Adding Employees to Payroll

Get your employees set up on Dripos payroll.

Employees must already be in the Dripos system in order for them to be onboarded onto Dripos payroll. To learn more about your team setup and adding employees to Dripos, click here.

Adding Employees to Payroll on the Web Dashboard

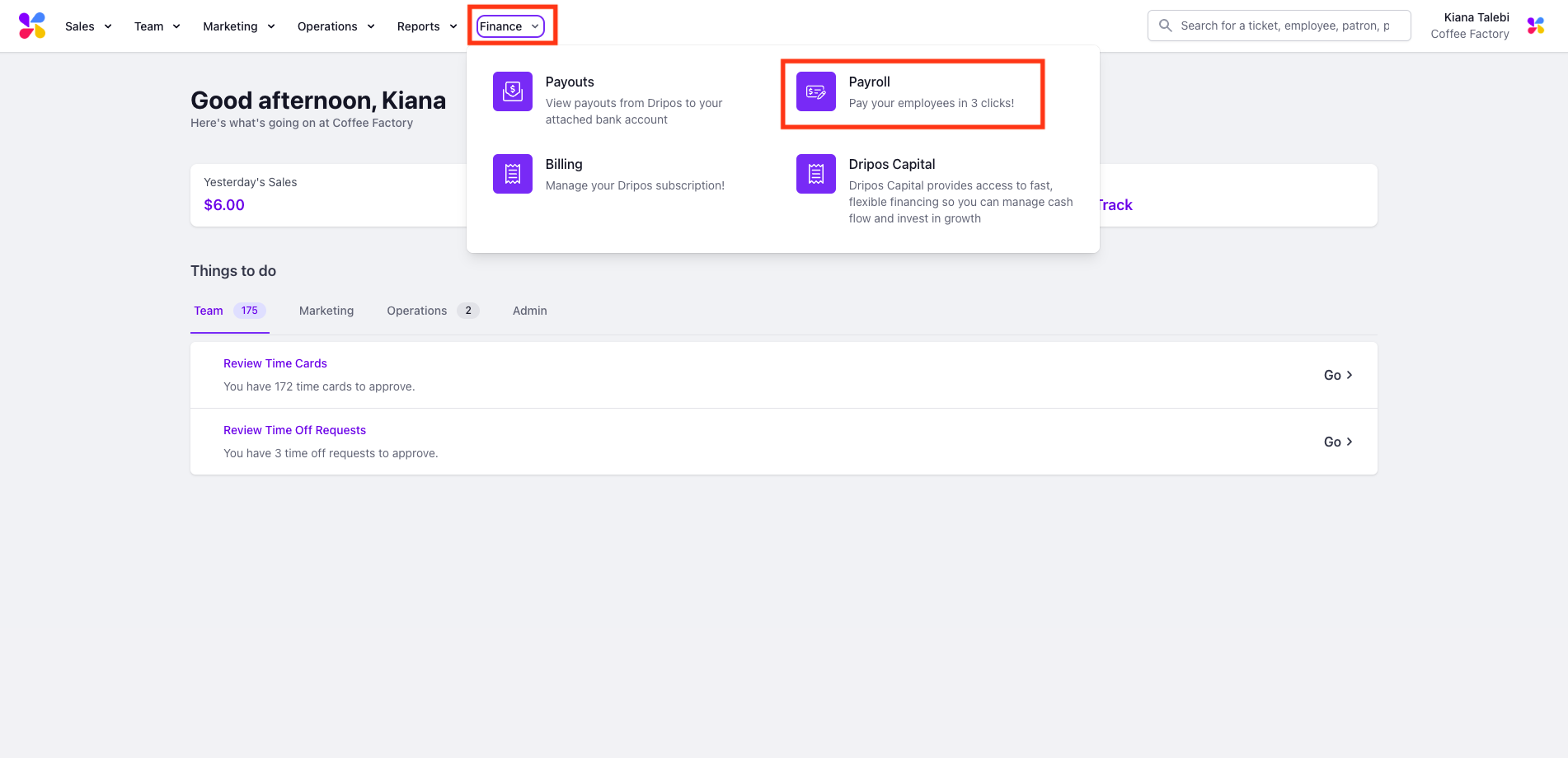

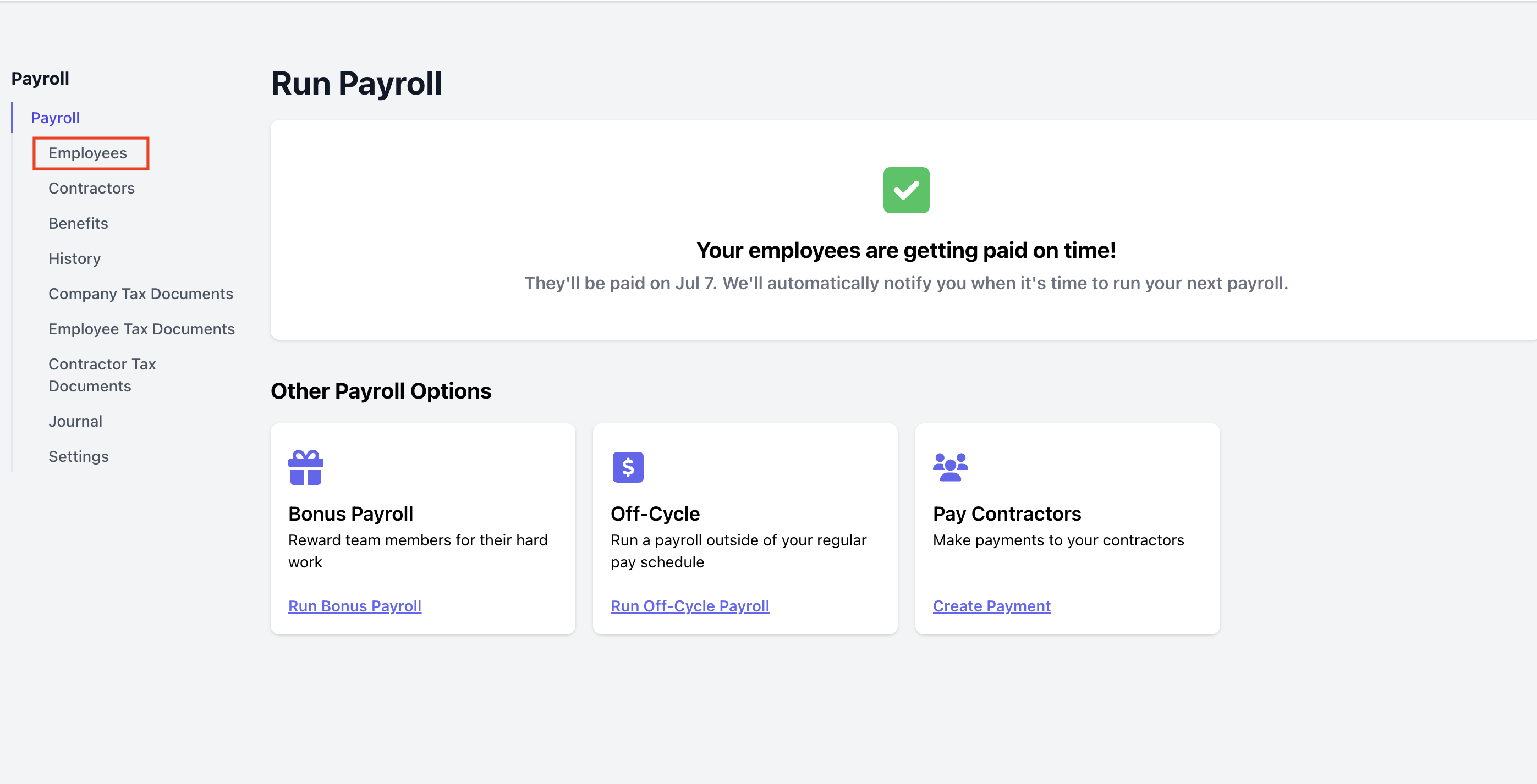

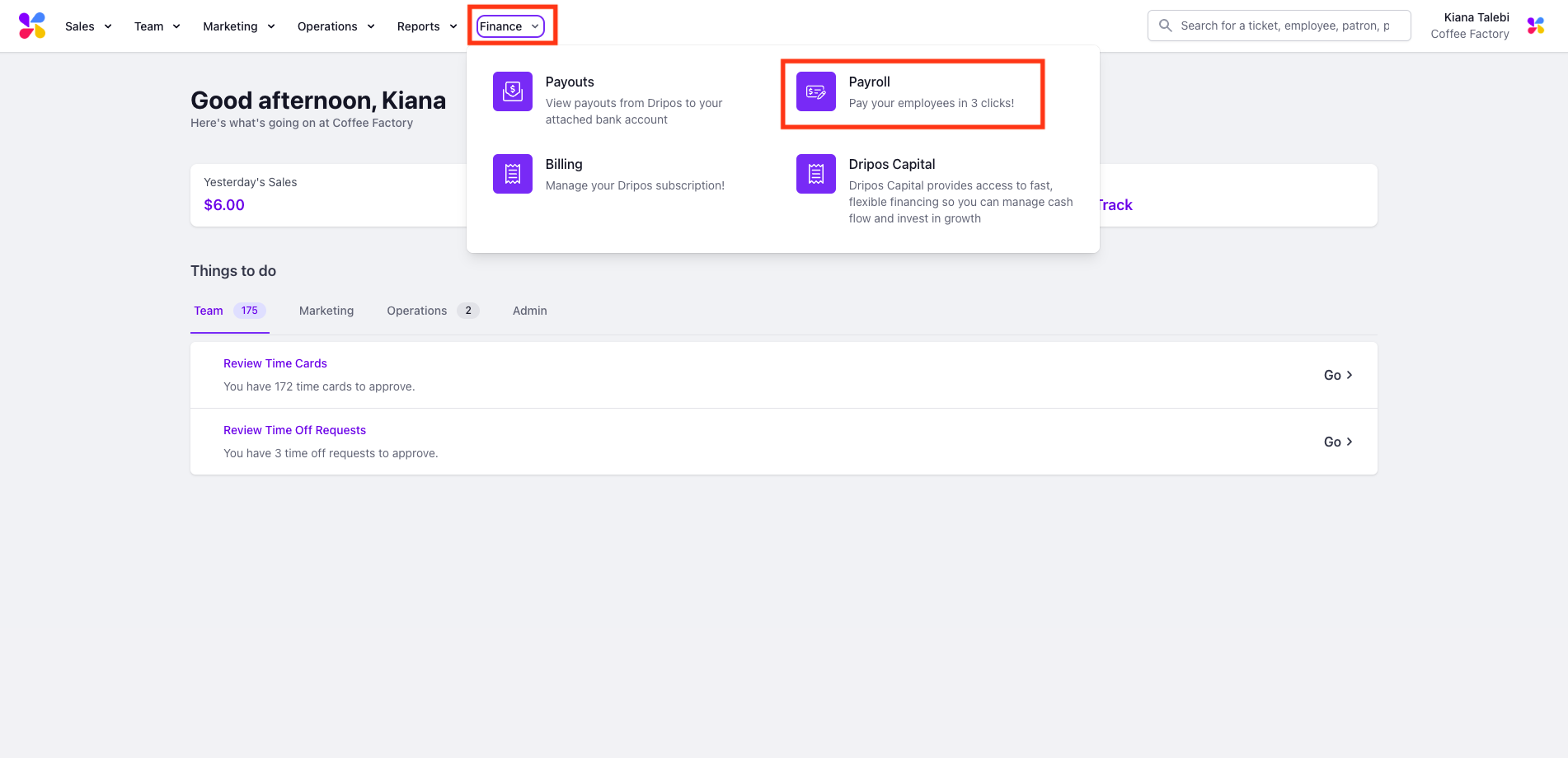

