Adding Tax Rates

Create and Apply Tax Rates

You must manually enter your sales tax rate and any other tax rates and apply those rates to the specific products or categories applicable.

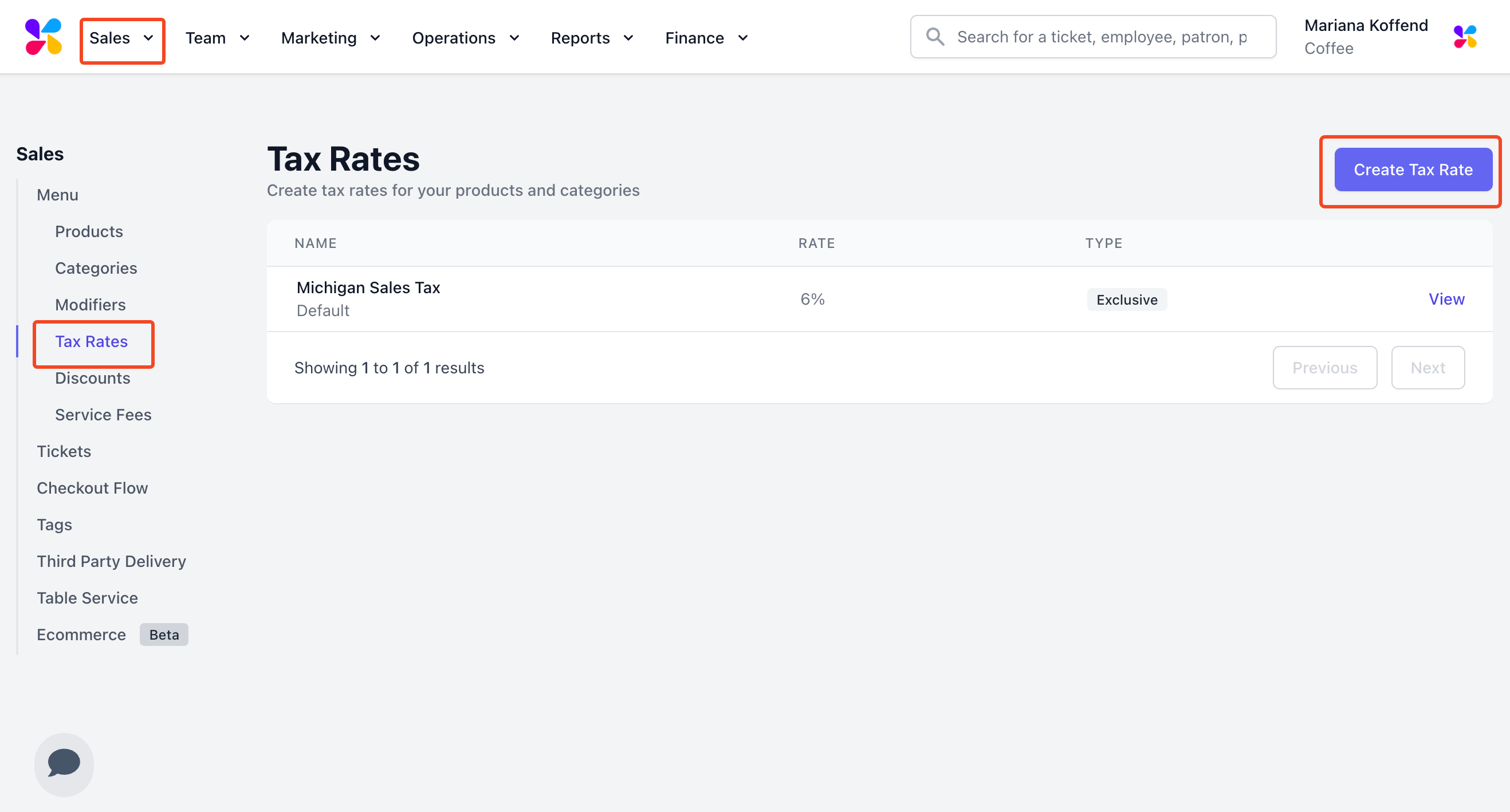

Create a Tax Rate on the Web Dashboard

Dripos will not automatically generate any sales tax rates for your location and Dripos is not responsible for ensuring the proper taxes are paid on your products.

