Regular Payroll

Weekly or bi-weekly pay cycle

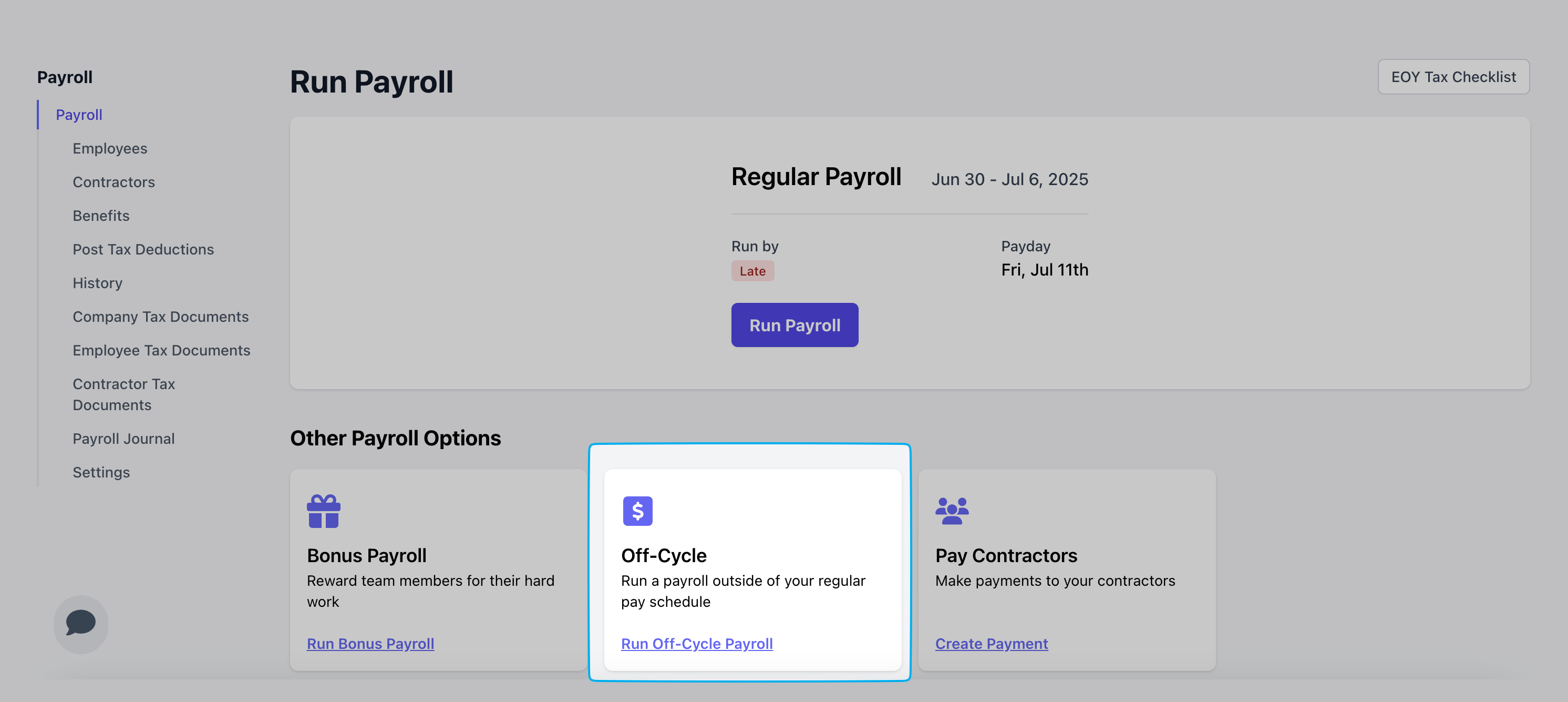

Off-cycle Payroll

Any payroll processed outside of your company’s regular pay schedule.

Bonus Payroll

Send one-time bonuses to your employees

Processing Timelines

The processing timeline is the time between when you run payroll and when your employees receive their direct deposit pay.3-Day

Every Dripos Payroll customer will begin on a 3-day processing timeline for regular payroll, i.e., run payroll by Tuesday for Friday payday

2-Day

Dripos Payroll customers who complete 10 successful regular payruns with Dripos with have the opportunity to upgrade to 2-day processing, i.e., run payroll by Wednesday for Friday payday

Funding Requirements

In order to run payroll on Dripos, it is imperative to have the full cash requirement, or debit amount, settled in your connected payroll bank account at the time of payroll submission. If Dripos’ banking partner attempts to withdraw the funds and funds are insufficient or the account is closed, the payroll will fail to fund. If your payroll fails to fund: ❗Depending on your processing period, your employees may not get paid on time. ❗Your payroll account will be moved to an ‘in bad standing’ status. ❗Your account will be locked from running further payrolls until the payroll is funded and your account is back in good standing. ❗While your account is in bad standing, Dripos and its compliance partner is unable to remit or file taxes on the employer’s behalf. ❗The account will be charged a $150 failed funding fee, which is the cost to Dripos’ of remedying the failed funding with our banking partner. ❗If your account fails to fund payroll, you will be notified via email and your Dripos payroll dashboard will show a warning. Reach out to payroll@dripos.com for assistance funding the payroll and putting your account back in good standing.Regular Payroll

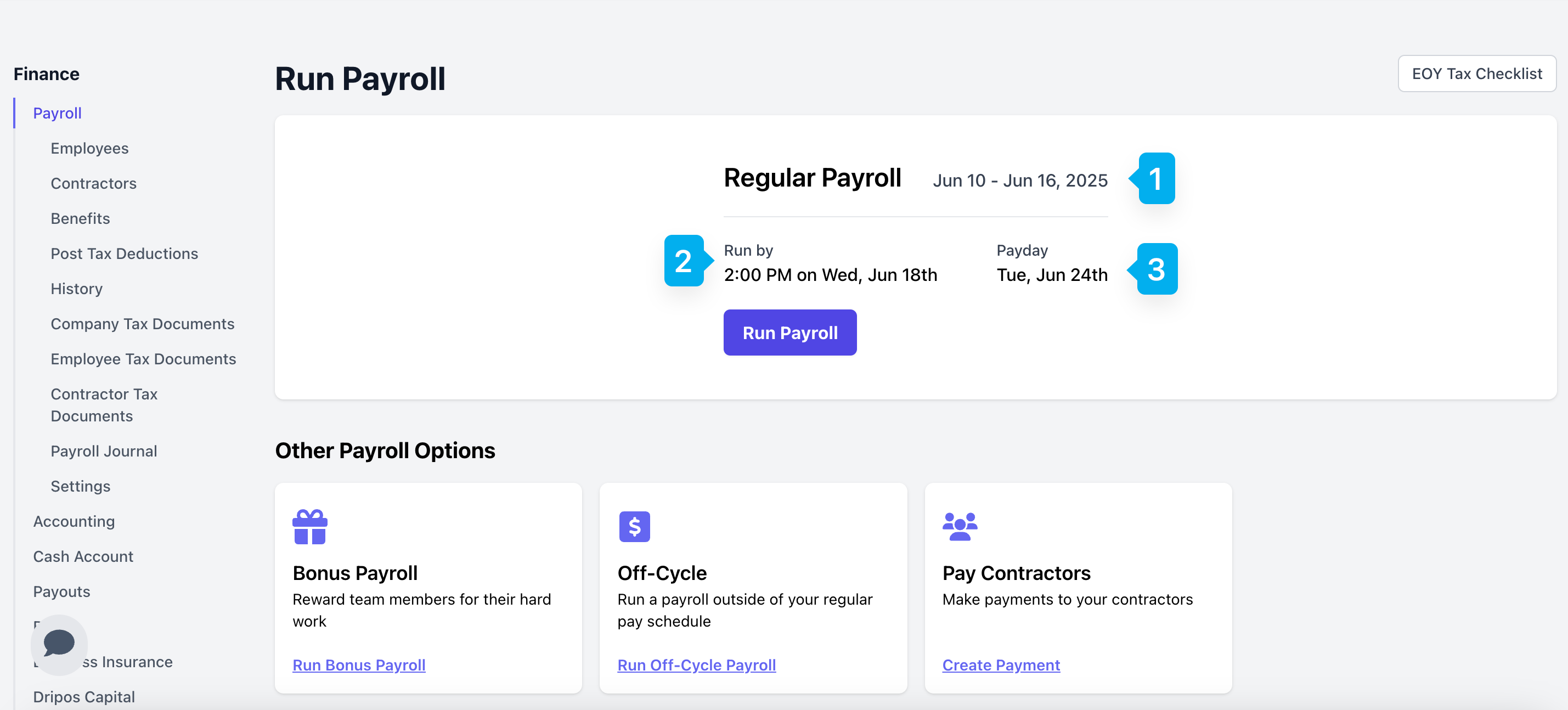

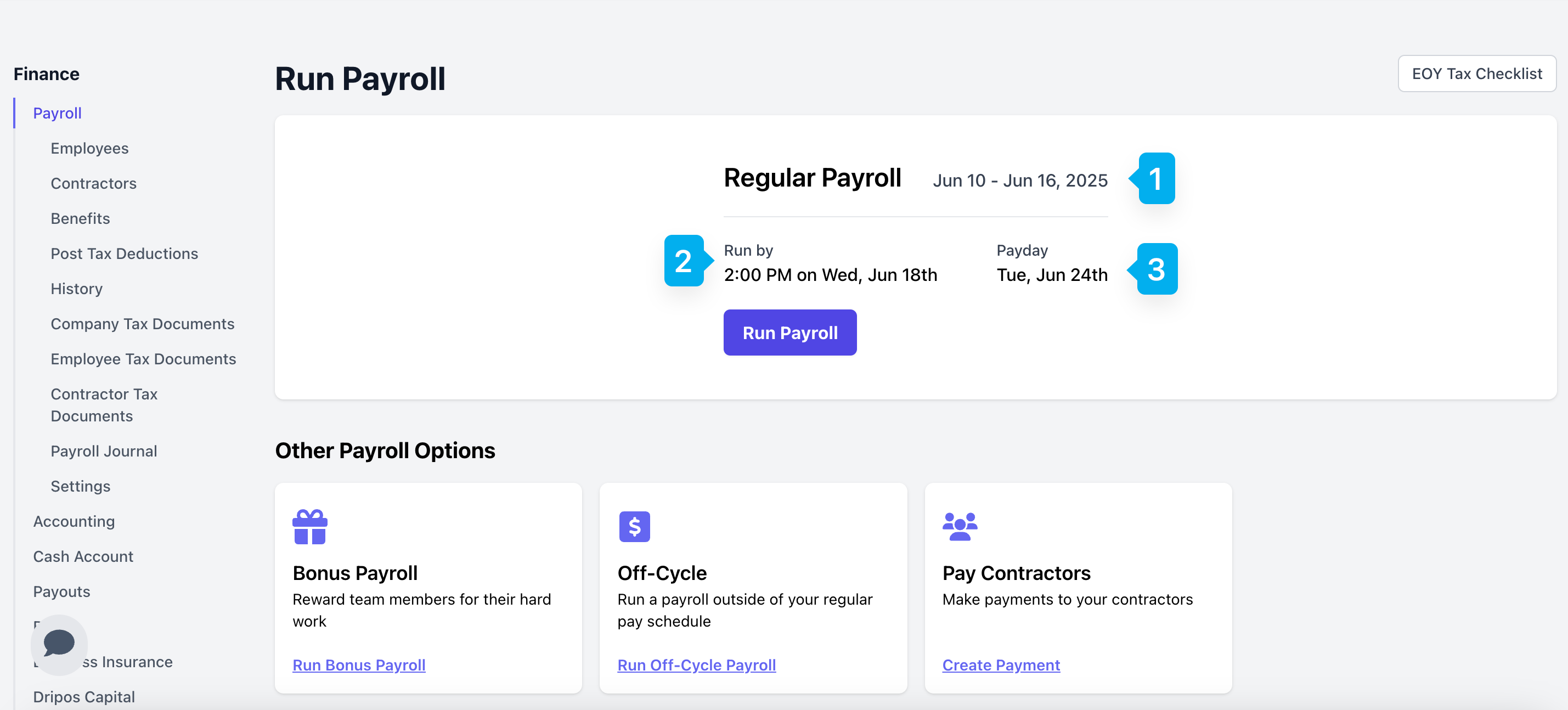

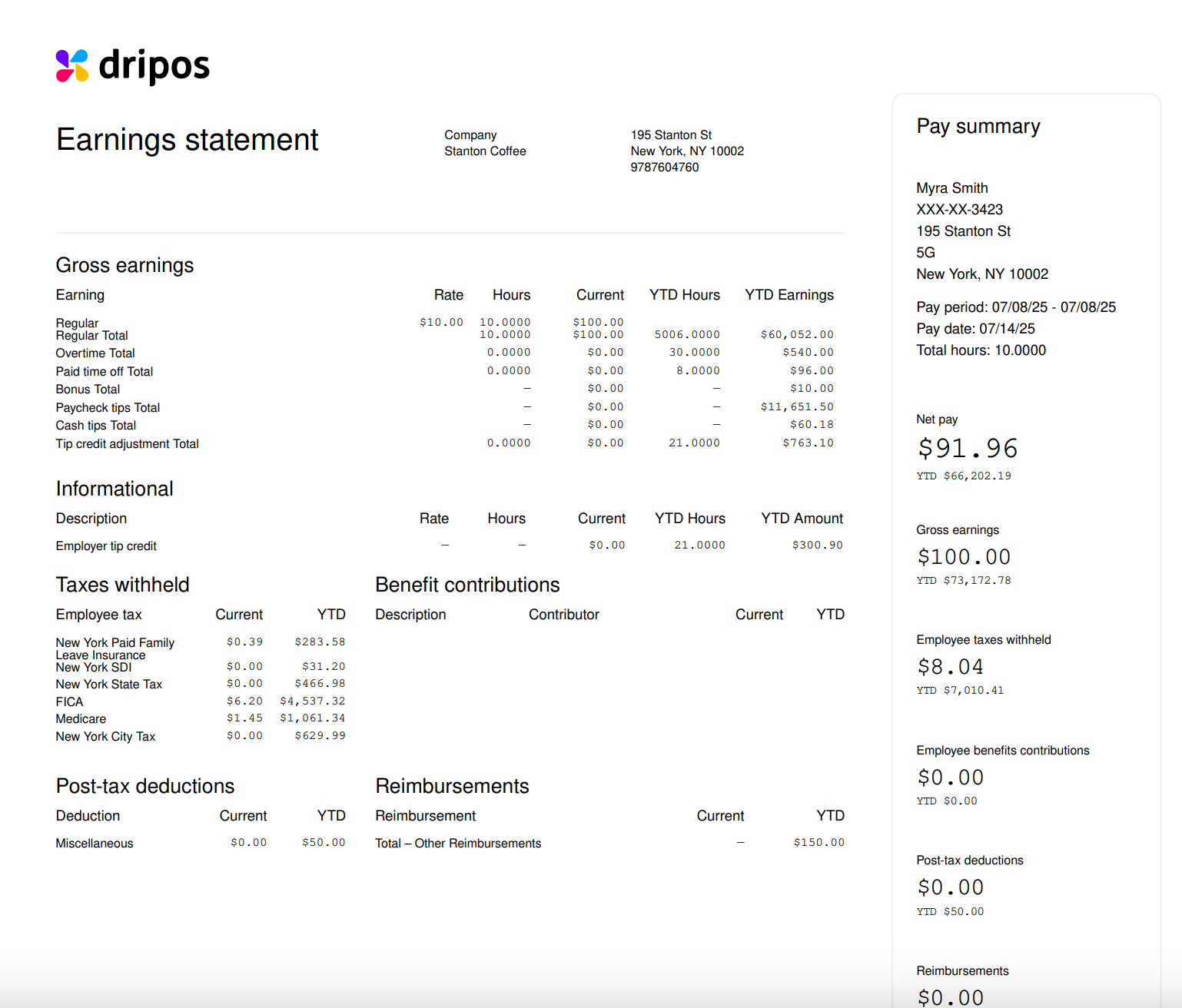

Regular payroll refers to your standard weekly or bi-weekly pay schedule used to pay most of your employees During your onboarding with Dripos Payroll, you and your specialist will agree on a first payroll run date and a weekly or bi-weekly pay schedule.Understanding your Regular Payroll

