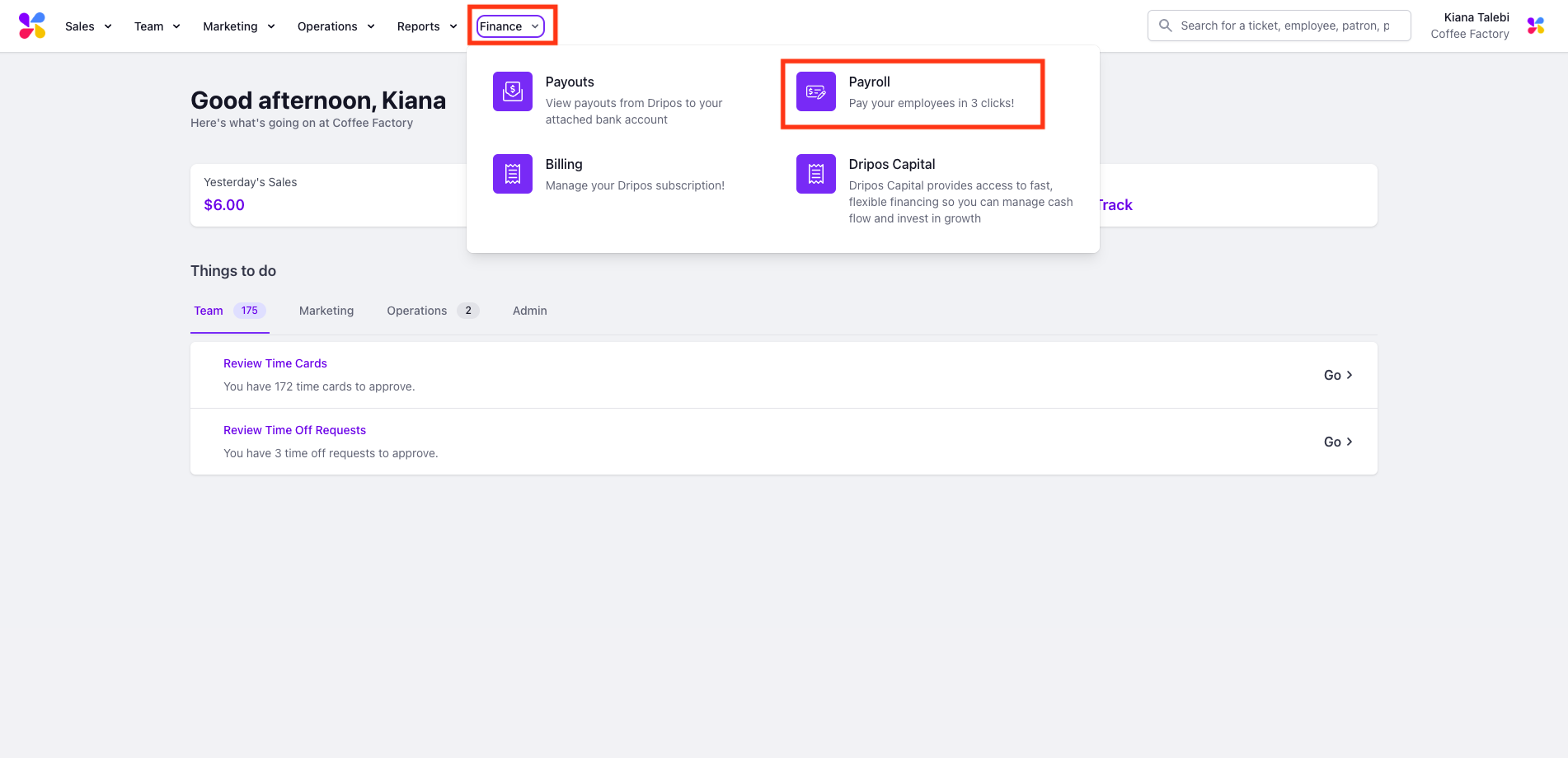

Log on to the Web Dashboard. Once signed in, select Finance > Payroll. Select the Company Tax Documents tab on the far left:

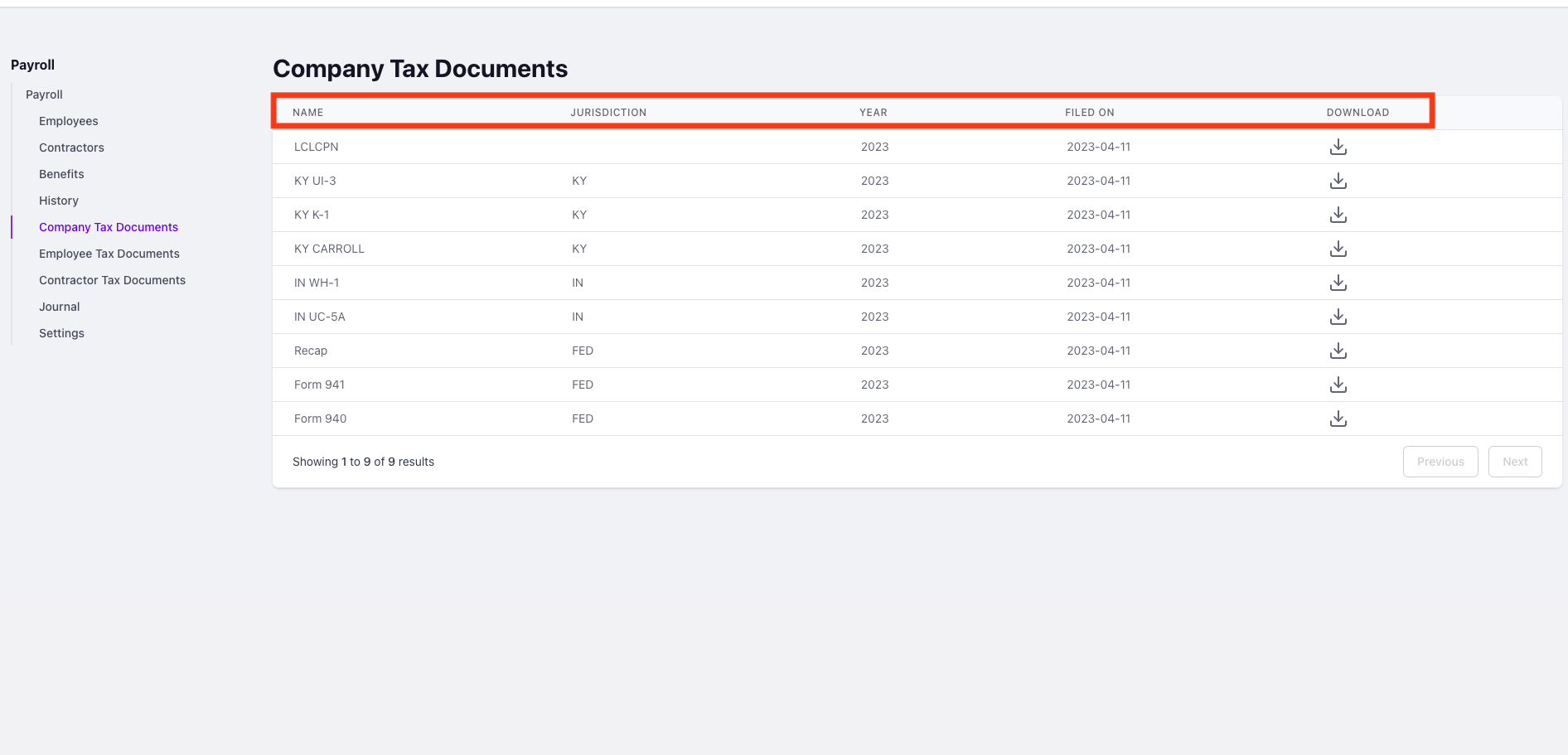

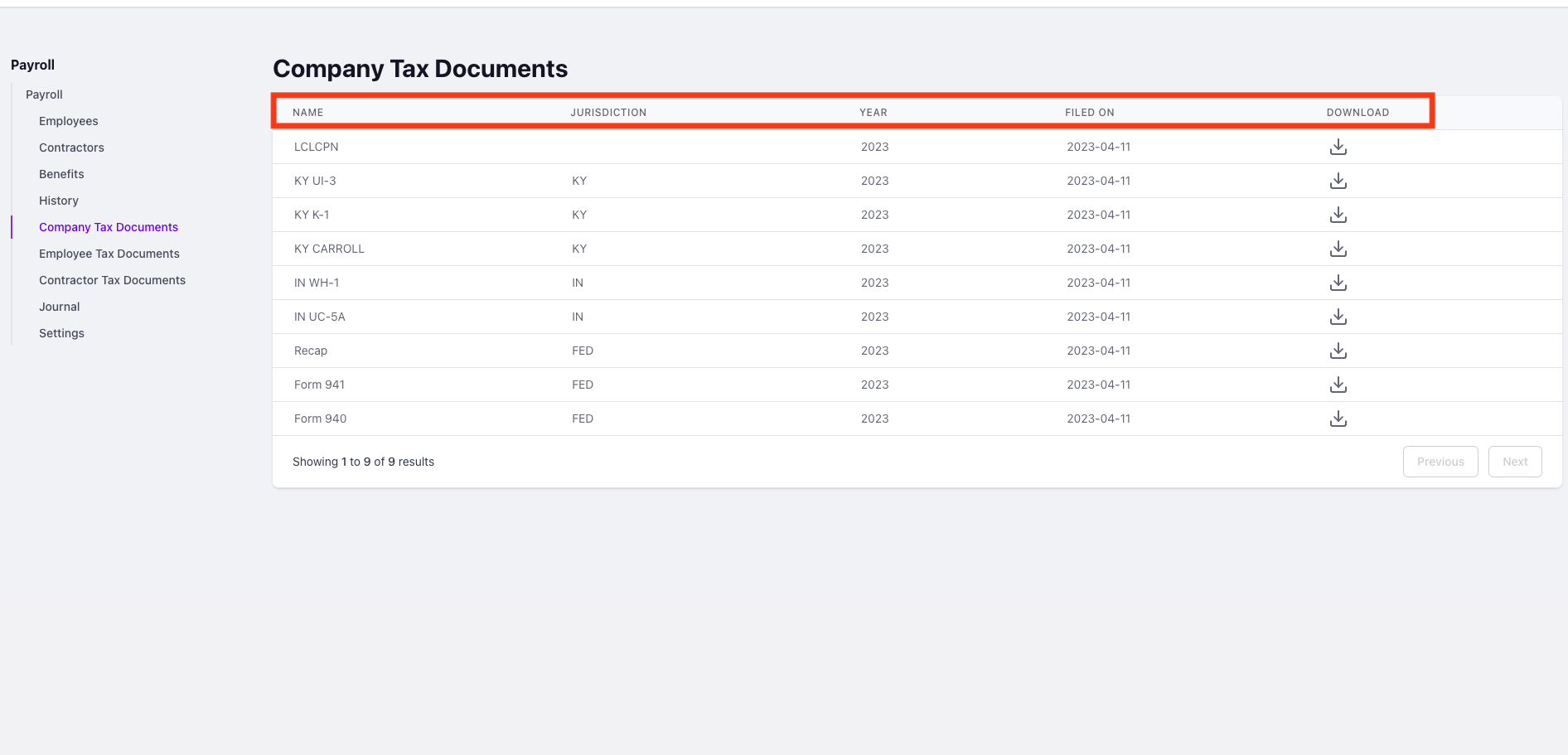

Here, each form filed on your behalf will be listed by name, and will have a corresponding jurisdiction, year, and date filed. All forms are also available for download:

Examples of forms listed here include:

- W-2 Copy D

- Form 940

- Form 941

- Form W-3

- Reconciliation Report

For a list of tax forms filed on your behalf for your state, please reach out to support@dripos.com

Access your Employee Tax Documents on the Web Dashboard

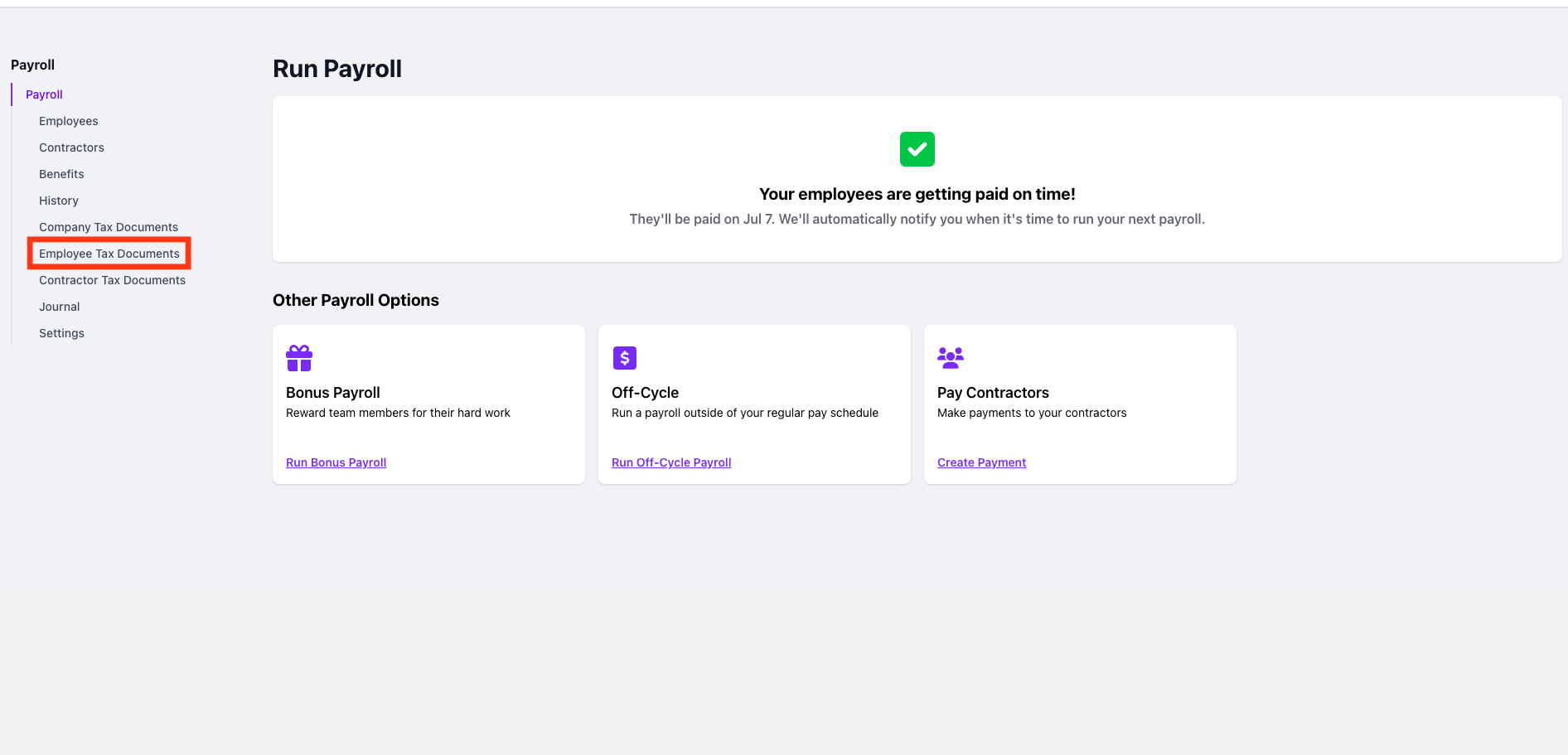

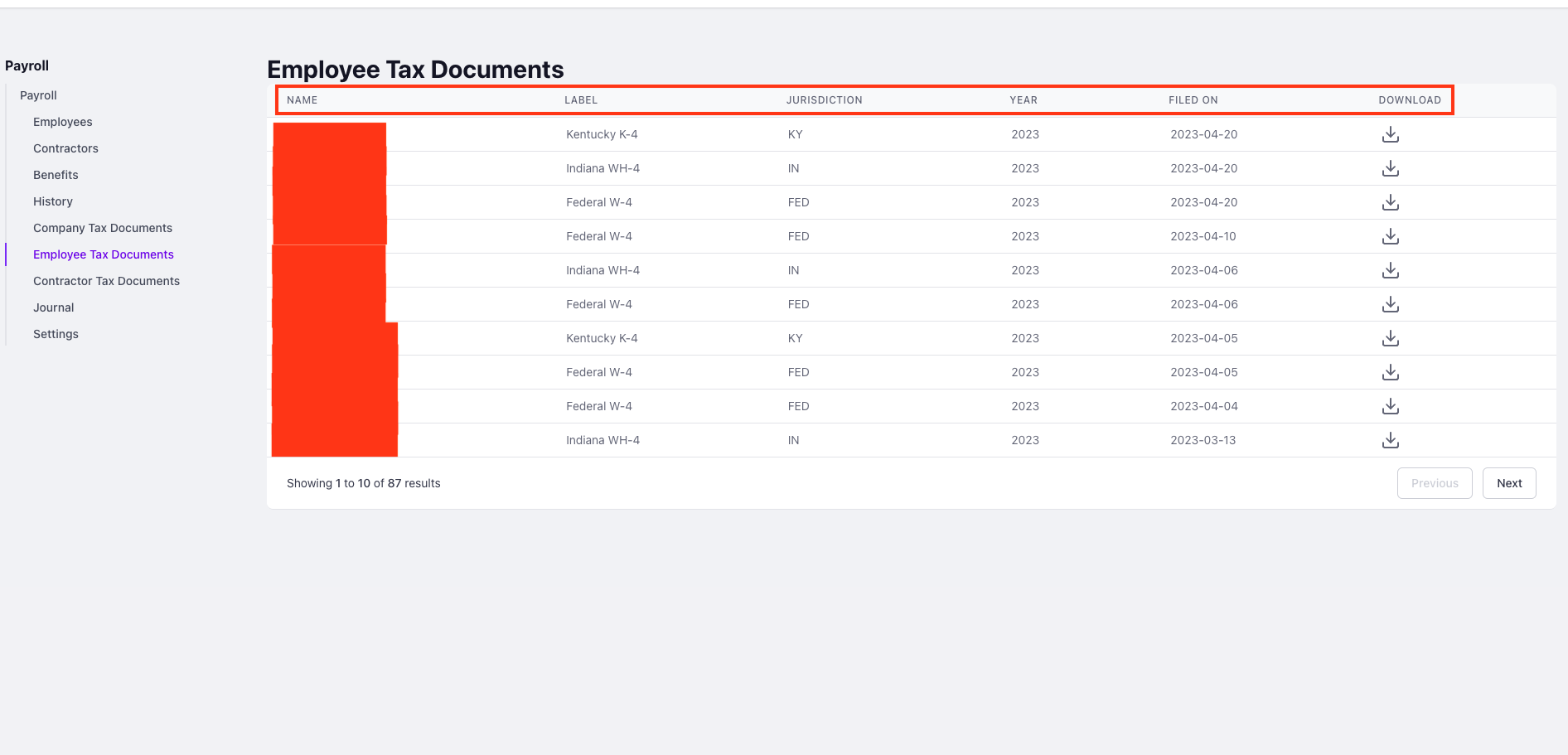