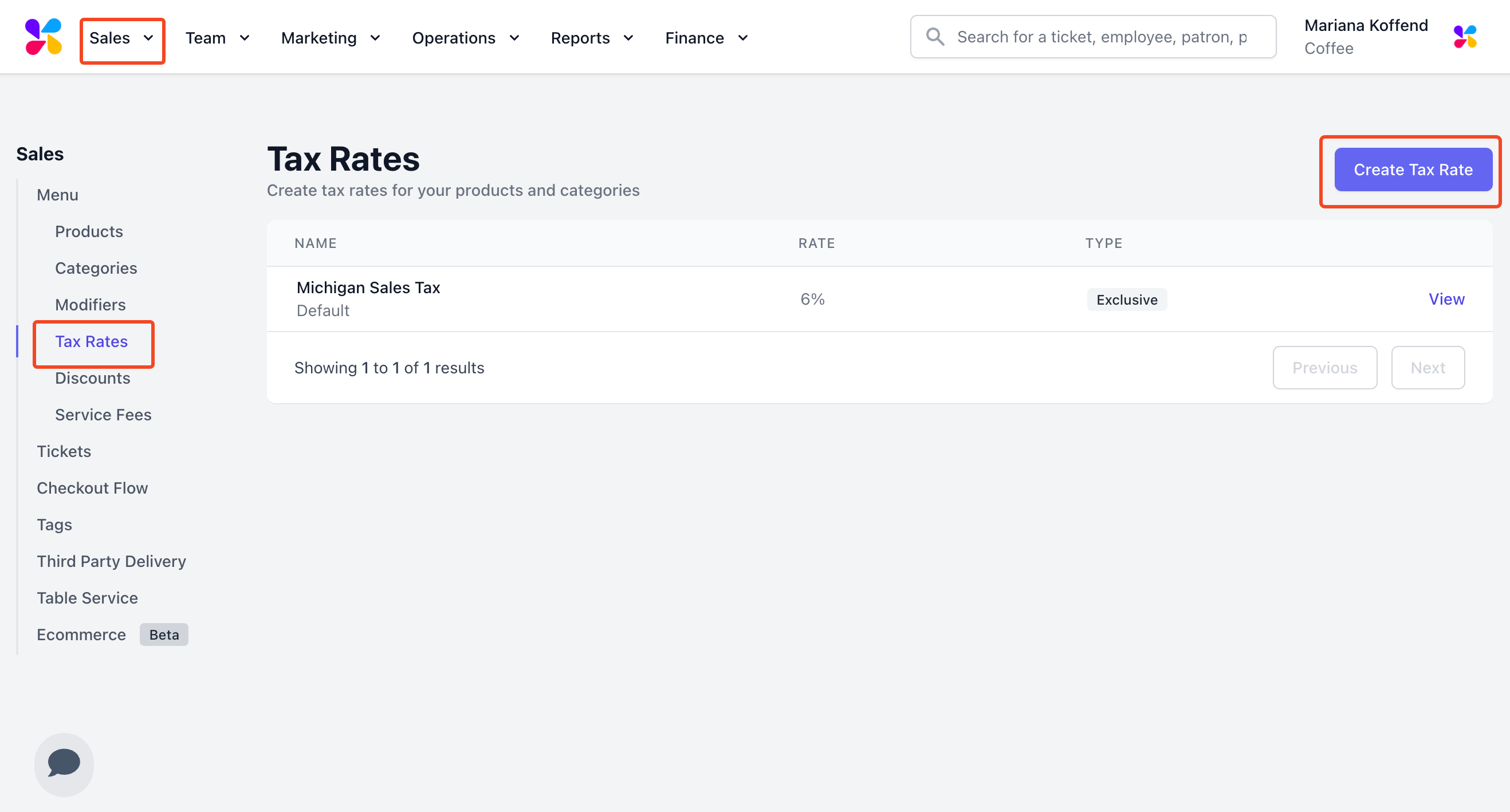

- Log onto the Web Dashboard. Once signed in, click on the Sales tab > select Menu > select Tax Rates:

Here is an article on how to create a tax rate.