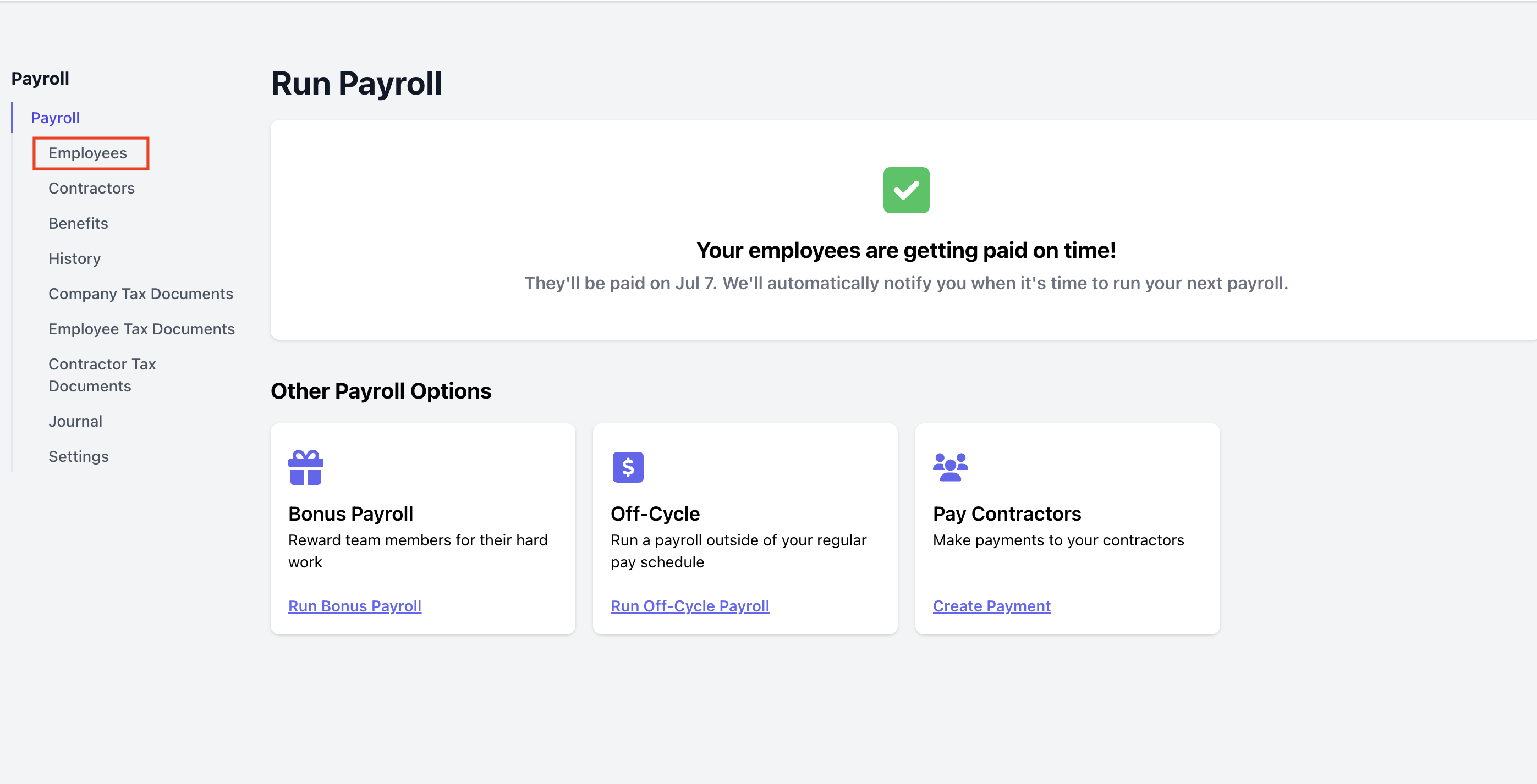

Log on to the Web Dashboard. Once signed in, select Finance > Payroll > click on the Employees tab on the far left:

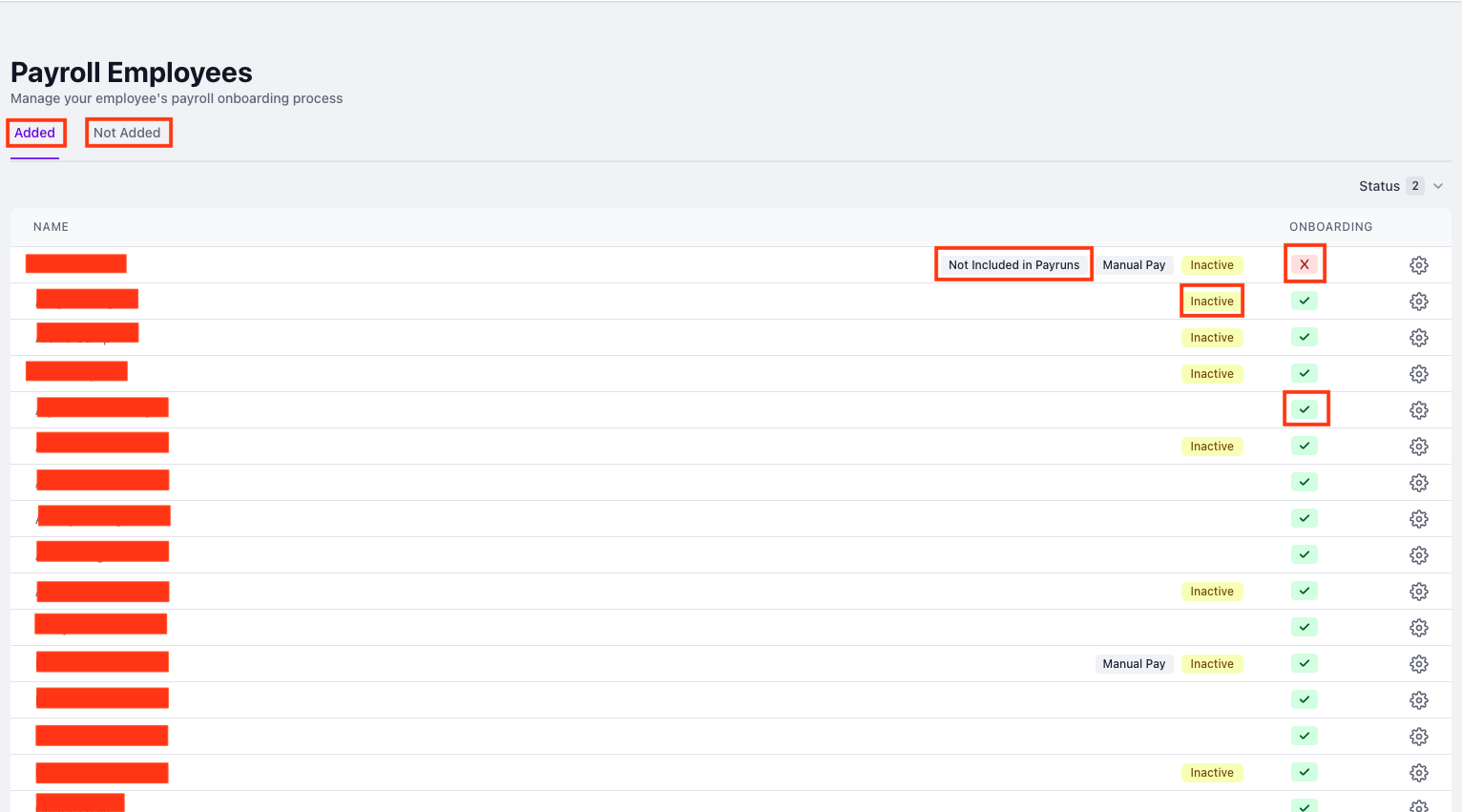

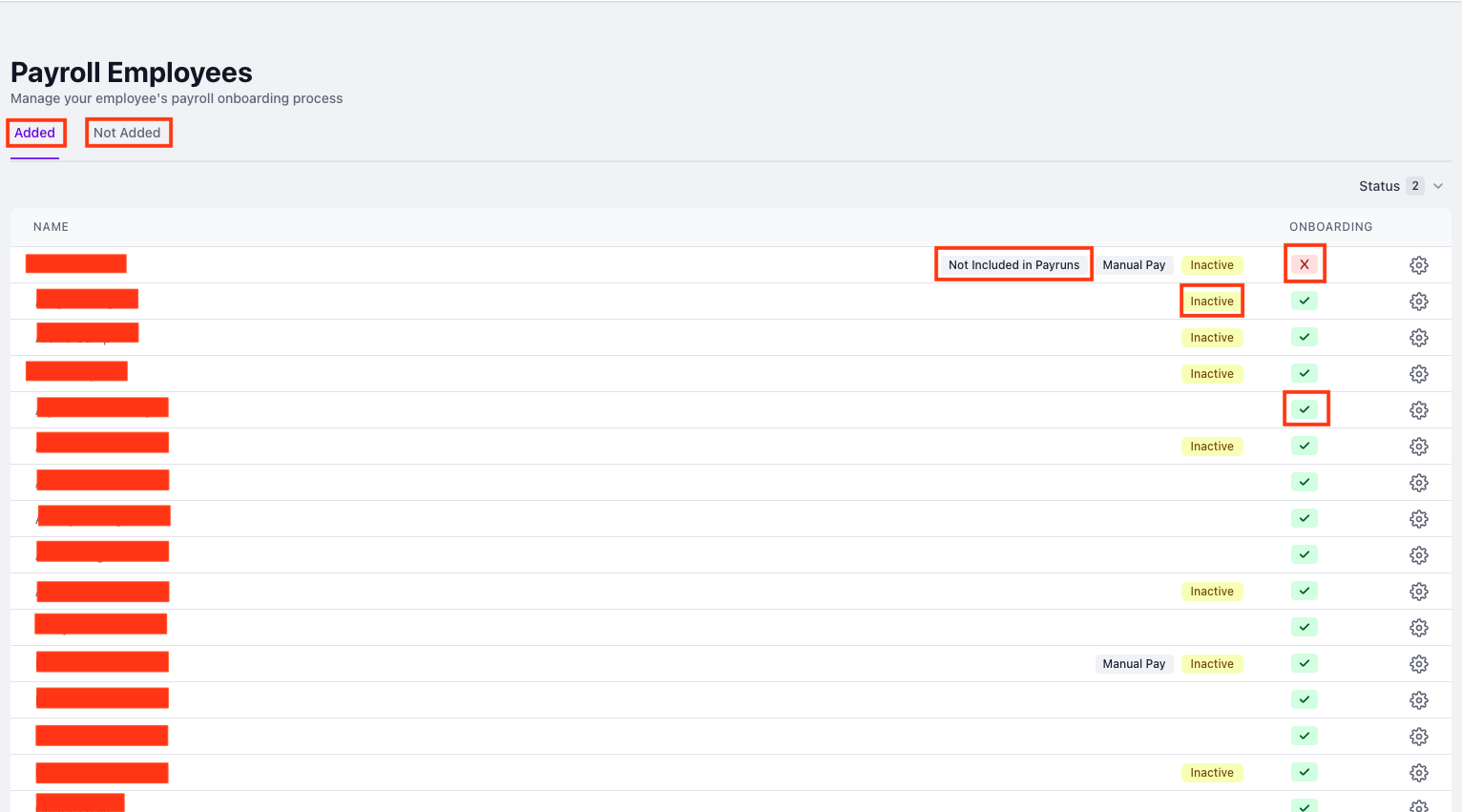

On this page, all of your payroll employees will be displayed under the Added tab and any employees that have not yet been added will be displayed under the Not Added tab. There will be an indicator next to each employee, displaying their payroll status:

Red X Icon: This means that the employee's payroll has not begun filling out their payroll onboarding fields. Untill this information is submitted, they will not be able to be paid or have payroll taxes filed.

Green Checkmark: This means that this employee has provided all the necessary information and is able to be paid and have payroll taxes filed.

Add: This means that the employee has not yet been added as a payroll employee.

Inactive: This means that the employee is no longer listed as an active employee at your company. For example, this could display next to a former employee that has been terminated.

Needed for Next Payrun: This means that some of the employee's information has been inputted, but additional information needs to be provided in order for them to successfully be paid.