Understanding your Regular Payroll

Click Run Payroll to begin

Pay Period

Start and end date for which work will be compensated

Payrun Deadline

Latest this payroll can be ran to guarantee employees are paid on the designated payday

Payday

Date of payment to employees for this payroll

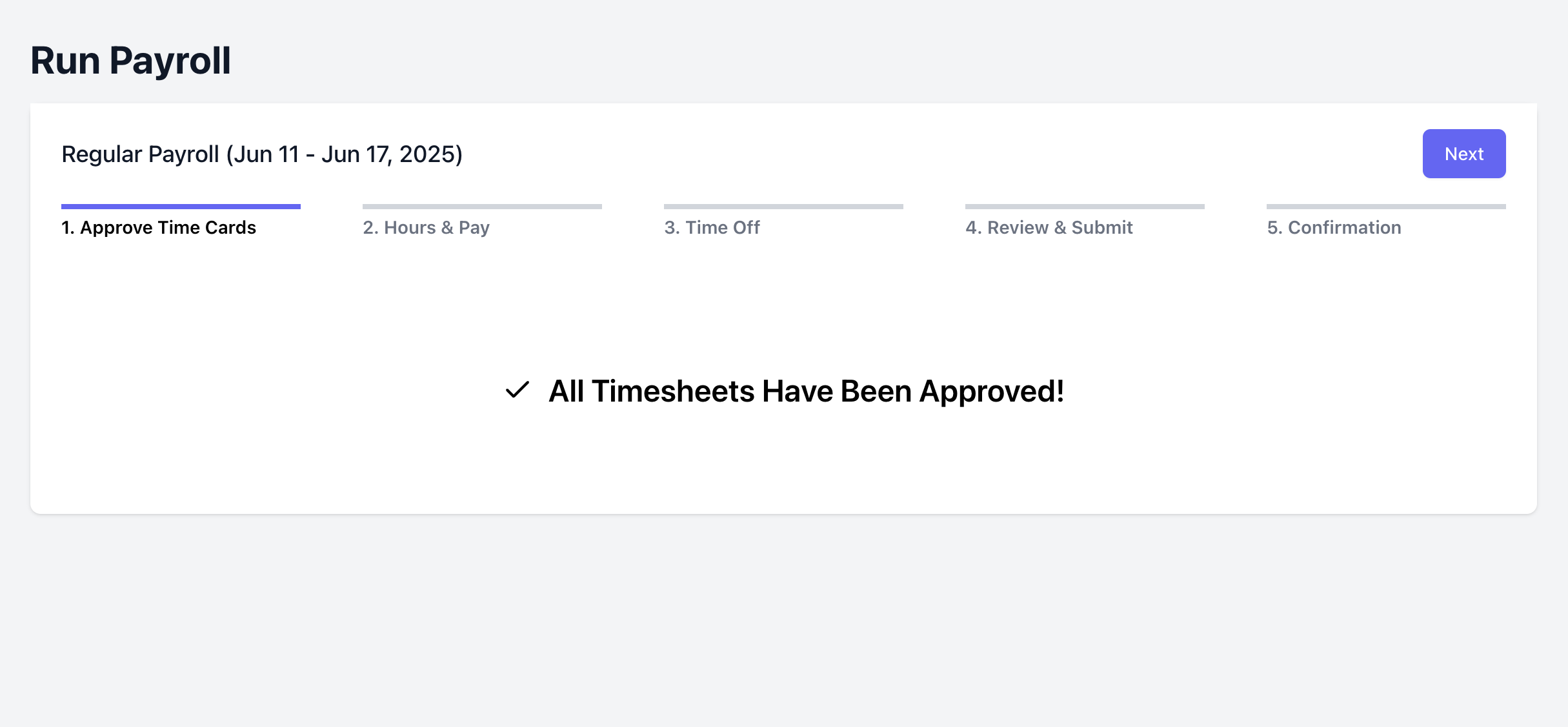

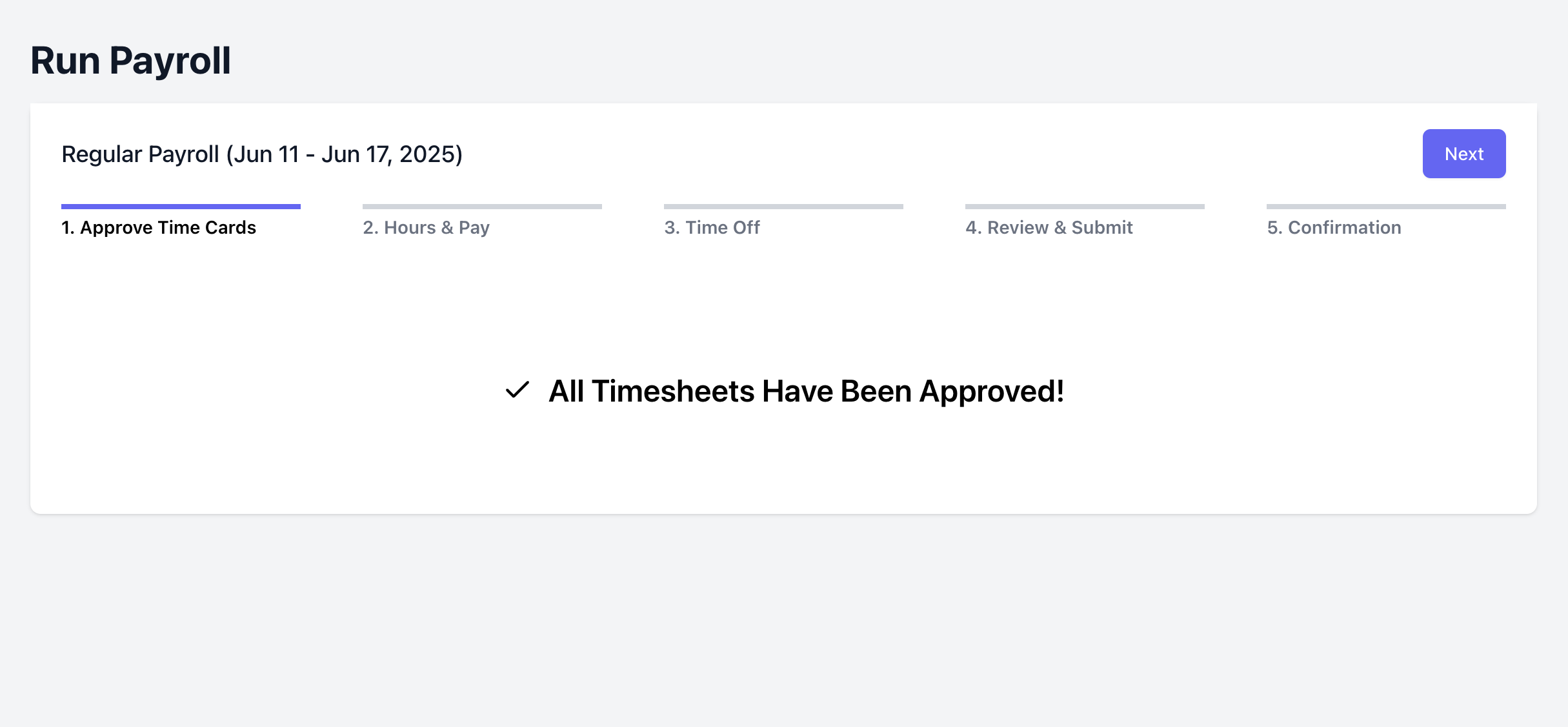

Step 1 - Approve Time Cards

Step 1 - Approve Time Cards

Any time cards that have not yet been approved in the Approval Center will appear here to either approve or reject for payroll.