You can use this website to help determine your tax rates based on your address. You should also consult with government resources.

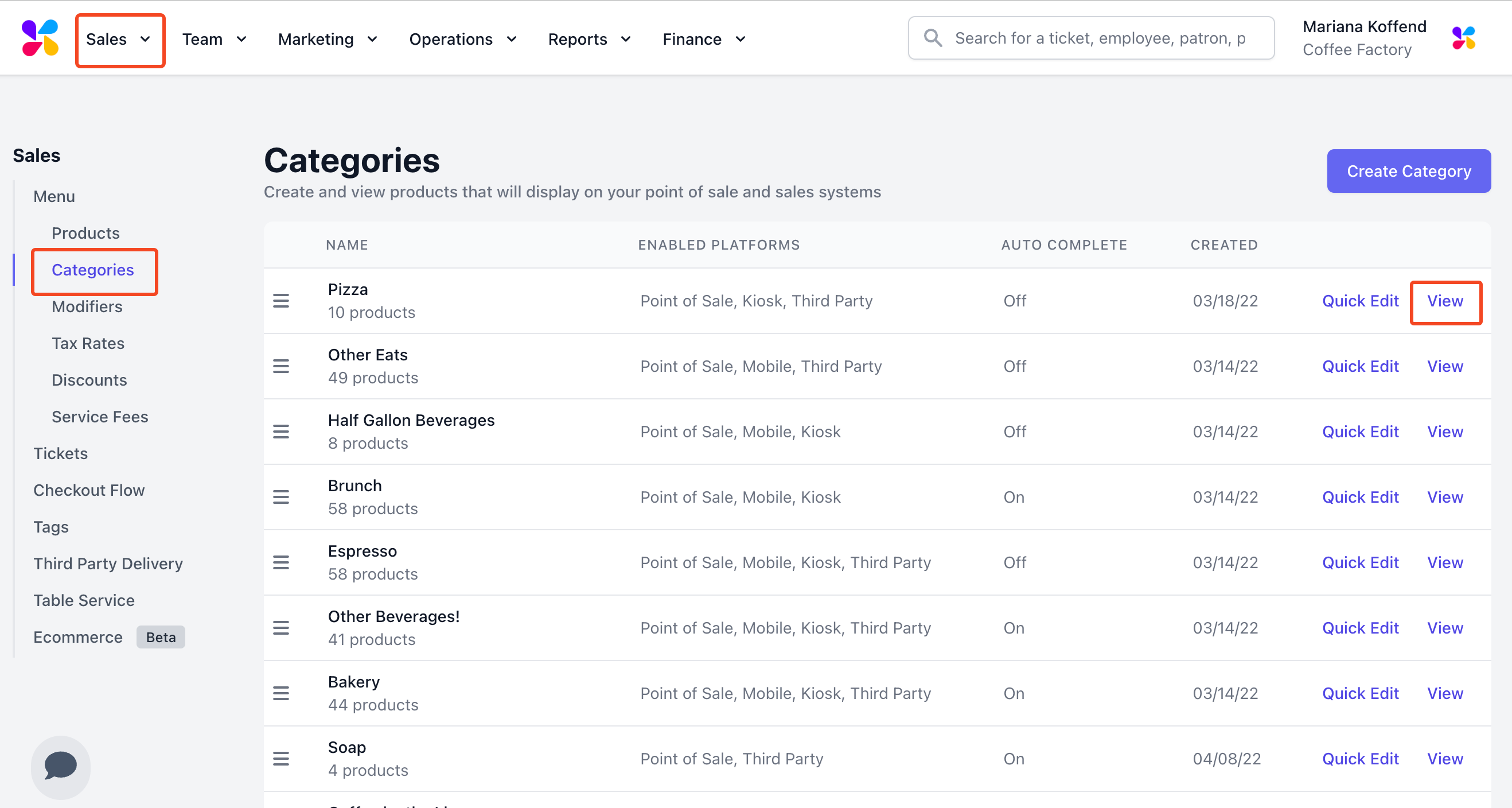

Apply the Tax Rate to Categories on the Web Dashboard

Once you create your default sales tax rate, it will not automatically apply to the products or categories in your menu.