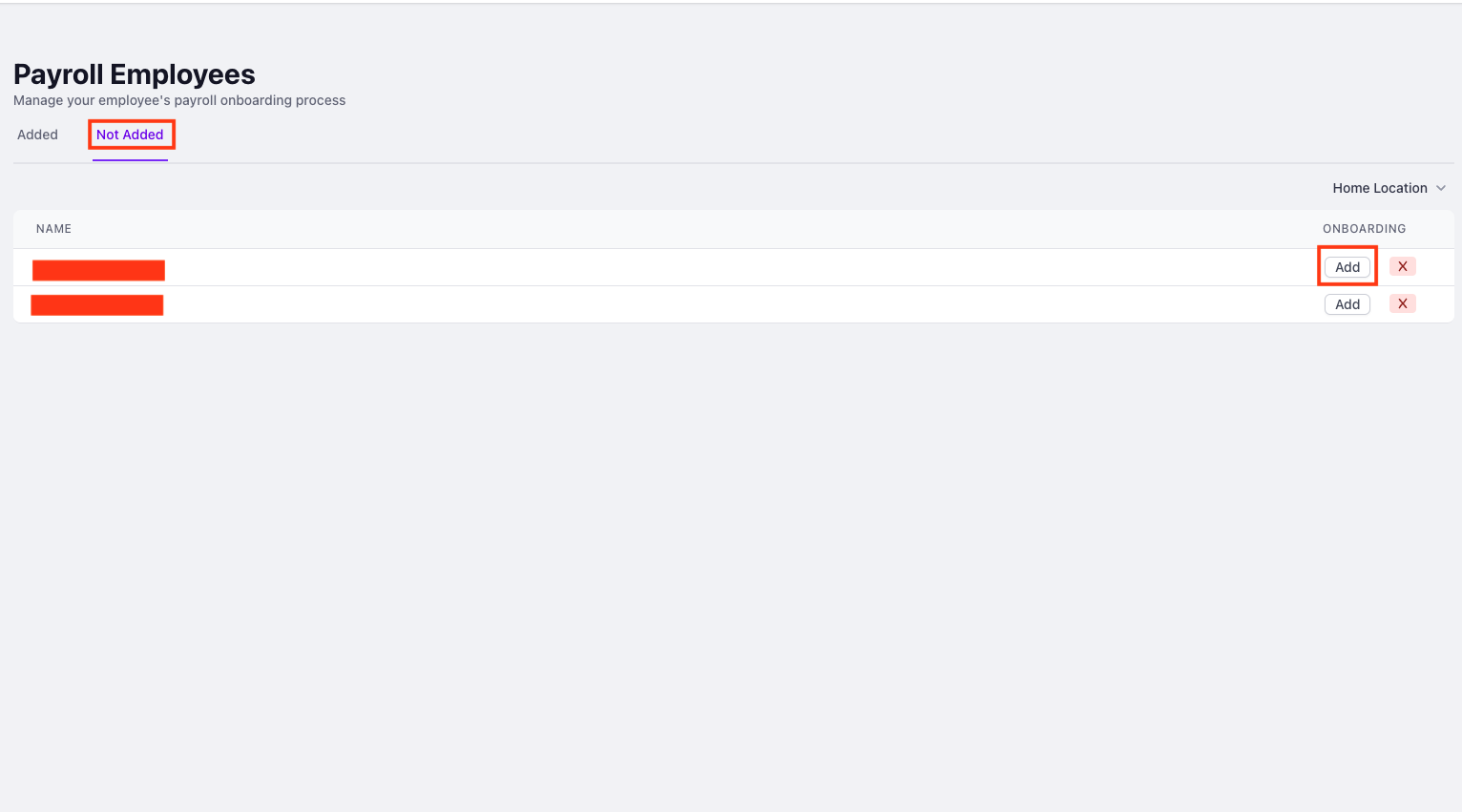

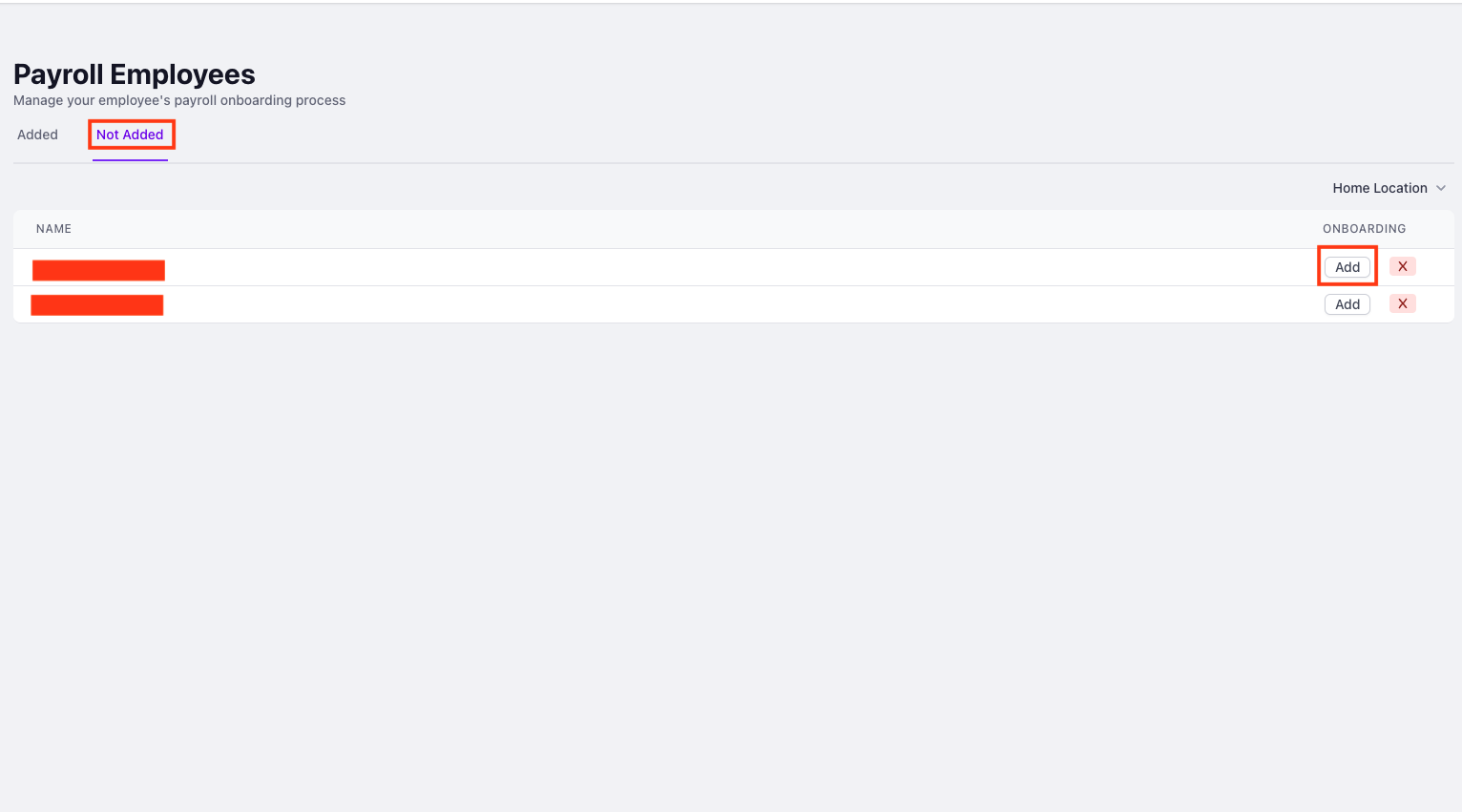

To onboard additional employees, click on the Not Added tab at the top of the page > click on the Add button next to the employee you want to add to payroll:

Once the Add button is selected, the employee will automatically be sent an email with a link to their payroll portal, where they can complete their payroll onboarding and manage their payroll settings.

Payroll employees can also access their payroll hub using this link.

To be onboarded, your employees must provide their basic personal information (legal name, email, date of birth, residential address) and their social security number at a minumum.

To be paid, your employees must also provide a newly signed W-4. If they want to be paid via direct deposit, they will also need to provide a bank account.

Bank accounts can either be verified with Plaid or manually inputted using an account and routing number.

Please allow up to four business days for your bank account to be verified. If your account is not verified, it may not be able to receive payments.

Occasionally, an employee will still be listed as Incomplete even though they have provided all of their personal information. This typically means that you, as the employer, will have to provide state tax or reporting information about this employee.

Click the gear symbol next to the employee's name to see if there are any pending fields to fill out:

Make sure you're checking the status of your employee's payroll onboarding before your next payroll, and communicate to them that they cannot be paid until they have submitted all required information.

Read more about employee payroll settings and preferences here.