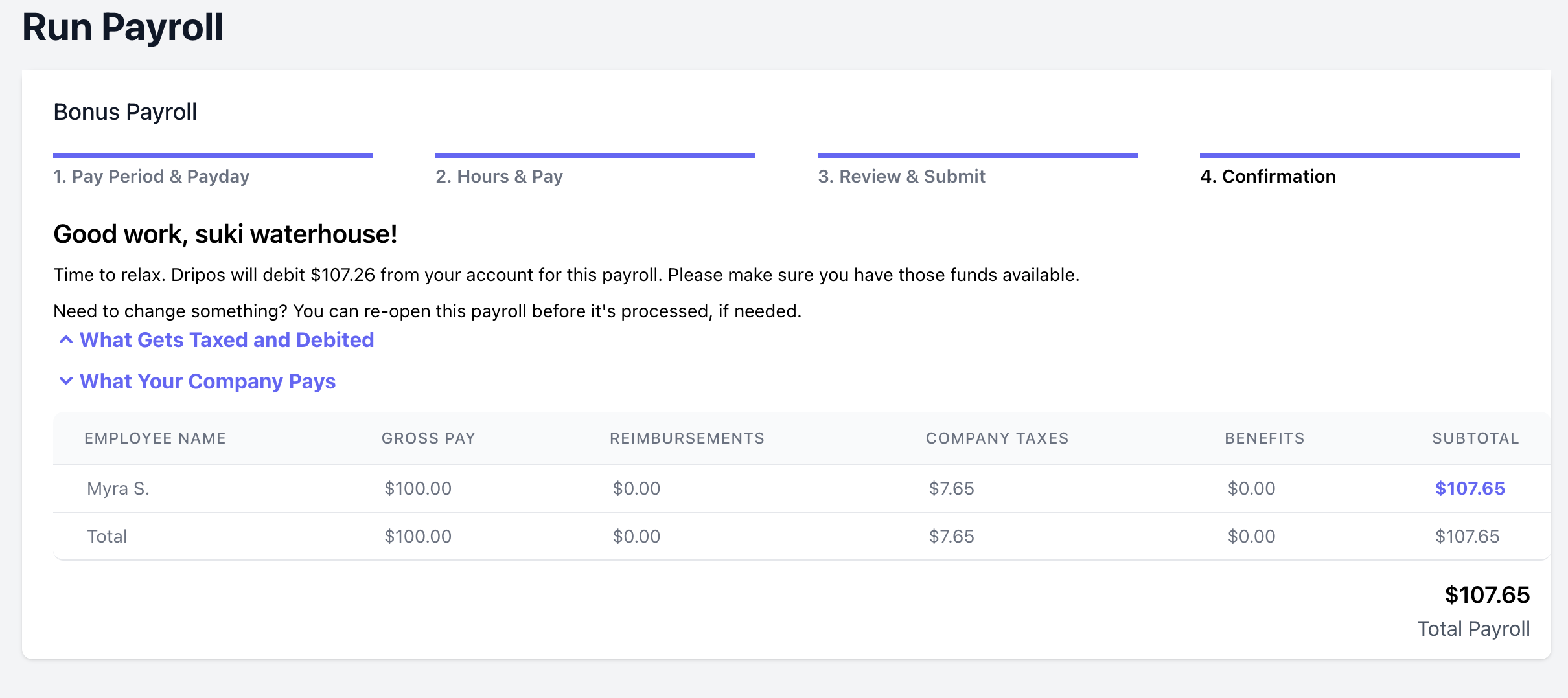

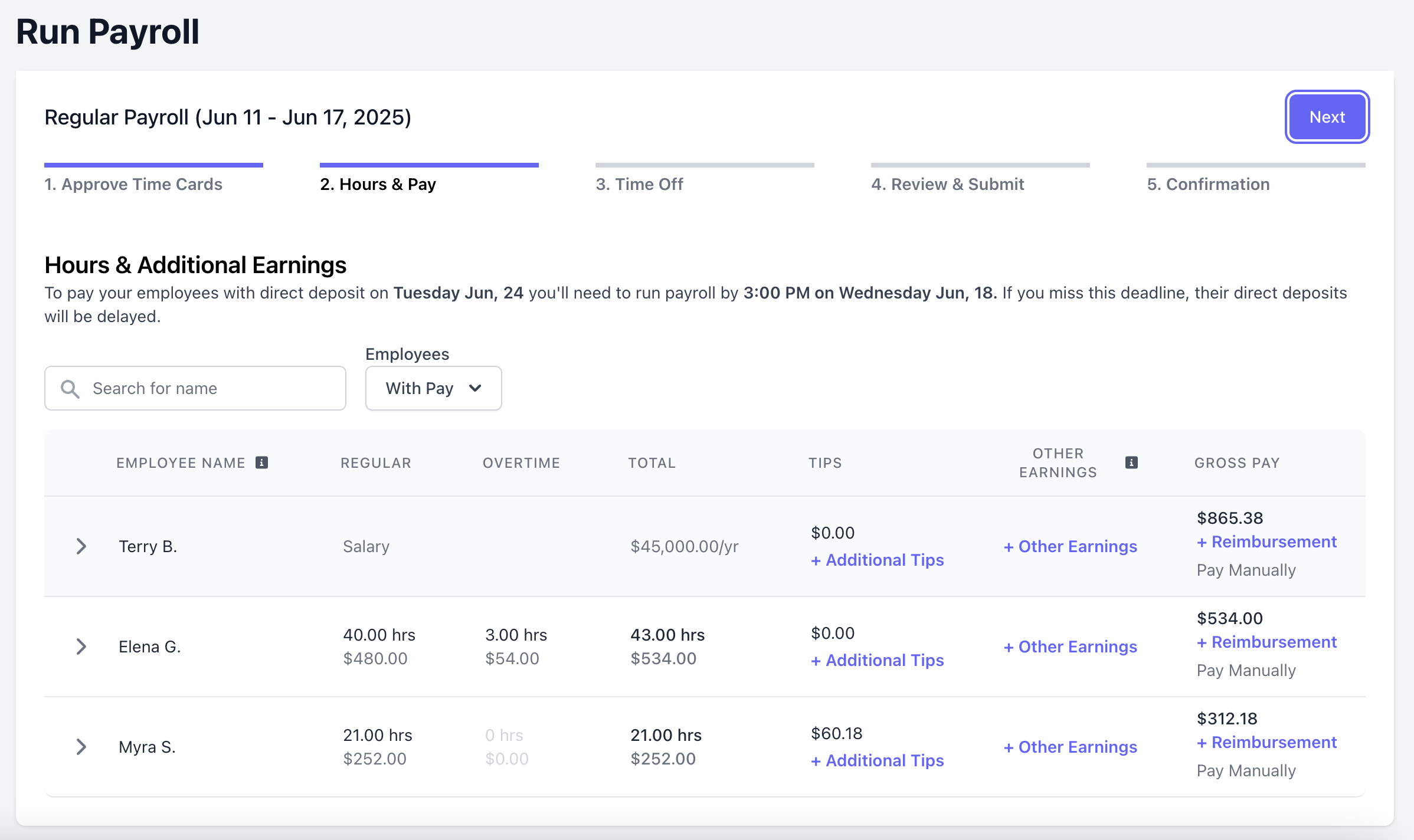

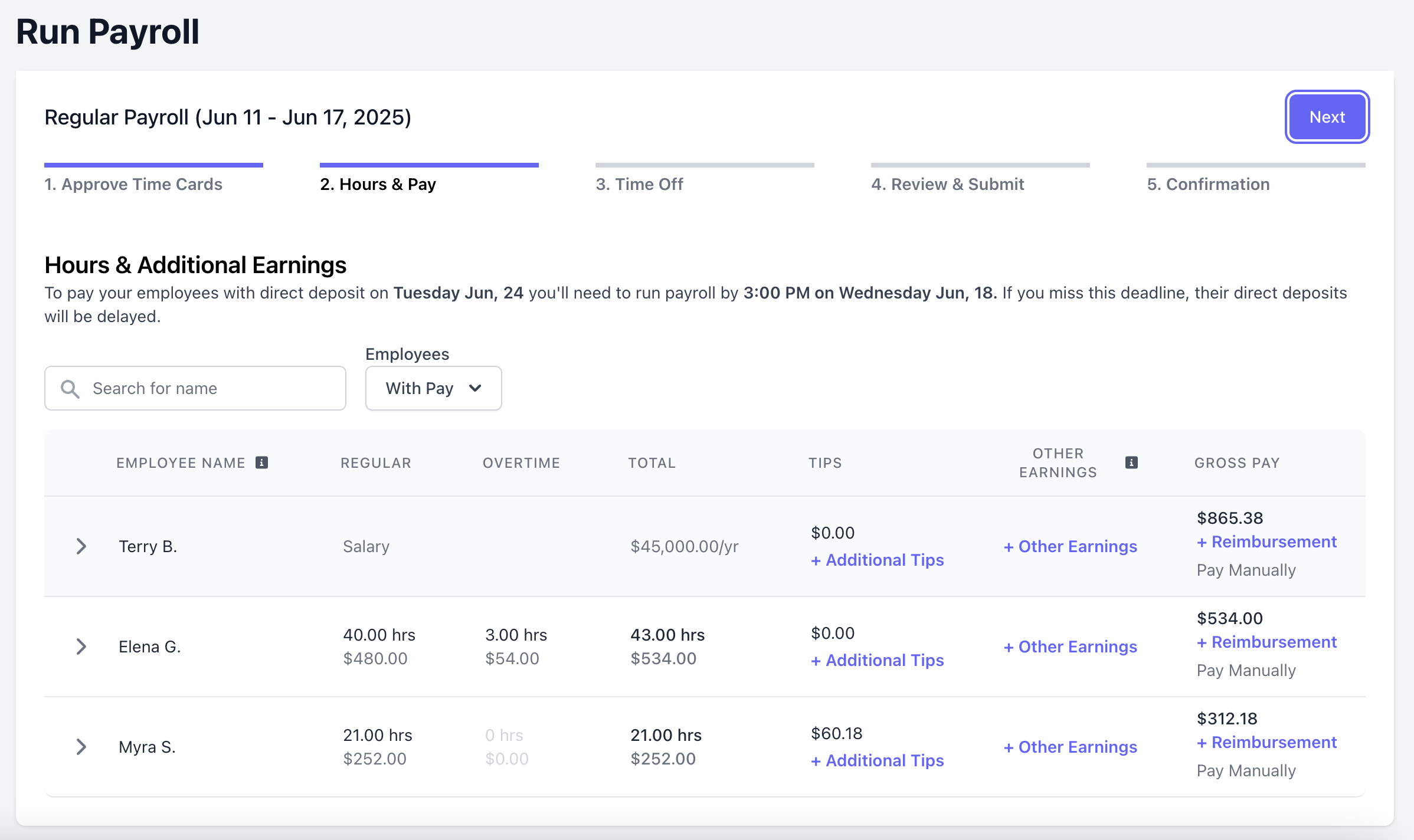

Step 2 - Hours & Pay

Step 2 - Hours & Pay

View the hours and pay for each employee

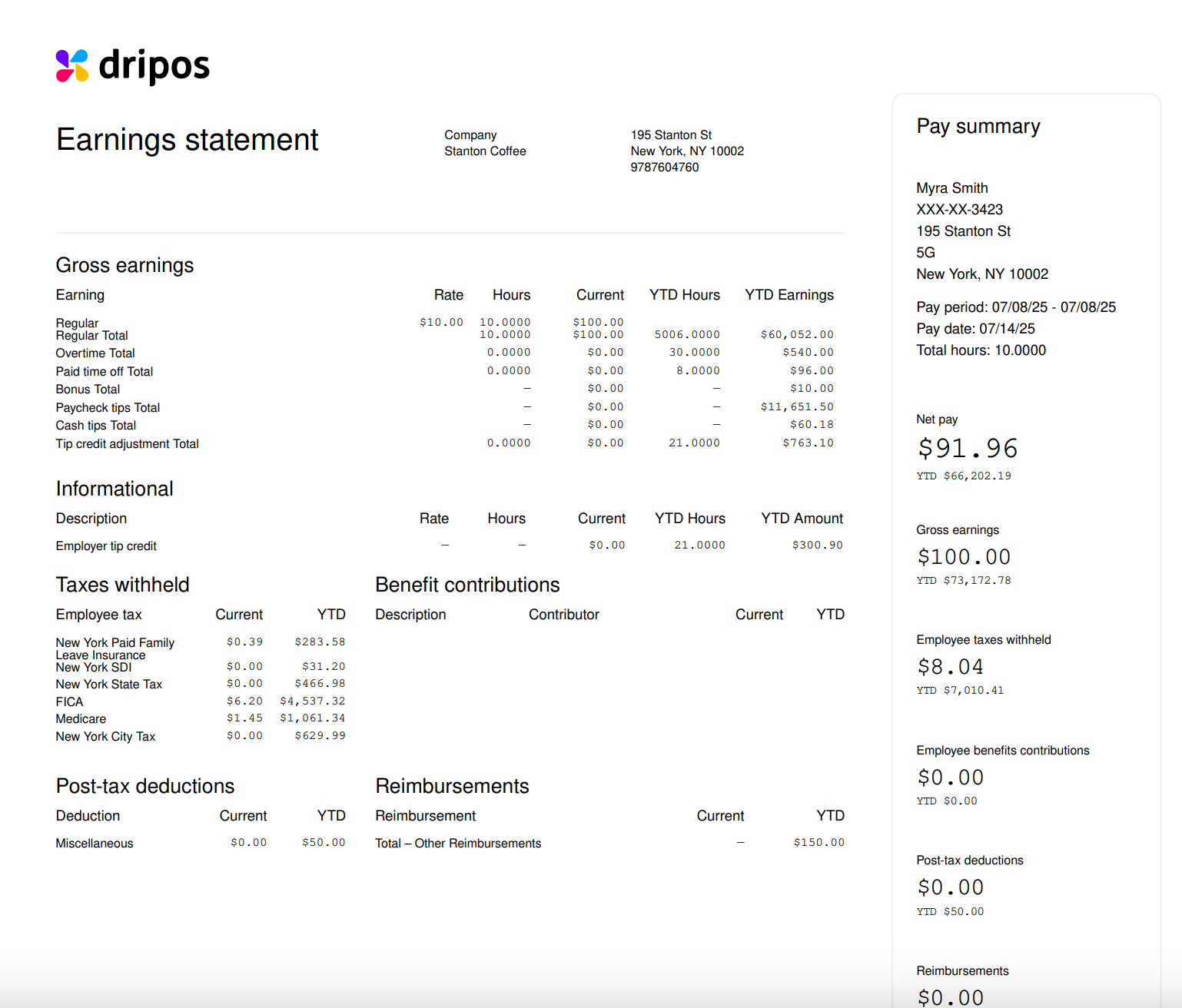

Gross Pay

Consists of all earnings before deductions, including regular wages, overtime, bonuses, commissions, and tips.

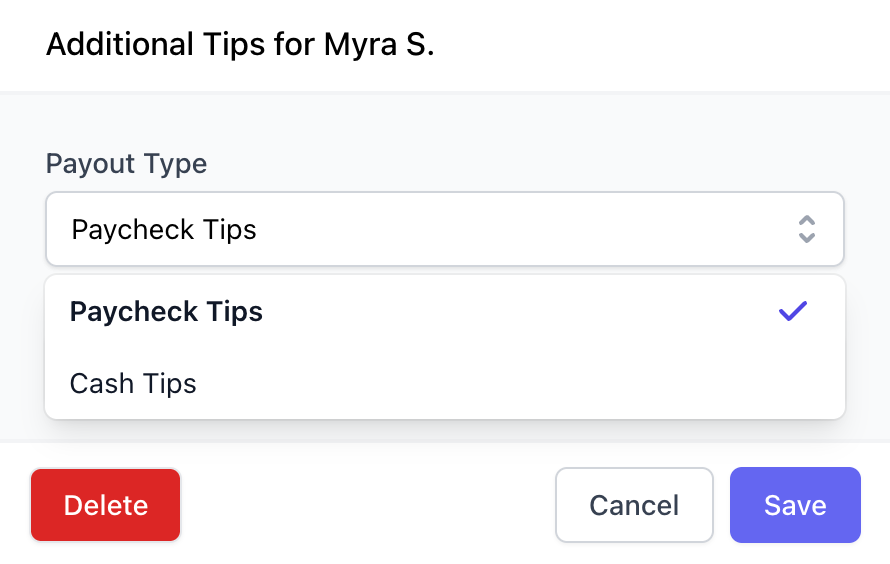

Additional Tips

- Paycheck Tips: Tips to be paid out to this employee via payroll

- Cash Tips: Tips that have already been paid out in cash and are only being reported on payroll for tax purposes (adding cash tips will not pay your employee additional tips)

Other Earnings

Bonus: Extra compensation given on top of regular wagesCommission: Pay earned based on the amount of sales or performance achievedGroup Term Life: Employer-provided life insurance that offers coverage to employees for a set termSeverance: A payment given to an employee when they are laid off or let go, typically based on tenure.Non Hourly Regular: A additionaly fixed amount paid to an employee, regardless of hours worked.Other Imputed: Other imputed income such as use of a company car or gym membershipTip Credit Adiustment: The difference between an employee’s tips and the minimum wage the employer must ensure they receive

Reimbursements

A payment made to an employee through payroll to repay them for out-of-pocket business expenses. It’s not considered wages if properly documented. Usually not taxed, as long as it meets IRS guidelines (e.g., part of an accountable plan)