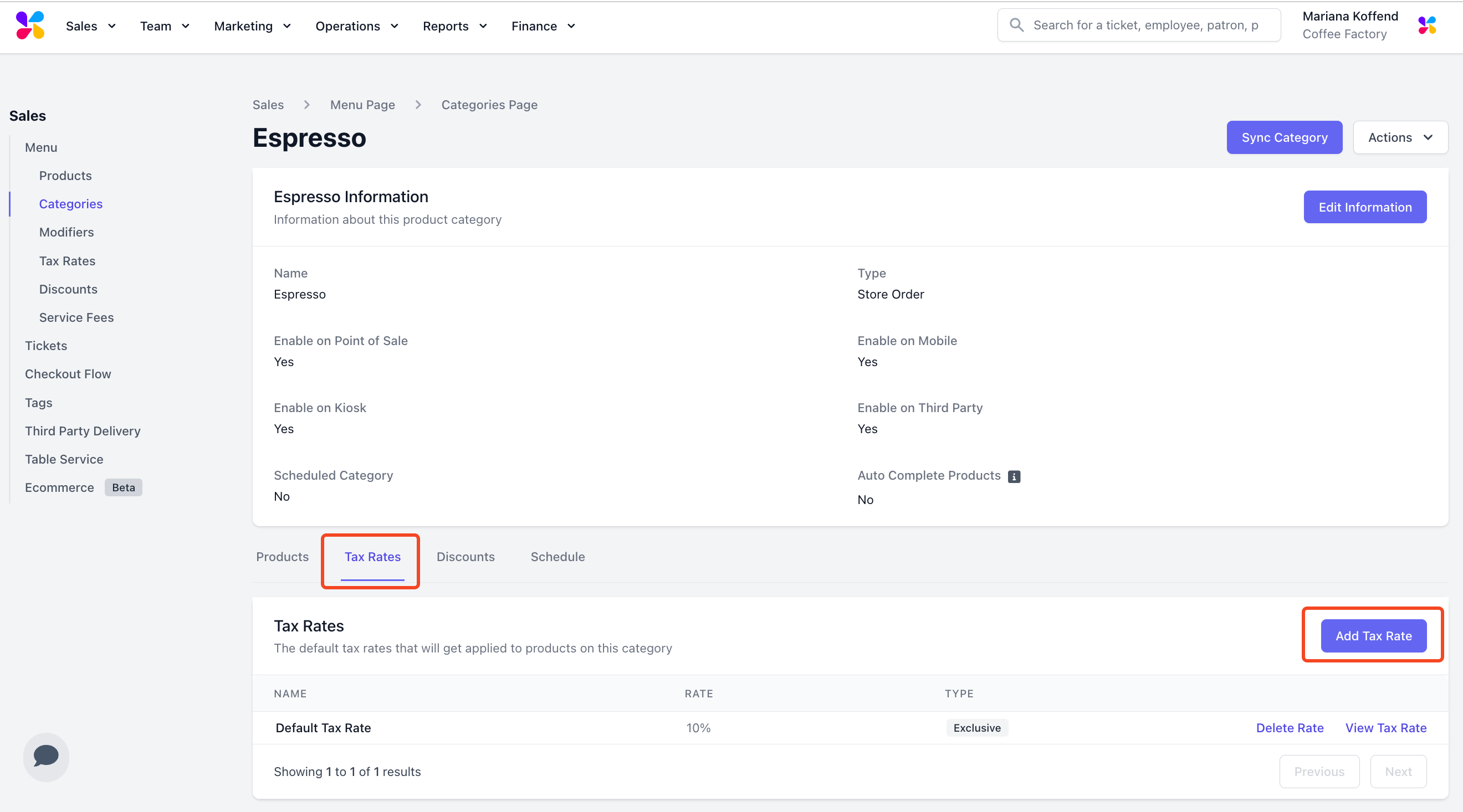

You must manually attach tax rates to categories because the Dripos tax system is meant to support different tax rates for different products and scenarios depending on state laws.