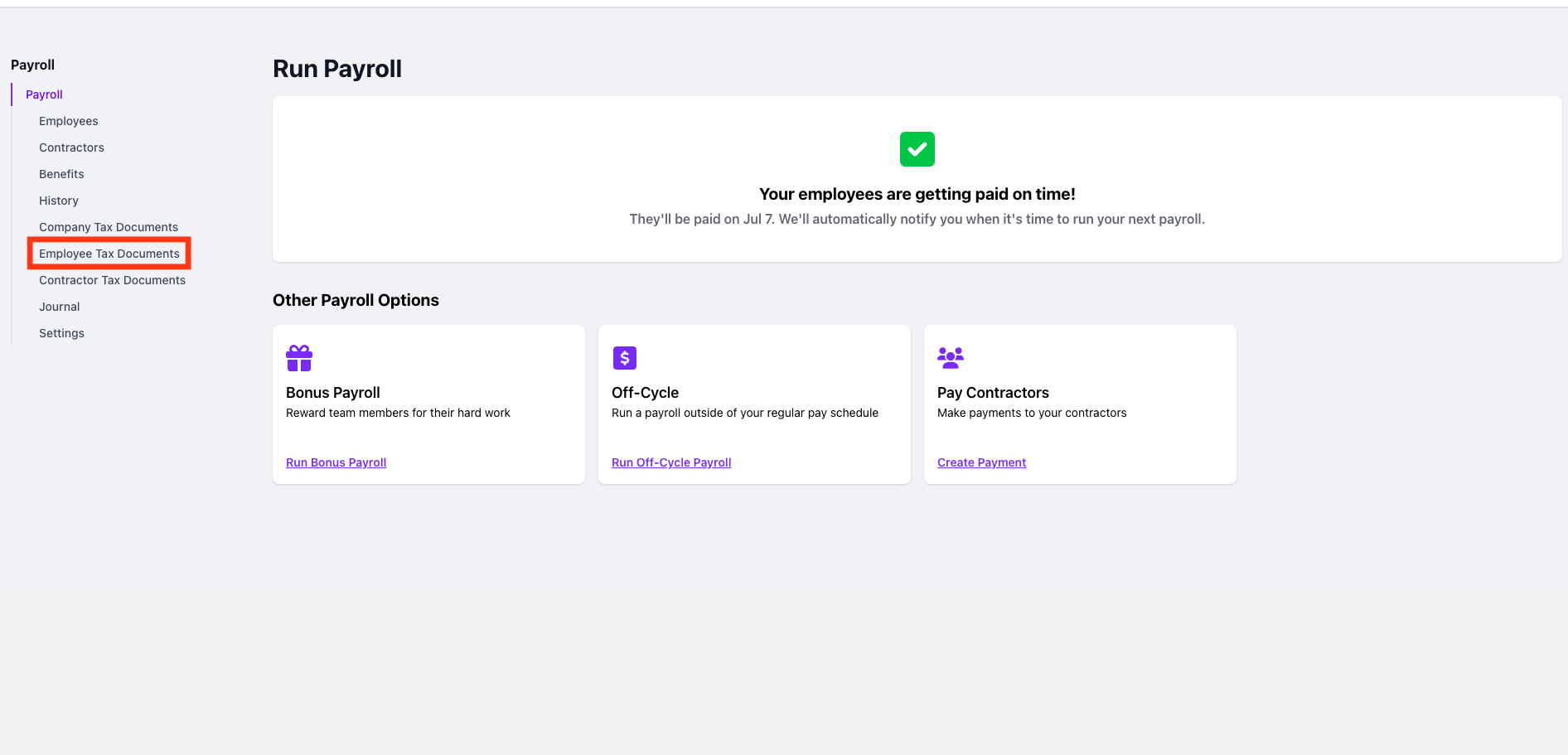

Log on to the Web Dashboard. Once signed in, select Finance > Payroll. Select the Employee Tax Documents tab on the far left:

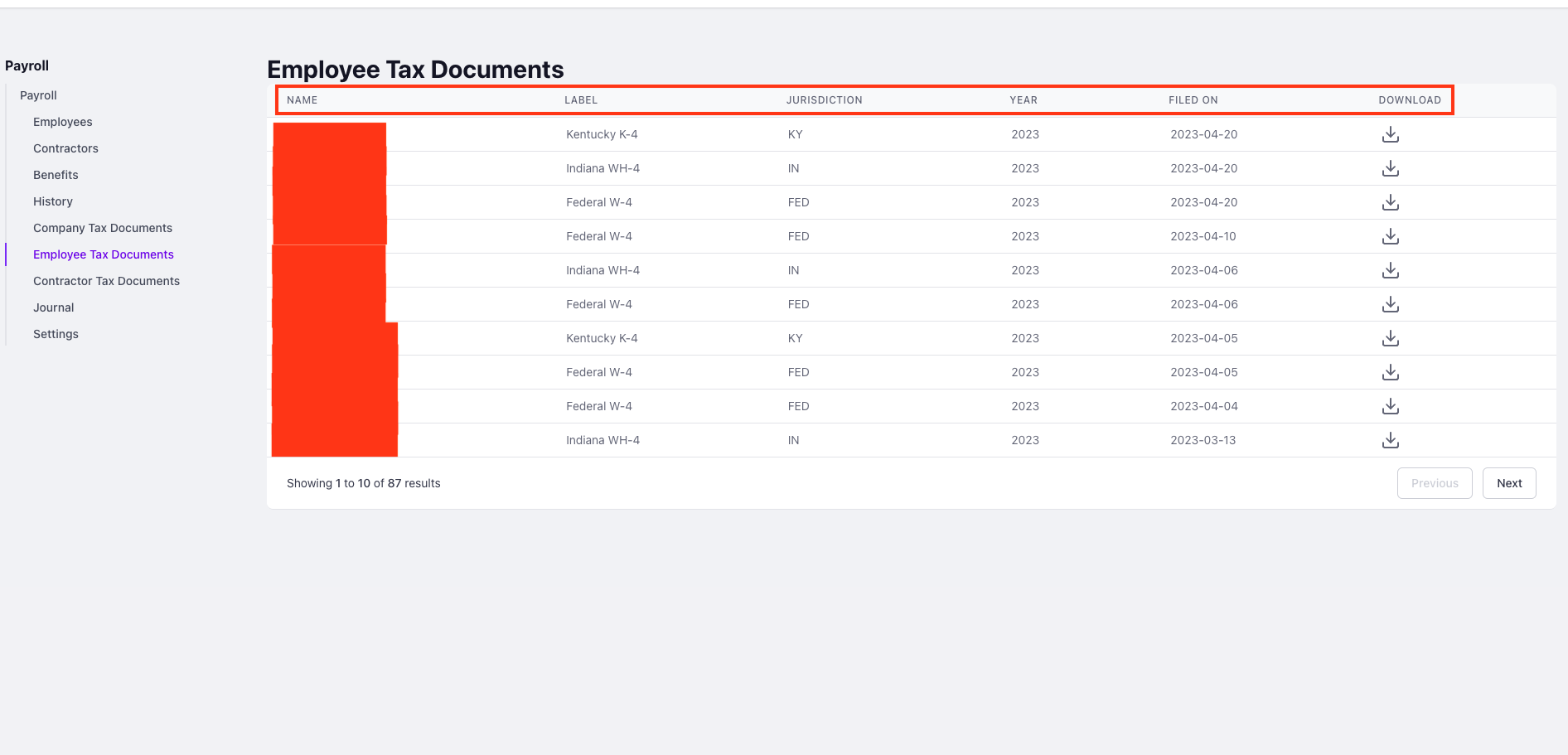

Here, all employee tax documents will be listed by employee name, and will have a corresponding jurisdiction, year, and date filed. All forms are also available for download:

You can find copies of your employee's W-2s, W-4s, 1099s, and state withholding forms here.