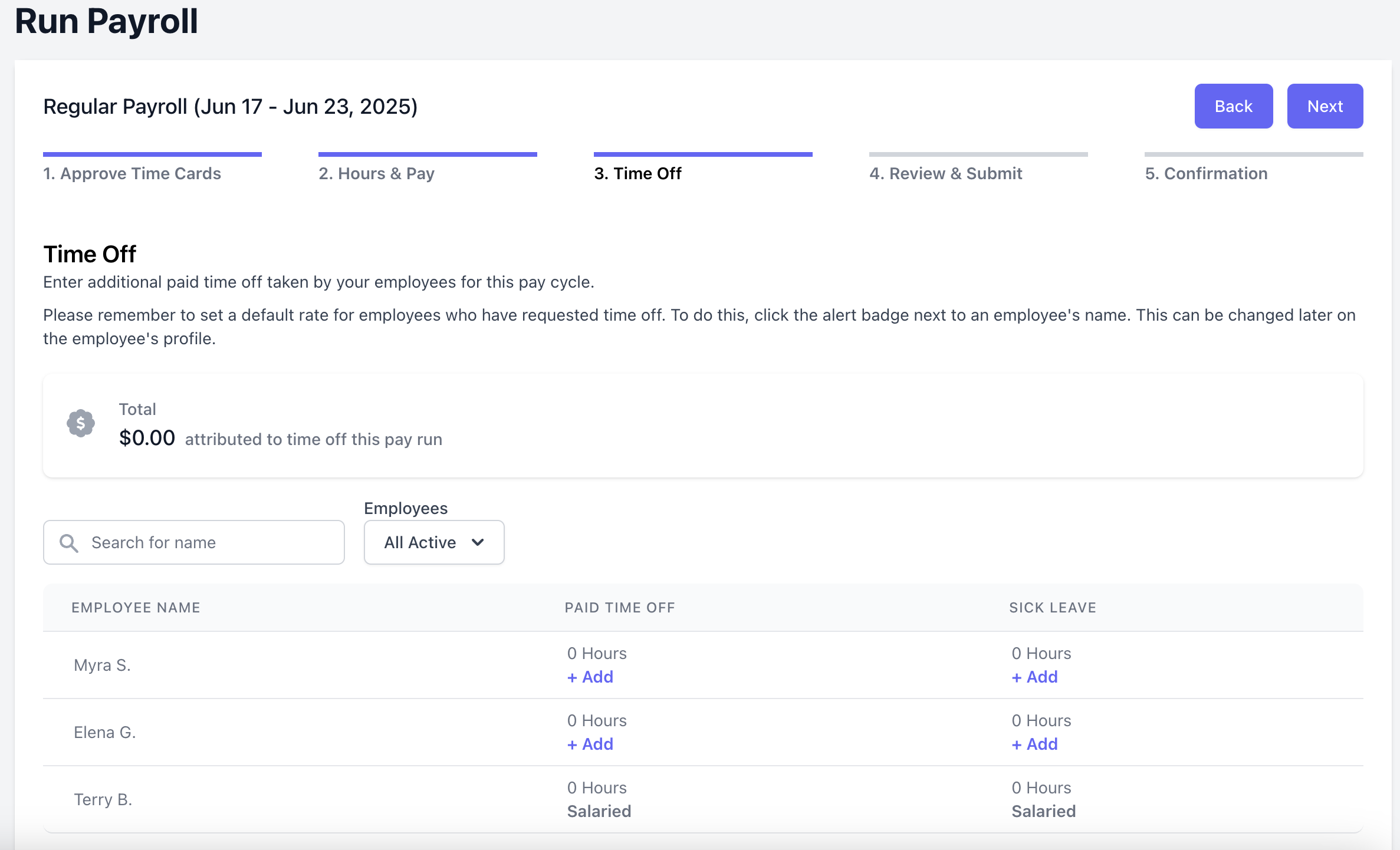

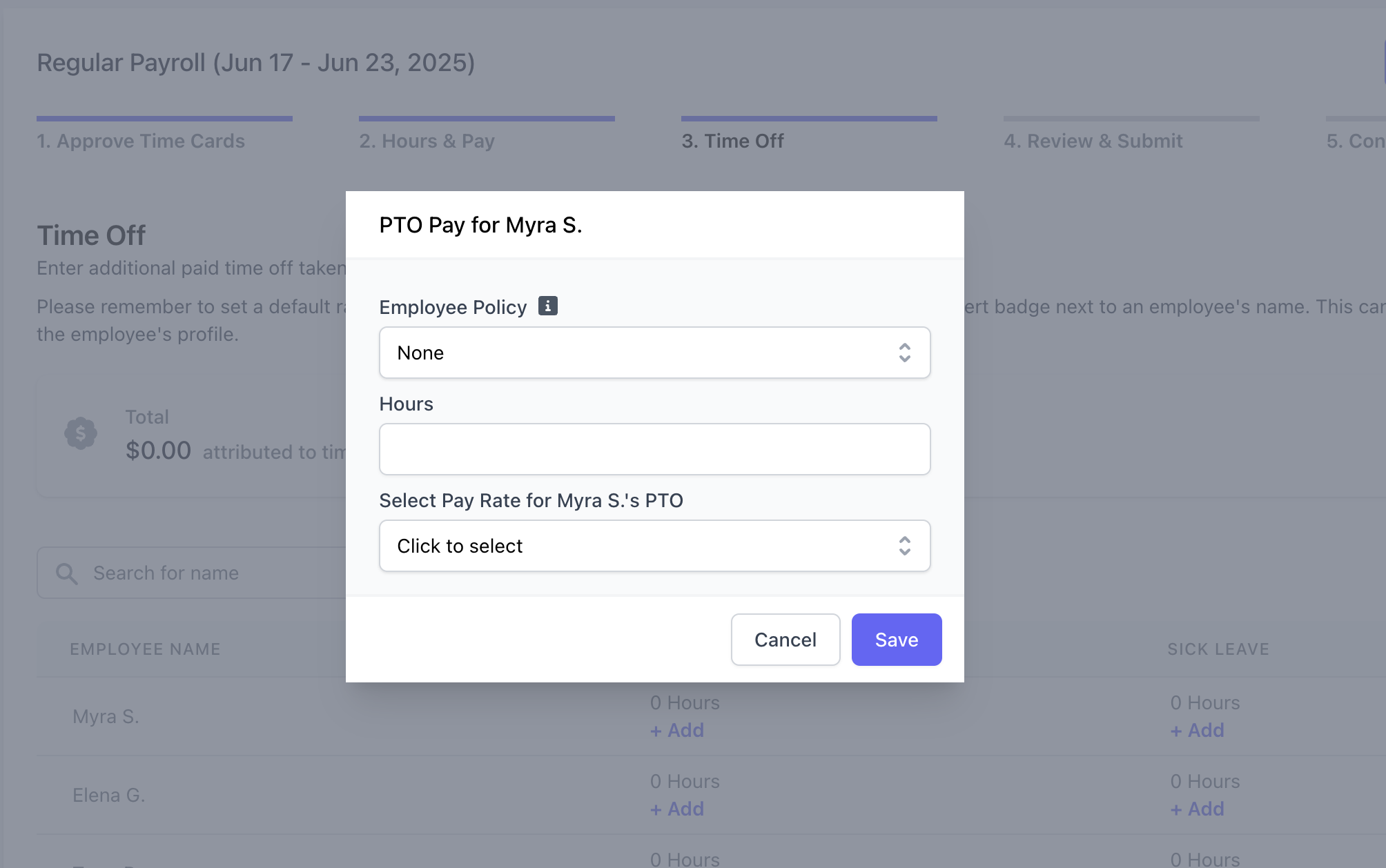

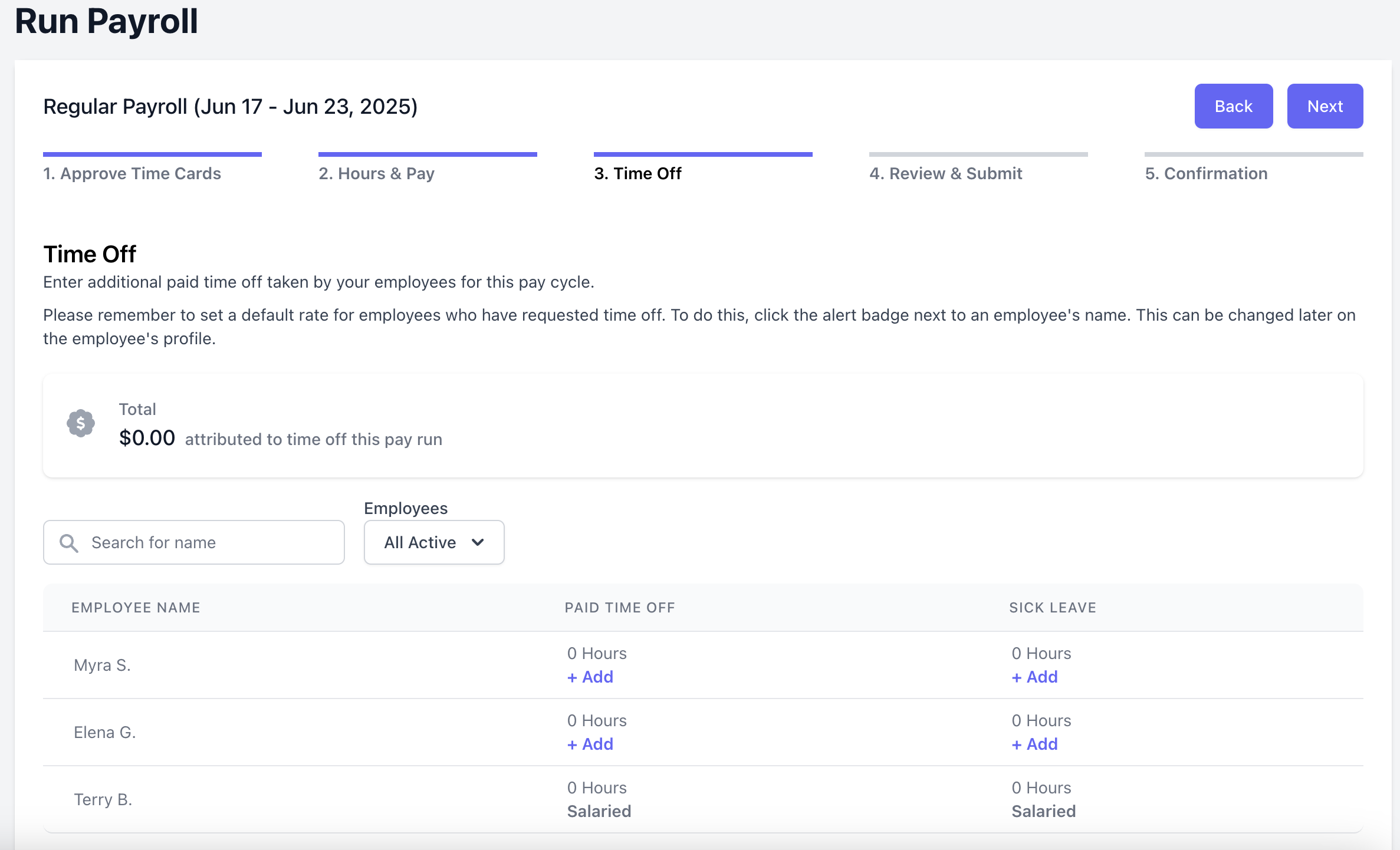

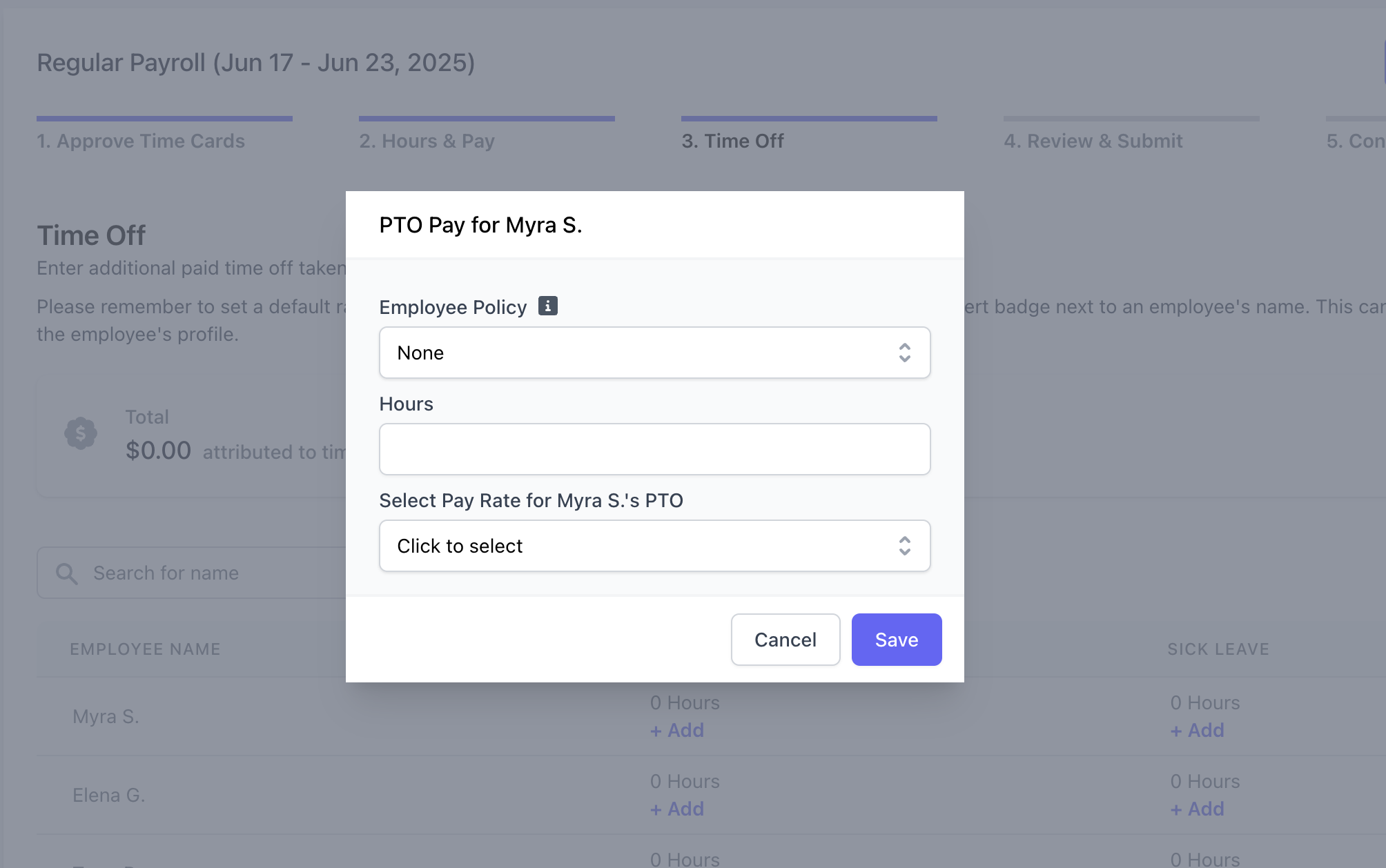

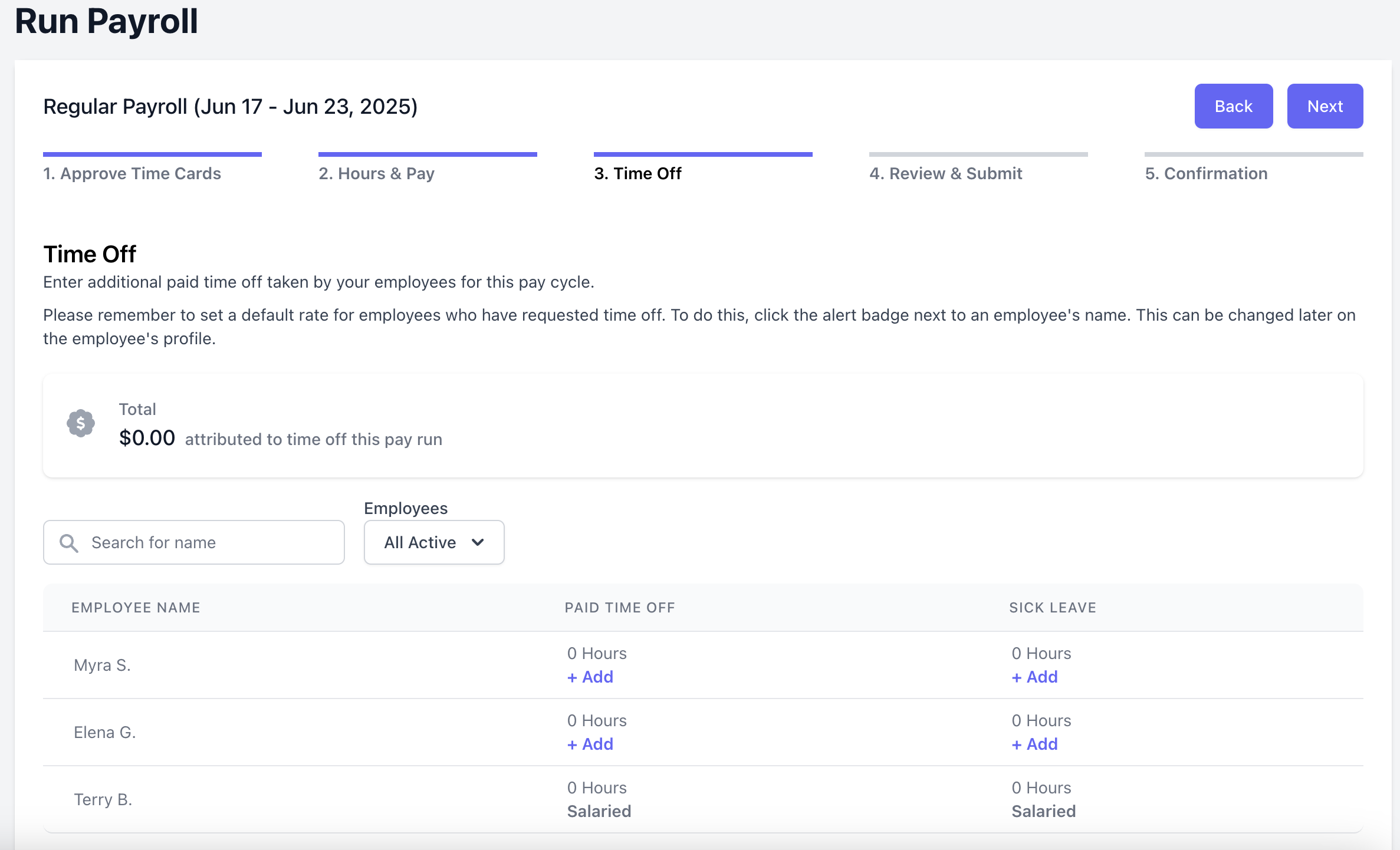

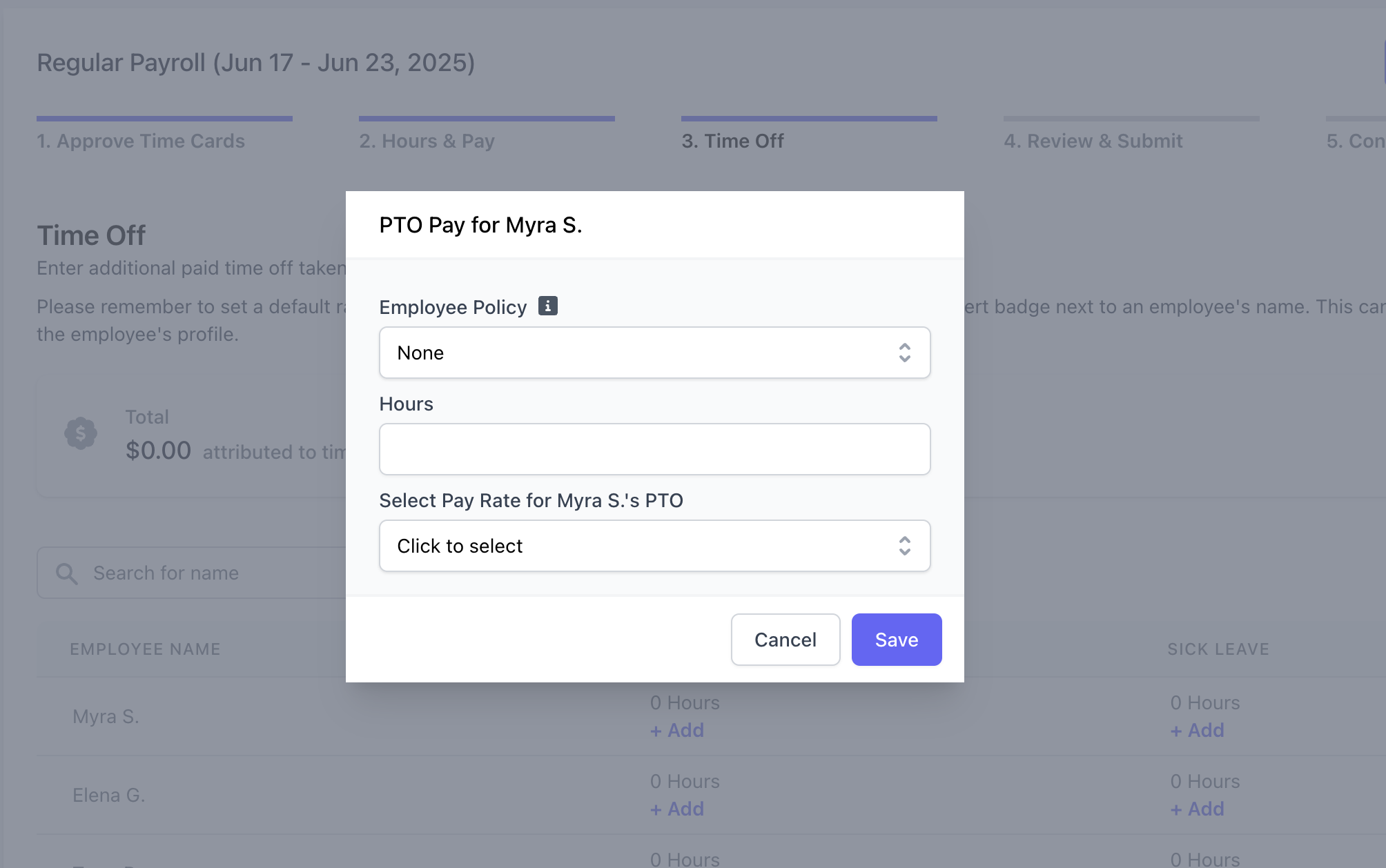

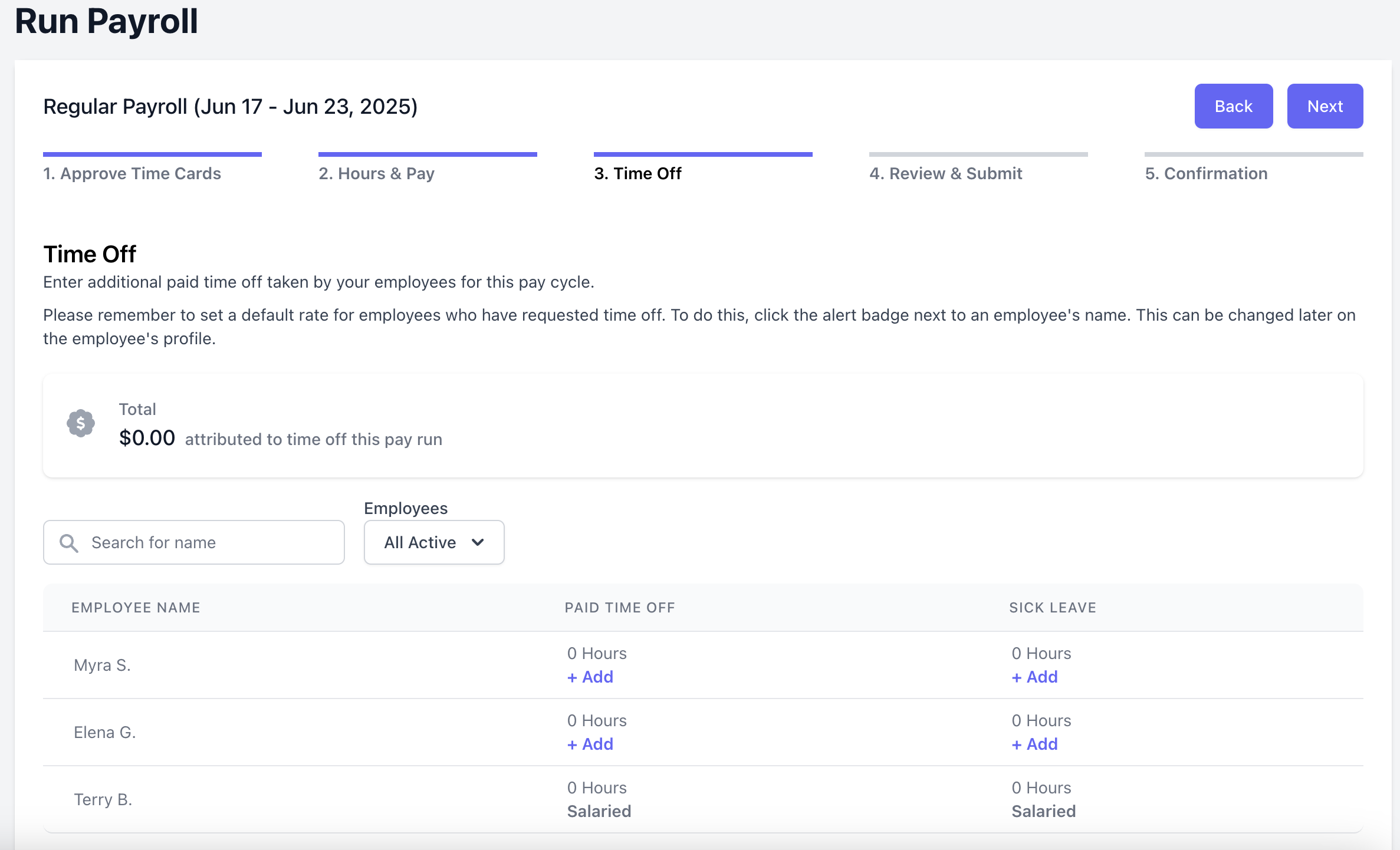

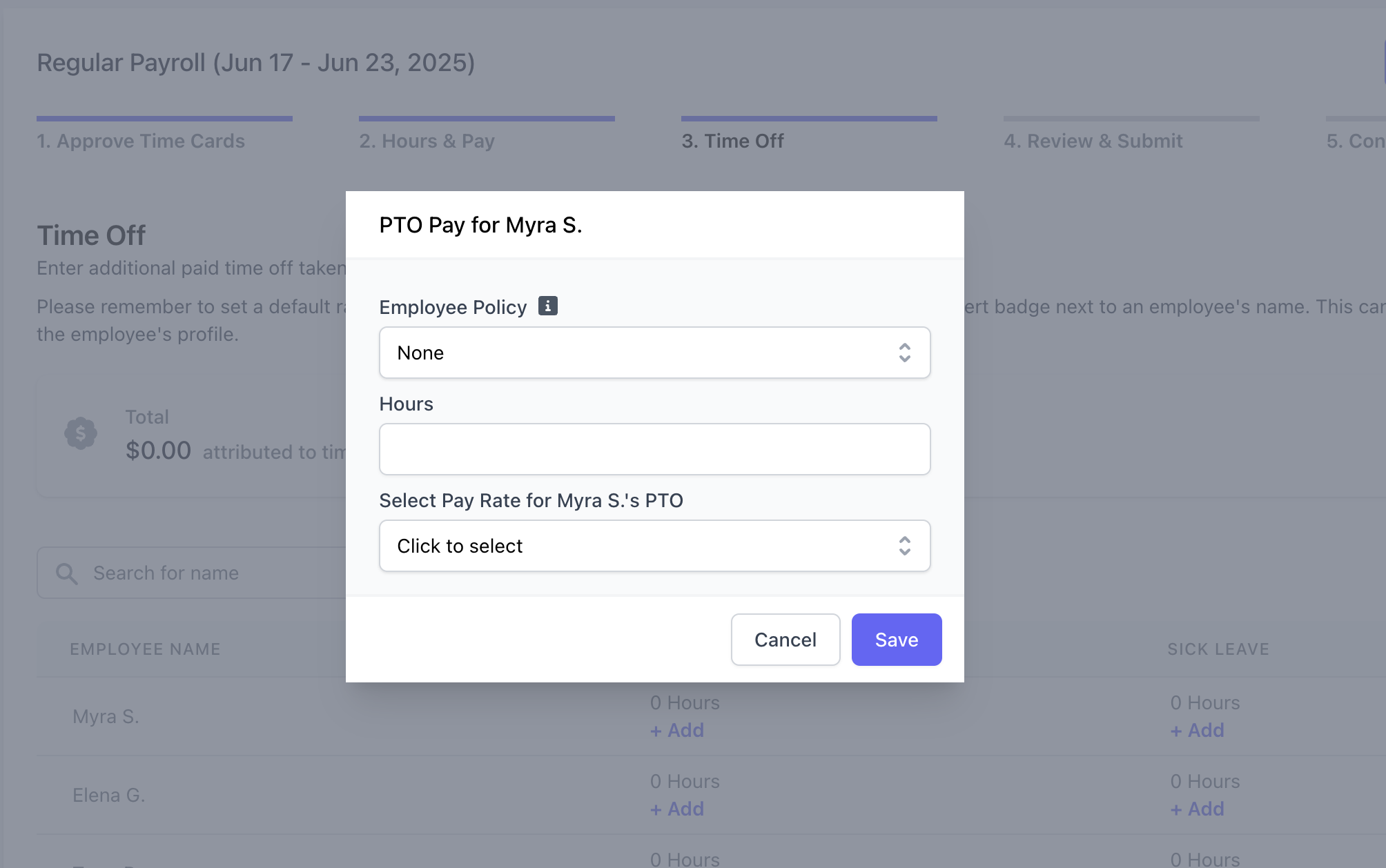

Step 3 - Time Off

Step 3 - Time Off

Any approved time off will automatically allocate itself here. To add any additional paid time off or sick leave, click Add under each respective employee and column.

Step 4 - Review & Submit

Step 4 - Review & Submit

Total Payroll

Total cost of payroll for you, the employer.

Debit Amount

The amount of funds to be withdrawn from your bank account on file to fund this payroll.

Paper Check Amount

If any employees are to be paid manually, that amount will appear here

Subtotal

Subtotal that you, the employer, are paying for each employee. This is not the net pay the employee will receive.

Benefits

Any benefits applied to employee pay will appear here. Learn more about employee benefits here.

What Gets Taxed and Debited

Listed will be the total amount of employee taxes to be withheld from employee paystubs, collectively.Additionally, the total amount of company taxes to be paid by the employer for this payroll will be listed here.