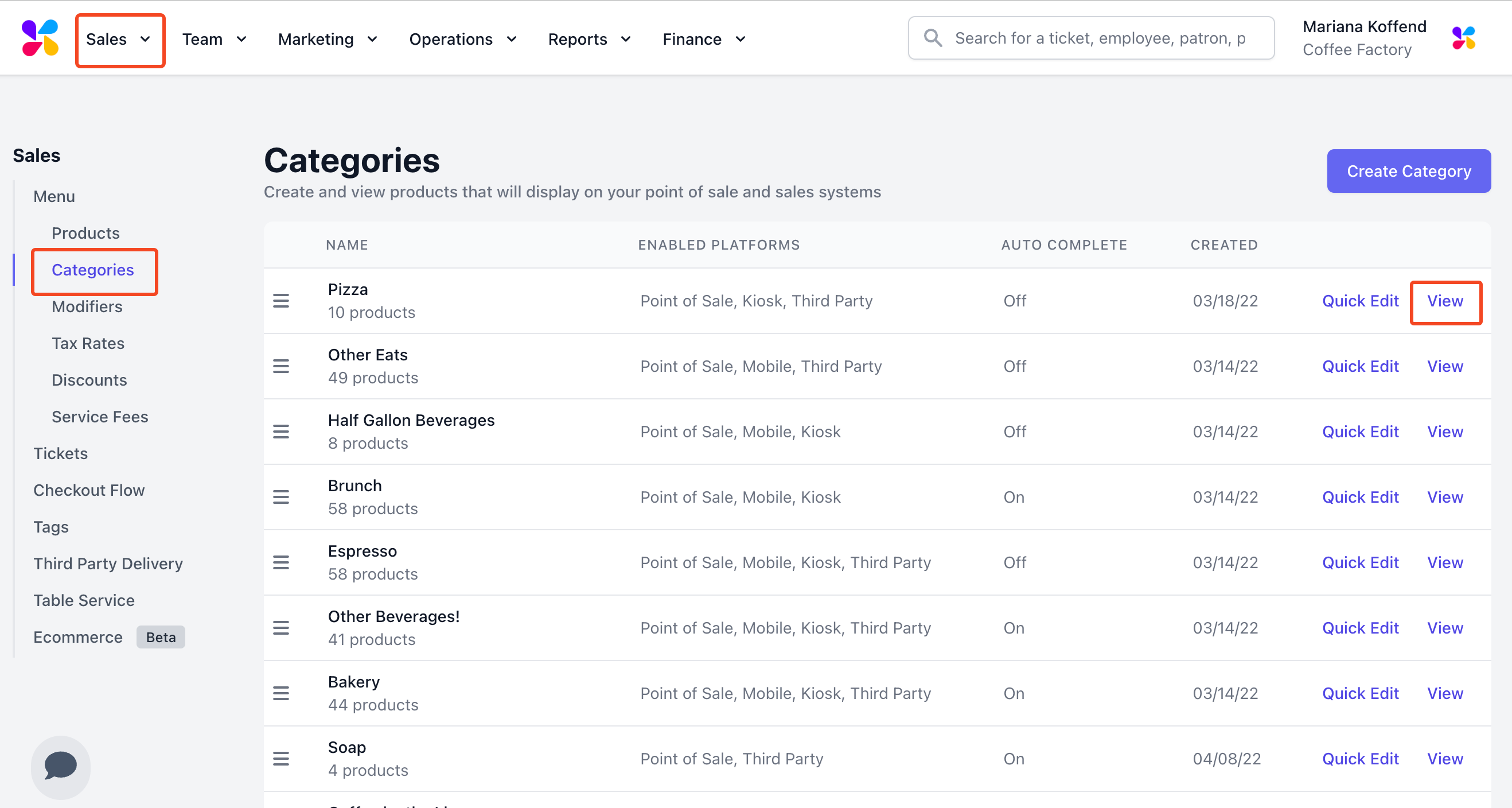

Log onto the Web Dashboard. Once signed in, click on the Sales tab > select Menu > select Categories:

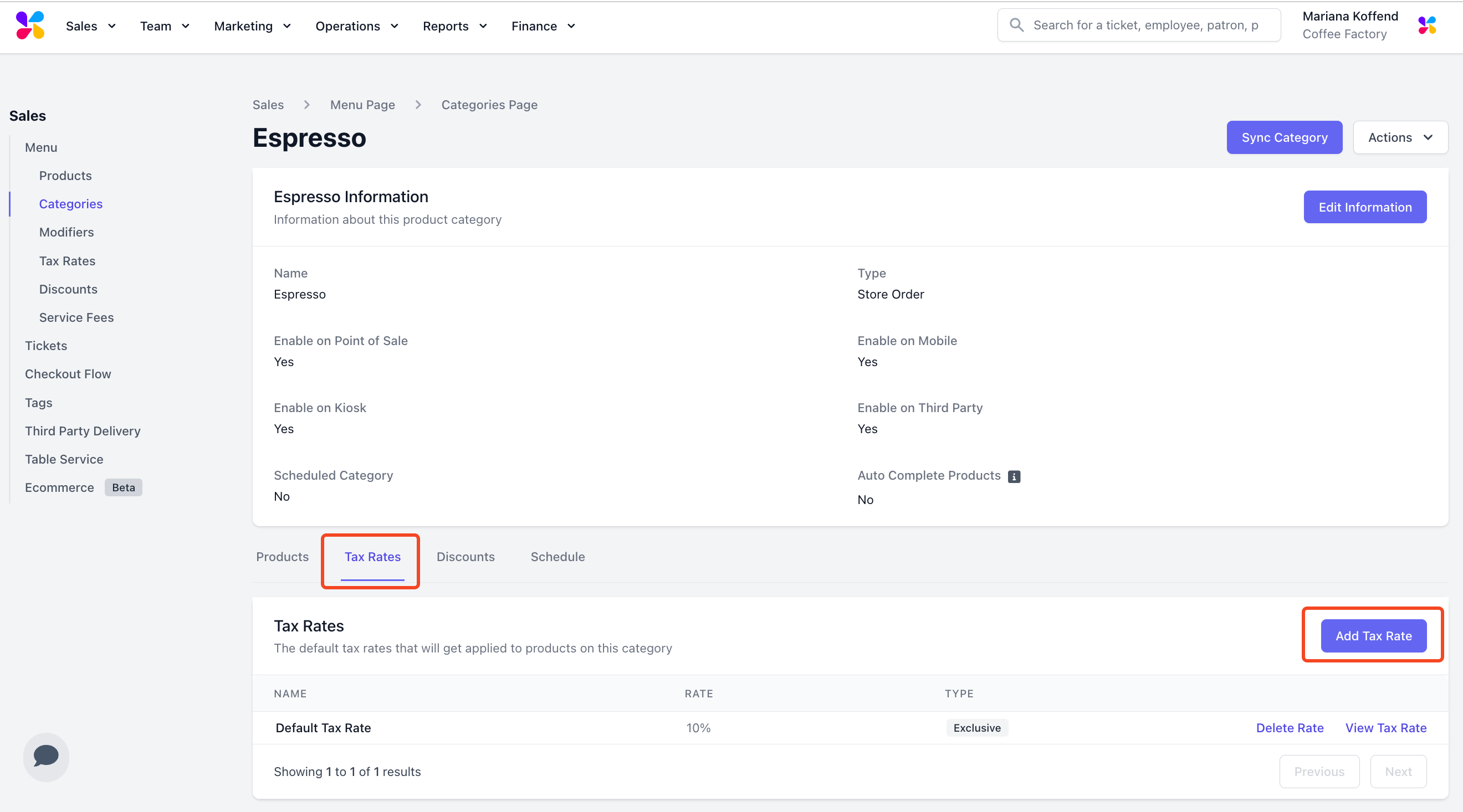

Click into a category > select Tax Rates > click Add Tax Rate to attach a tax rate to all of the products within the category:

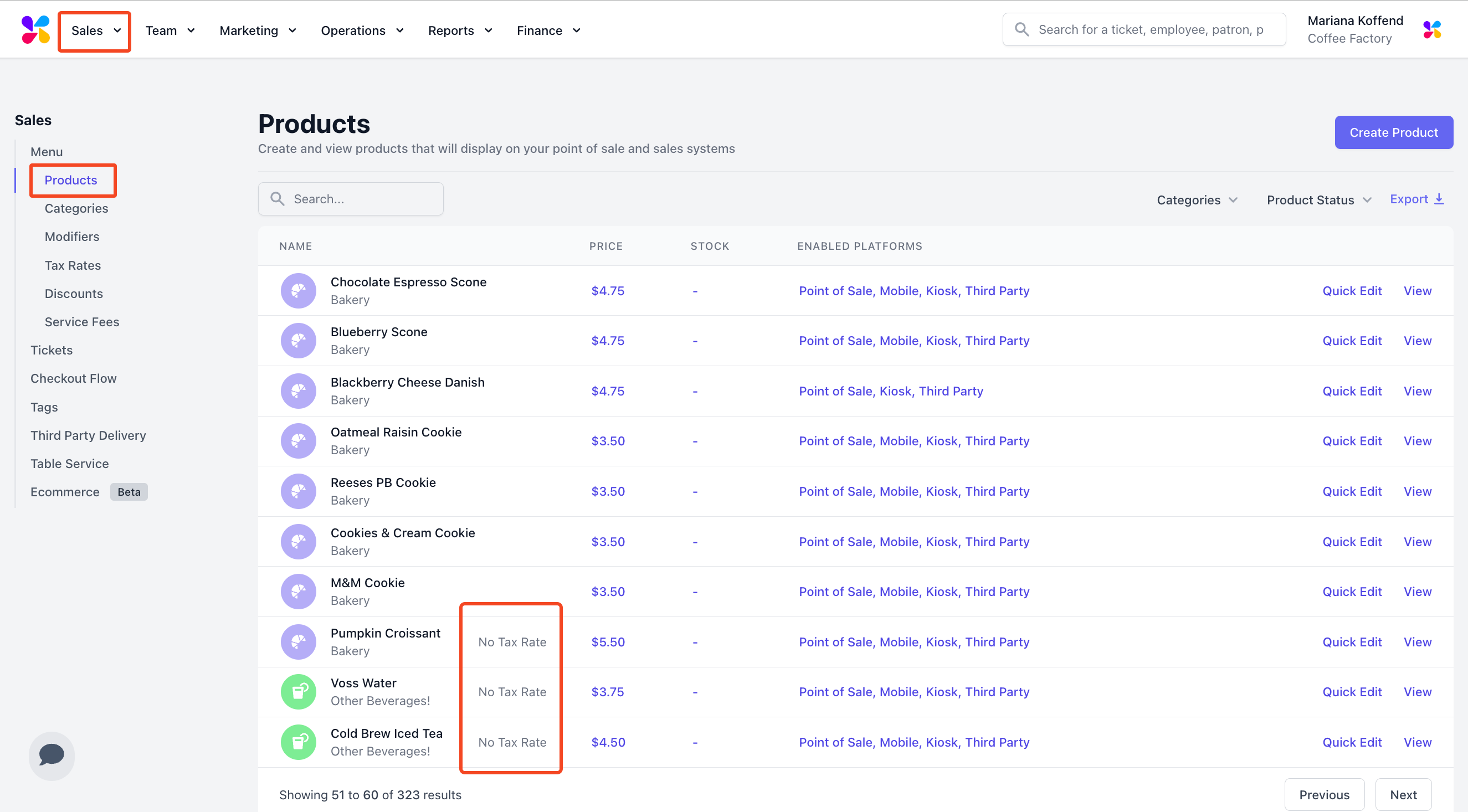

Review Which Products Have Tax Rates Attached on the Web Dashboard

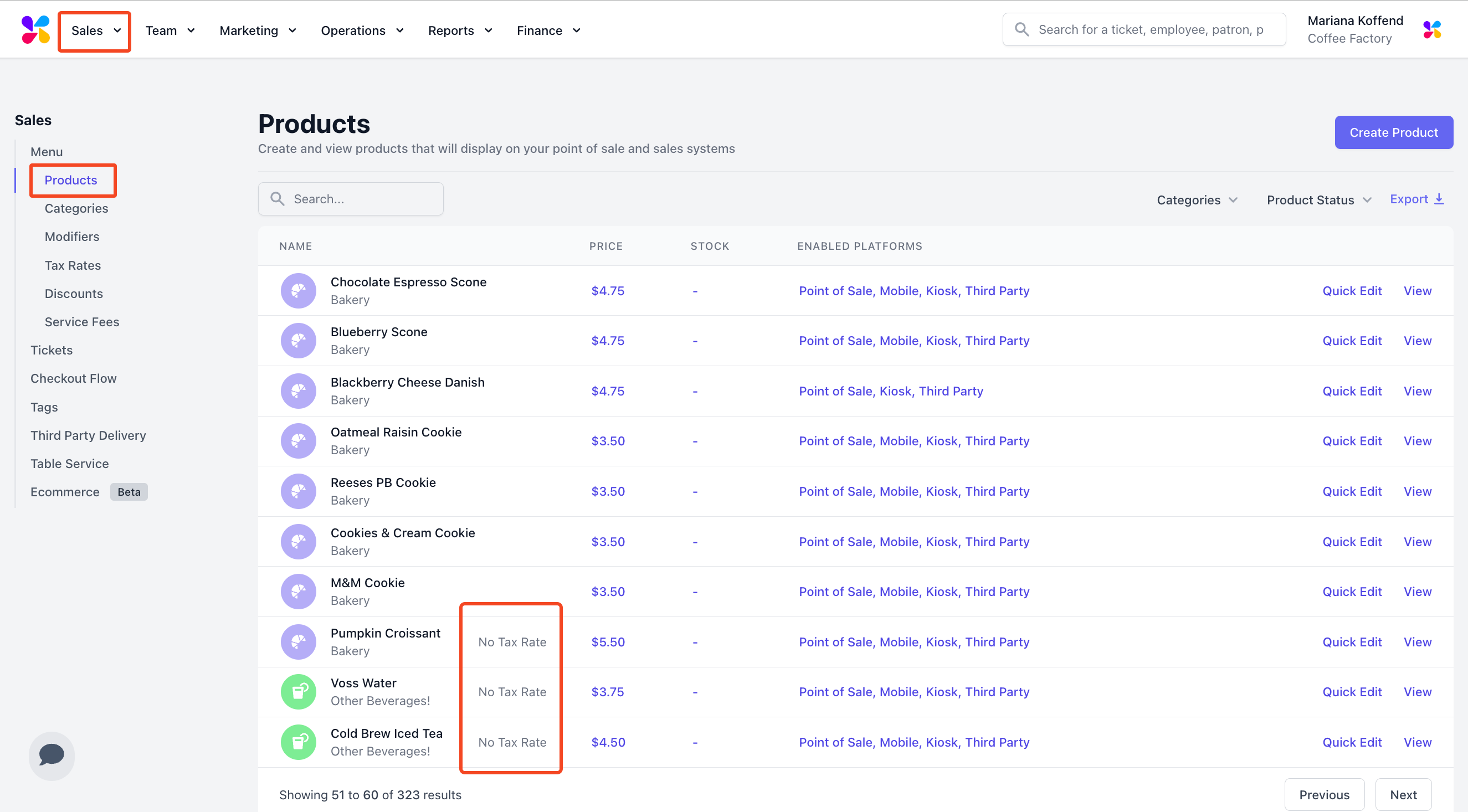

Log onto the Web Dashboard. Once signed in, click on the Sales tab > select Menu > select Products:

Ensure that the products with No Tax Rate should be listed as such, or edit the category to attach a tax rate.

.