Step 5 - Confirmation

Step 5 - Confirmation

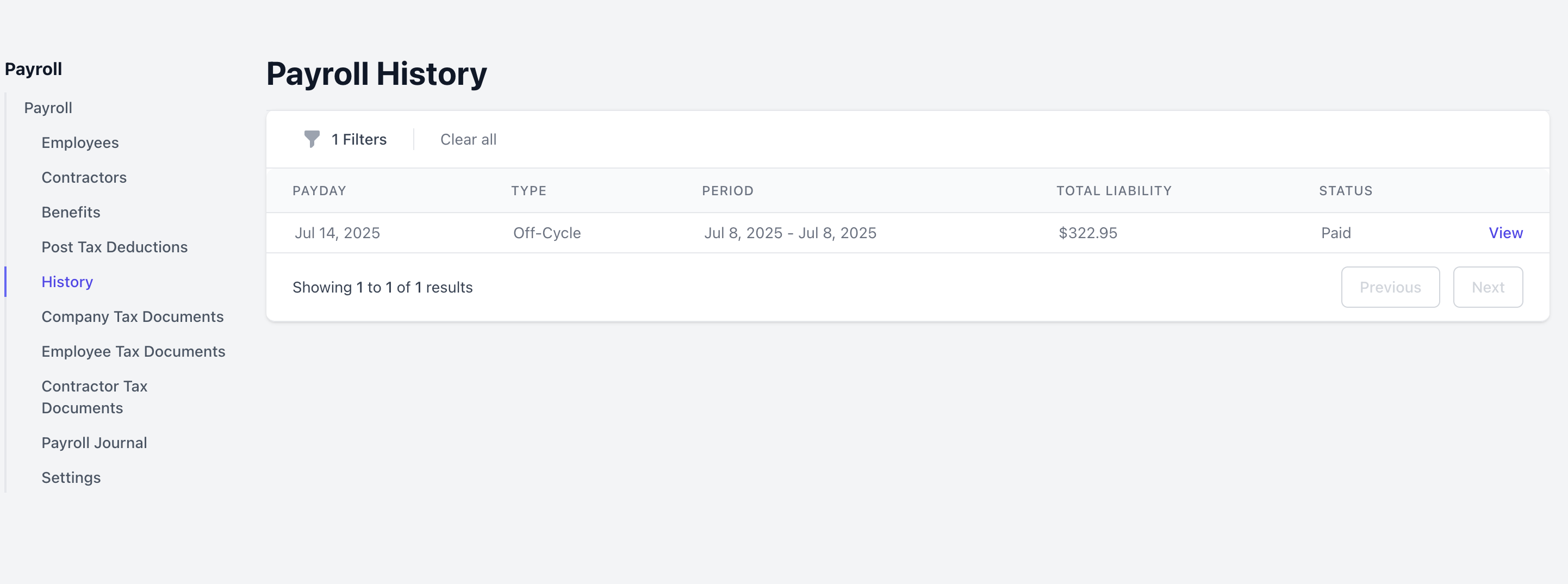

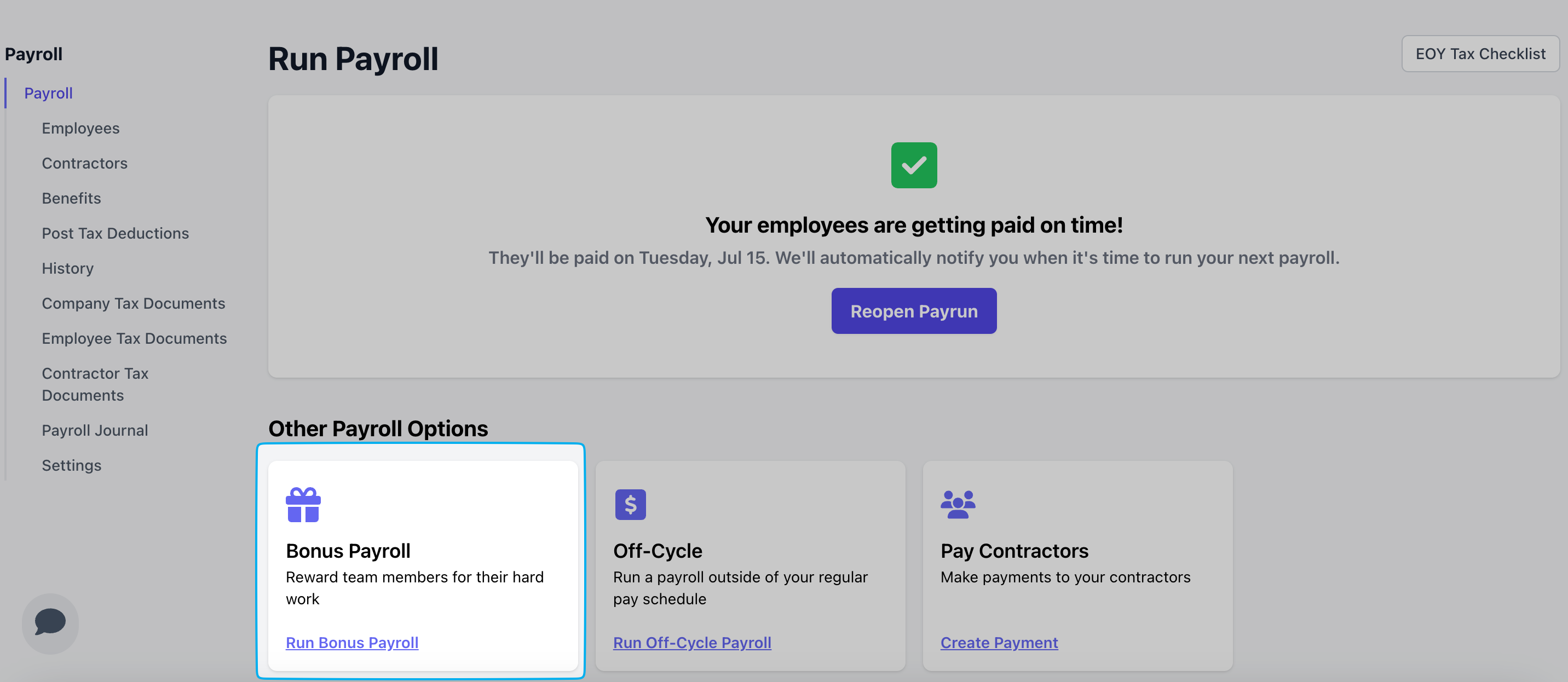

Off-Cycle Payroll

Off-cycle payrolls can be ran at anytime from your payroll dashboard. Learn more below about the different use cases for an off-cycle payroll.Off-Cycle Use Cases

Off-Cycle Use Cases

- Missed pay – An employee wasn’t included in a regular payroll run.

- New hire start – A new employee started after the regular payroll was processed.

- Termination payout – A final paycheck is due upon an employee’s departure.

- Bonus or commission – Paying discretionary or performance-based earnings separately.

- Correction – Fixing payroll errors from a previous run (e.g. wrong hours, pay rate).

- Reimbursement – Issuing business expense reimbursements quickly.

- Manual adjustment – Adjusting for a retroactive raise or change in withholdings.

- State requirements – Some states require faster payouts after termination.

- Holiday conflicts – Payroll needs to be moved due to bank or office closures.

- Tip payouts – Issuing tips more frequently than the regular pay schedule.

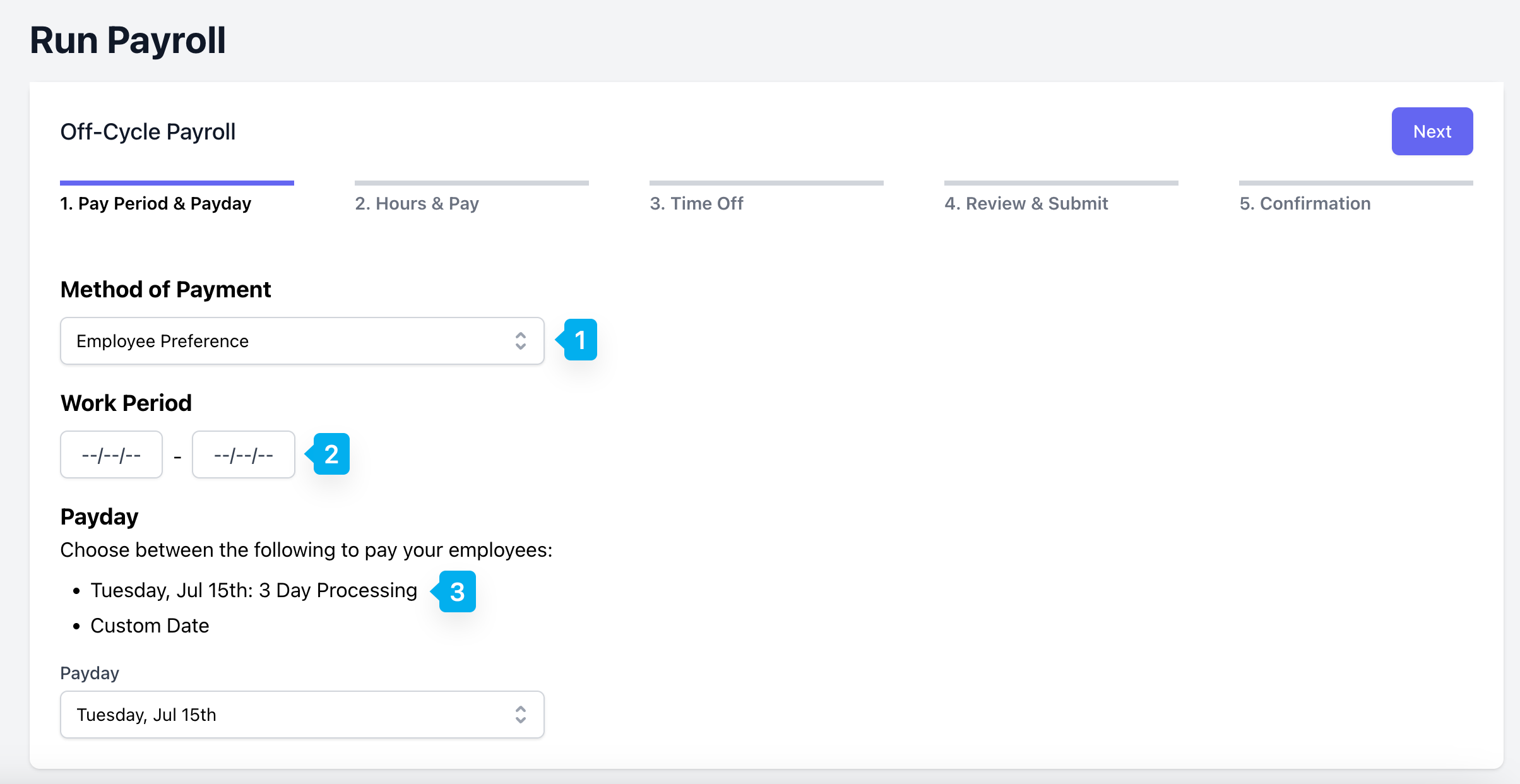

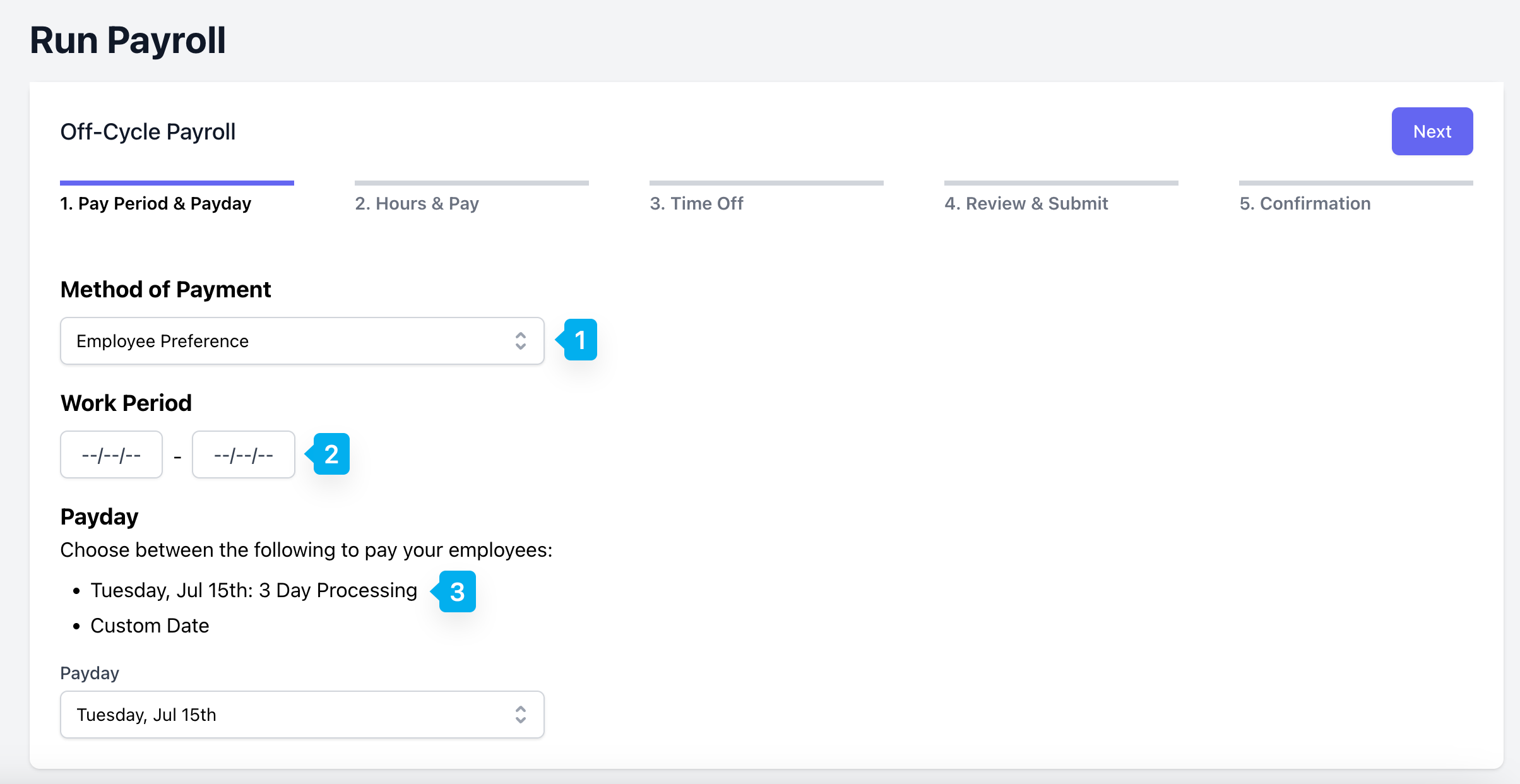

Step 1 - Pay Period & Payday

Step 1 - Pay Period & Payday

Method of Payment

Employee Preference: Employees will be paid using the payment method they have selected for regular payroll—either direct deposit or manual pay. Be sure each employee’s payment method is up to date to ensure timely delivery.Manual: Employees will be paid with a manual method. Employer is responsible for paying employees out of pocket.

Work Period

Select the date range you’d like to pay employees for. Any unpaid time cards within that range will automatically be included in this off-cycle payroll.

Payday

The next available payday within your processing timeline will automatically be selected. You may also choose a custom payday, but it must be after the next available pay date.

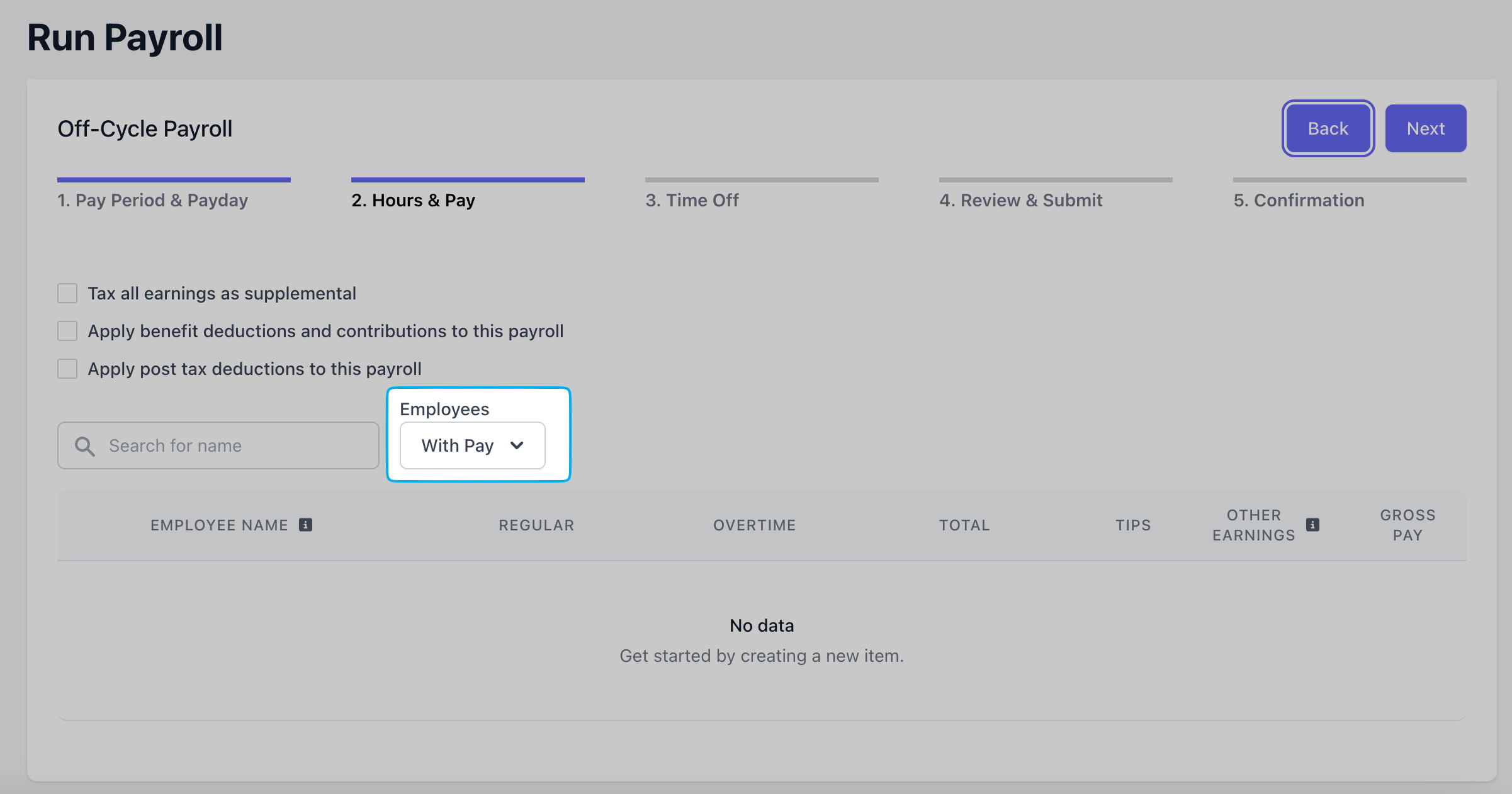

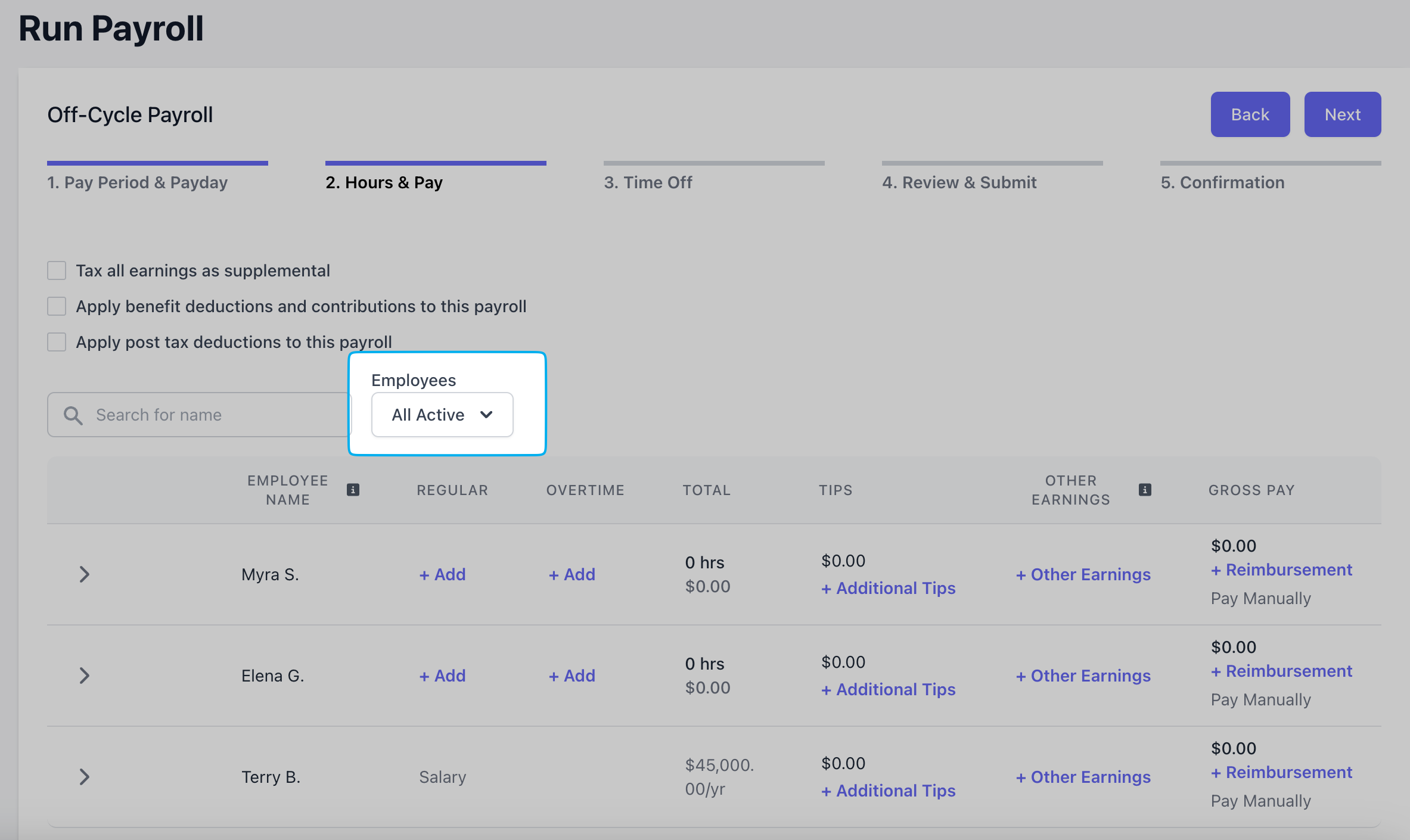

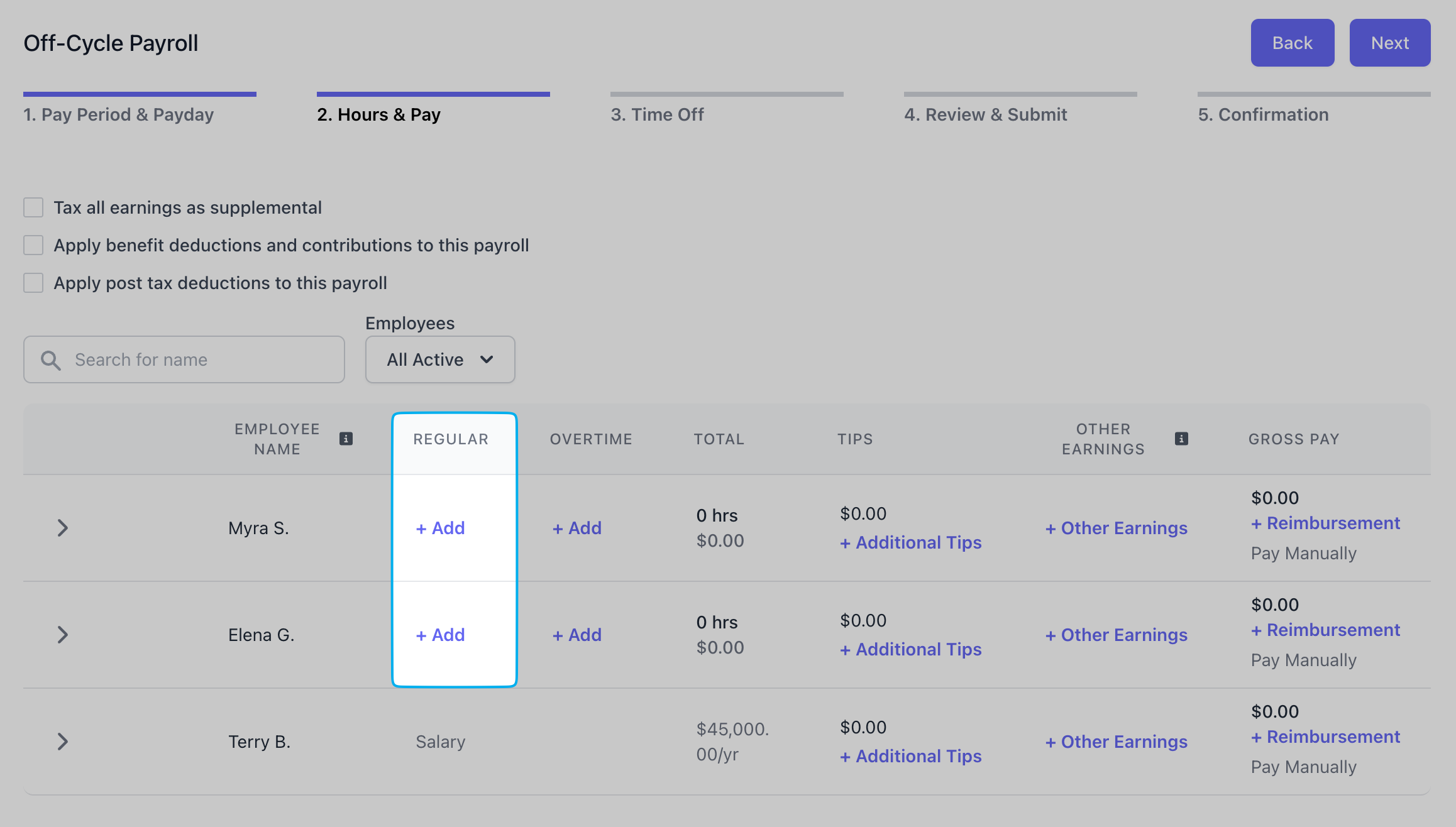

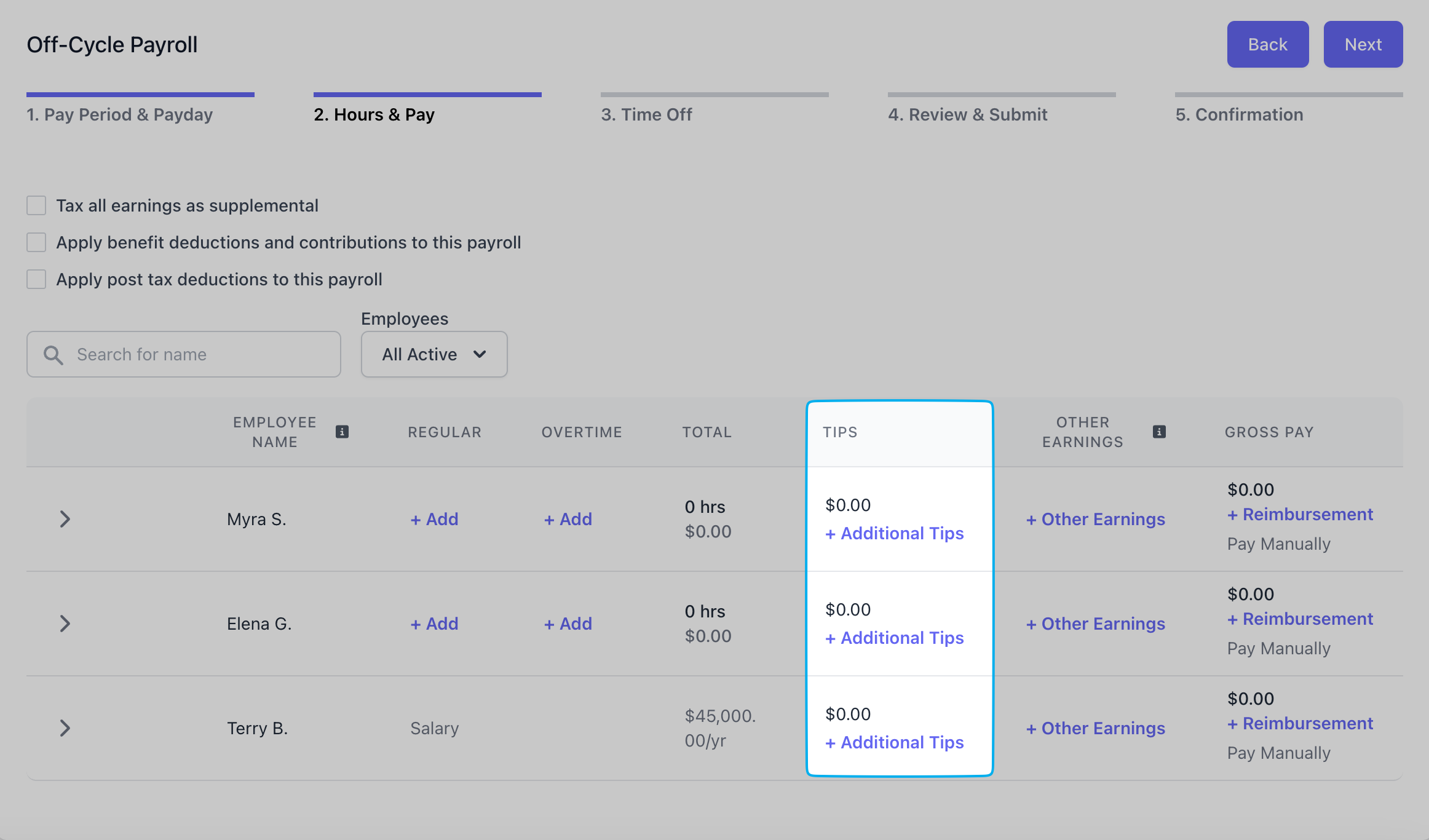

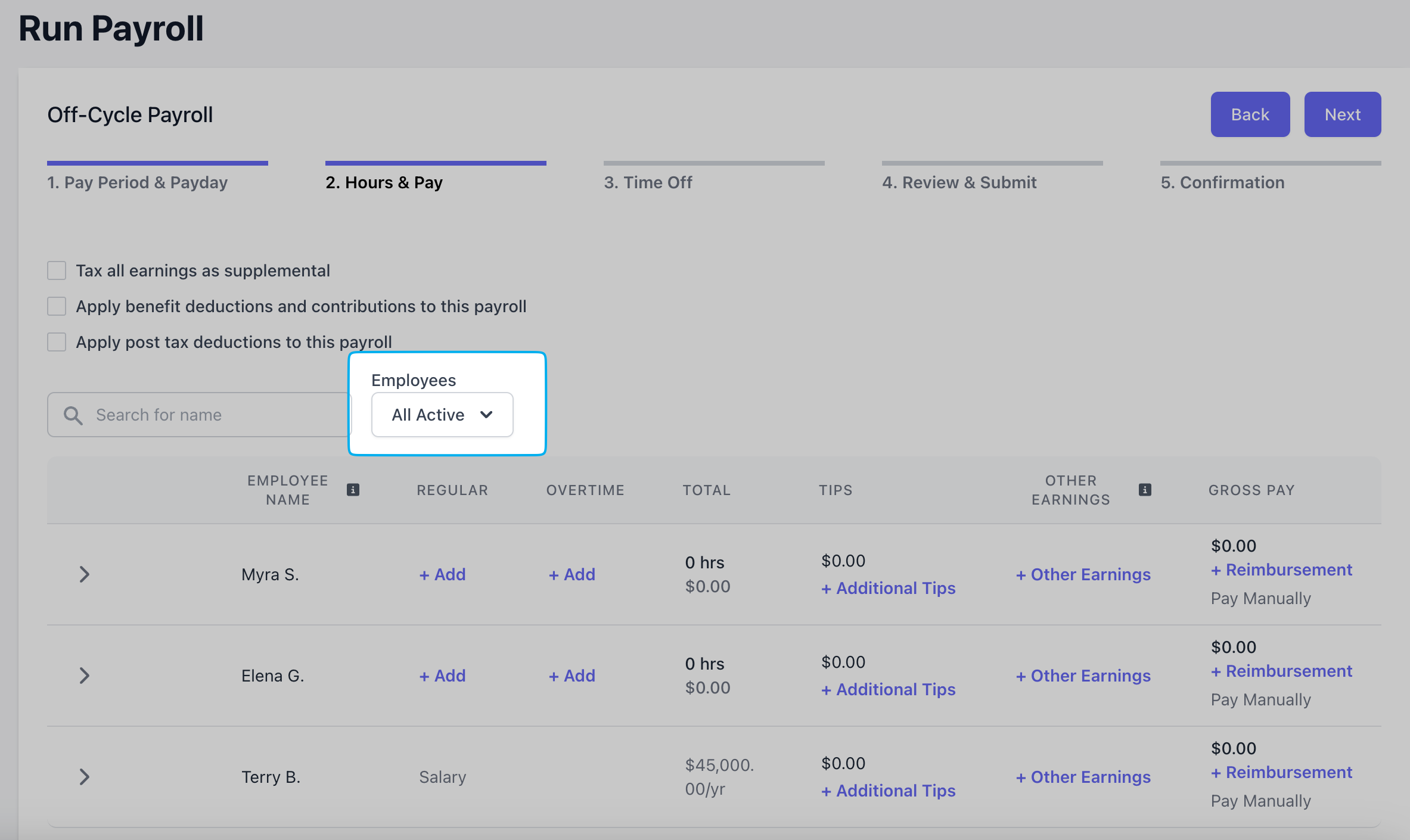

Step 2 - Hours & Pay

Step 2 - Hours & Pay

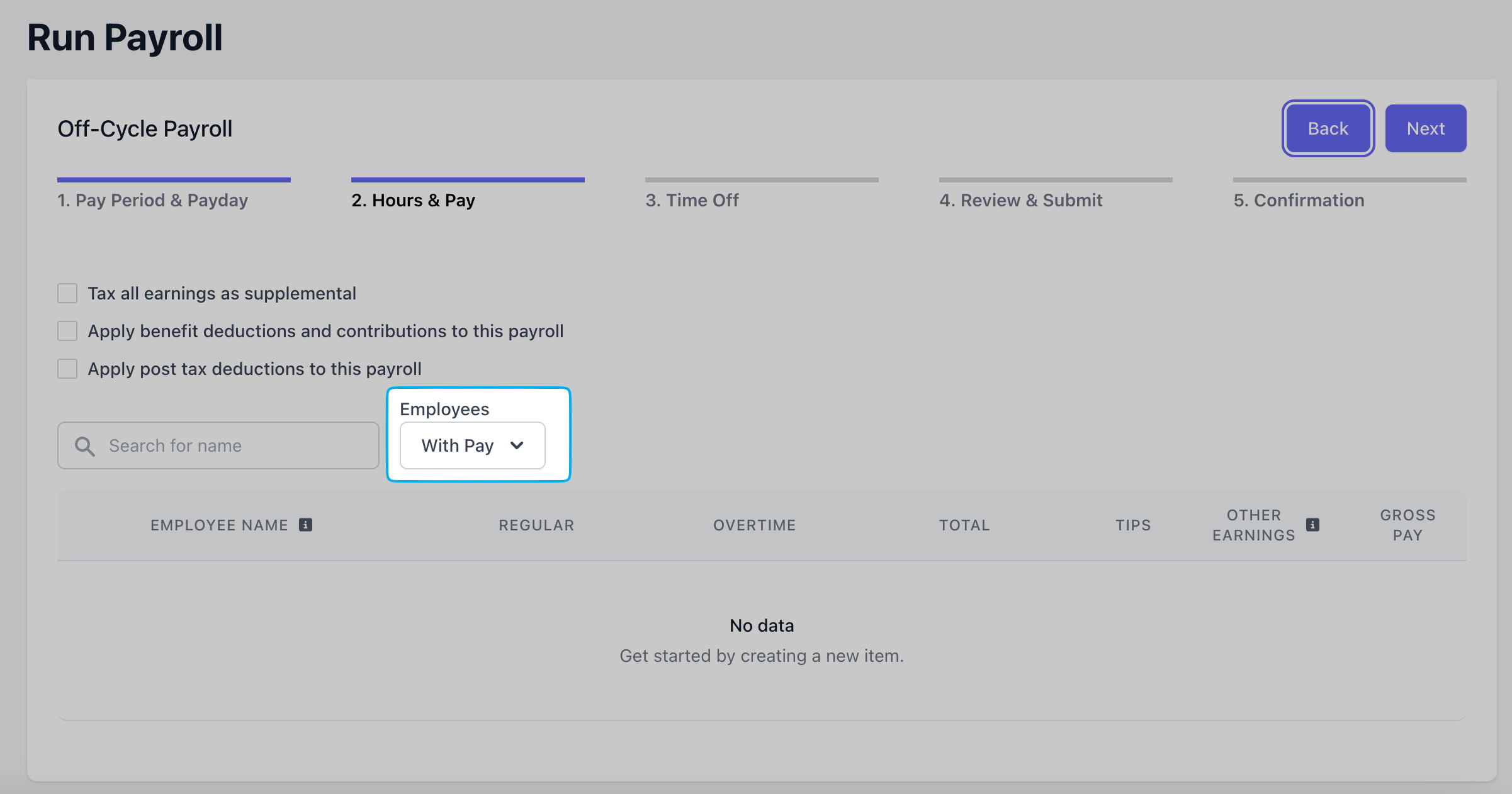

All time cards to be paid for the selected period will appear under Employees - With Pay

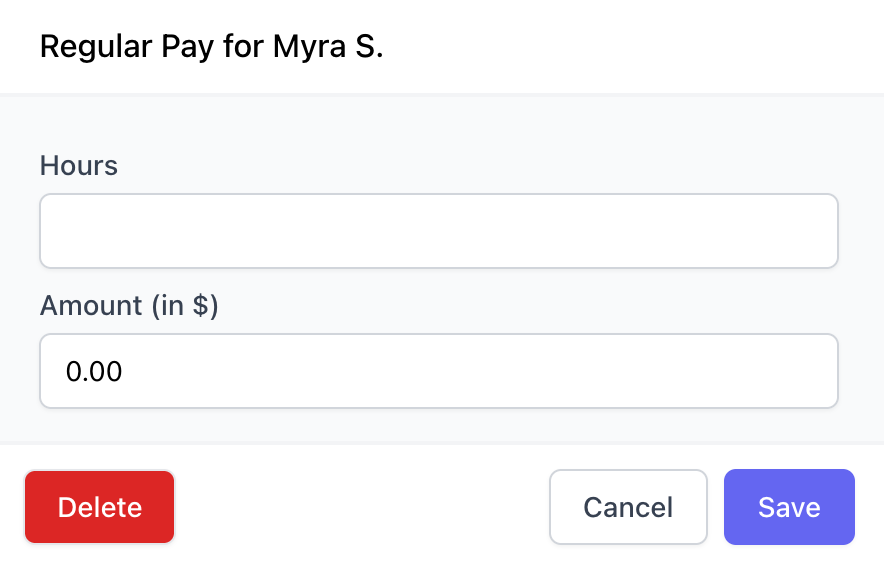

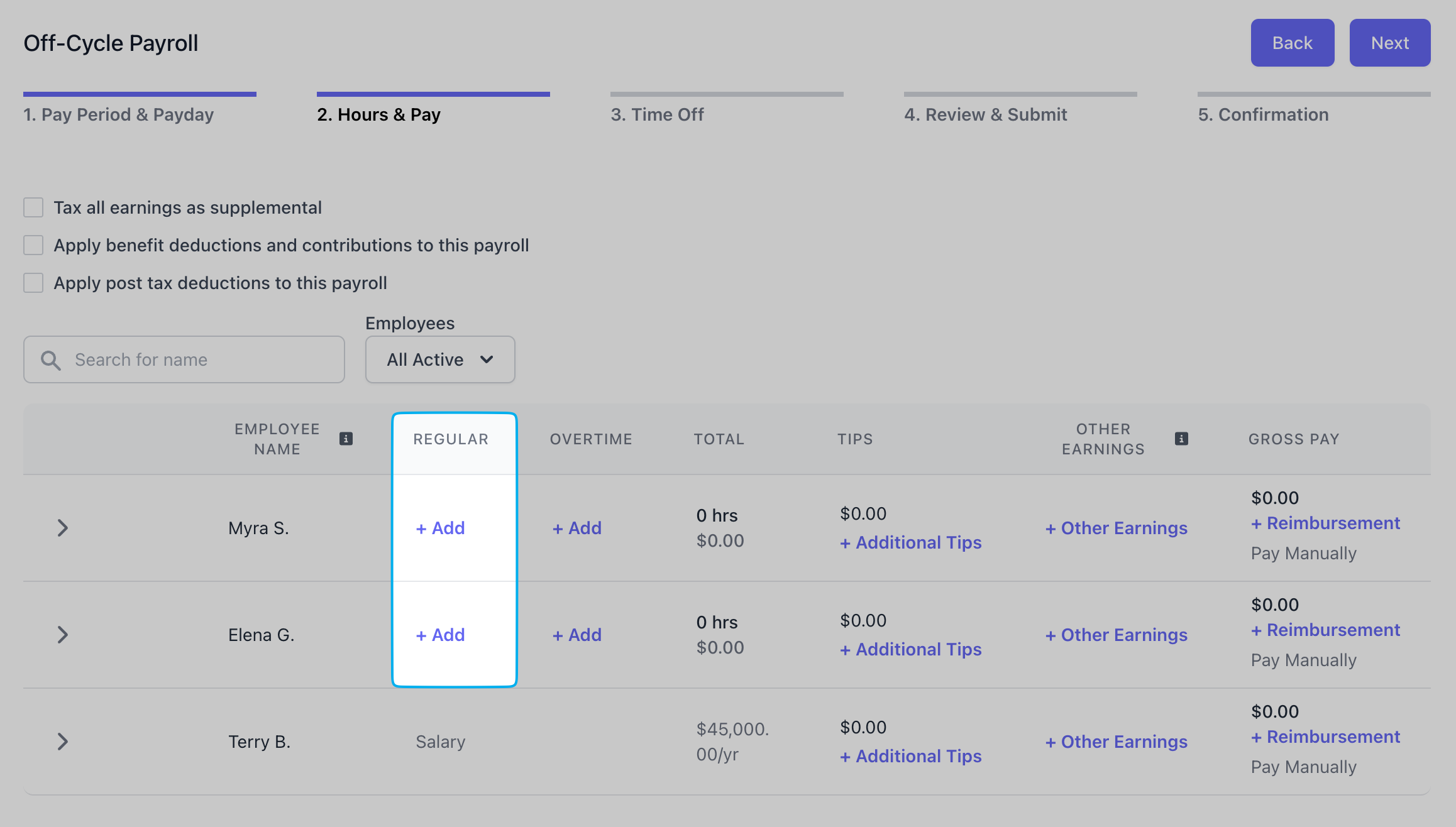

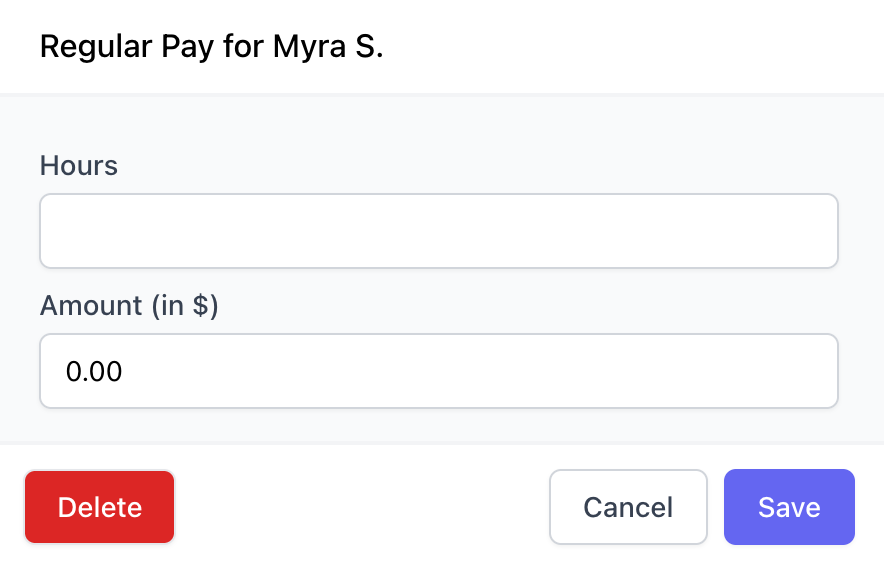

Click + Add next to an employee

Add hours and dollars to be paid

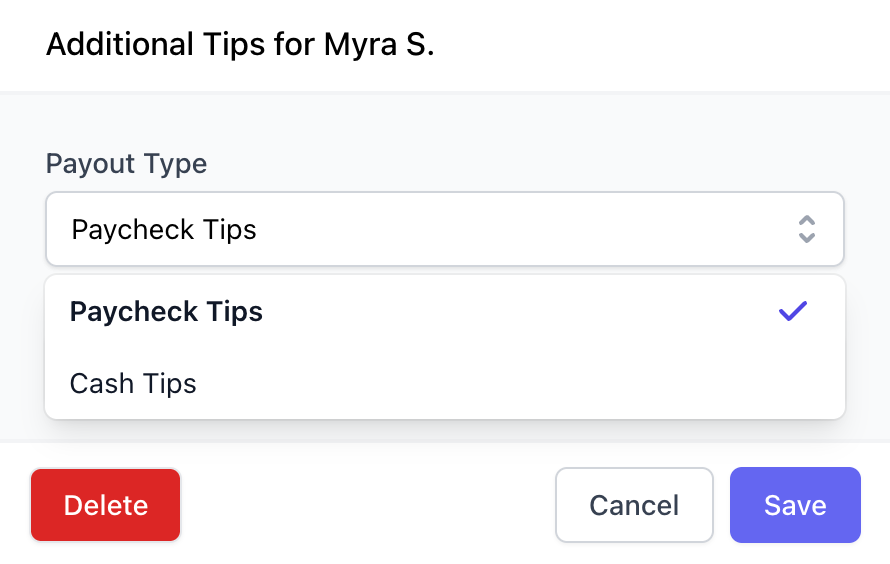

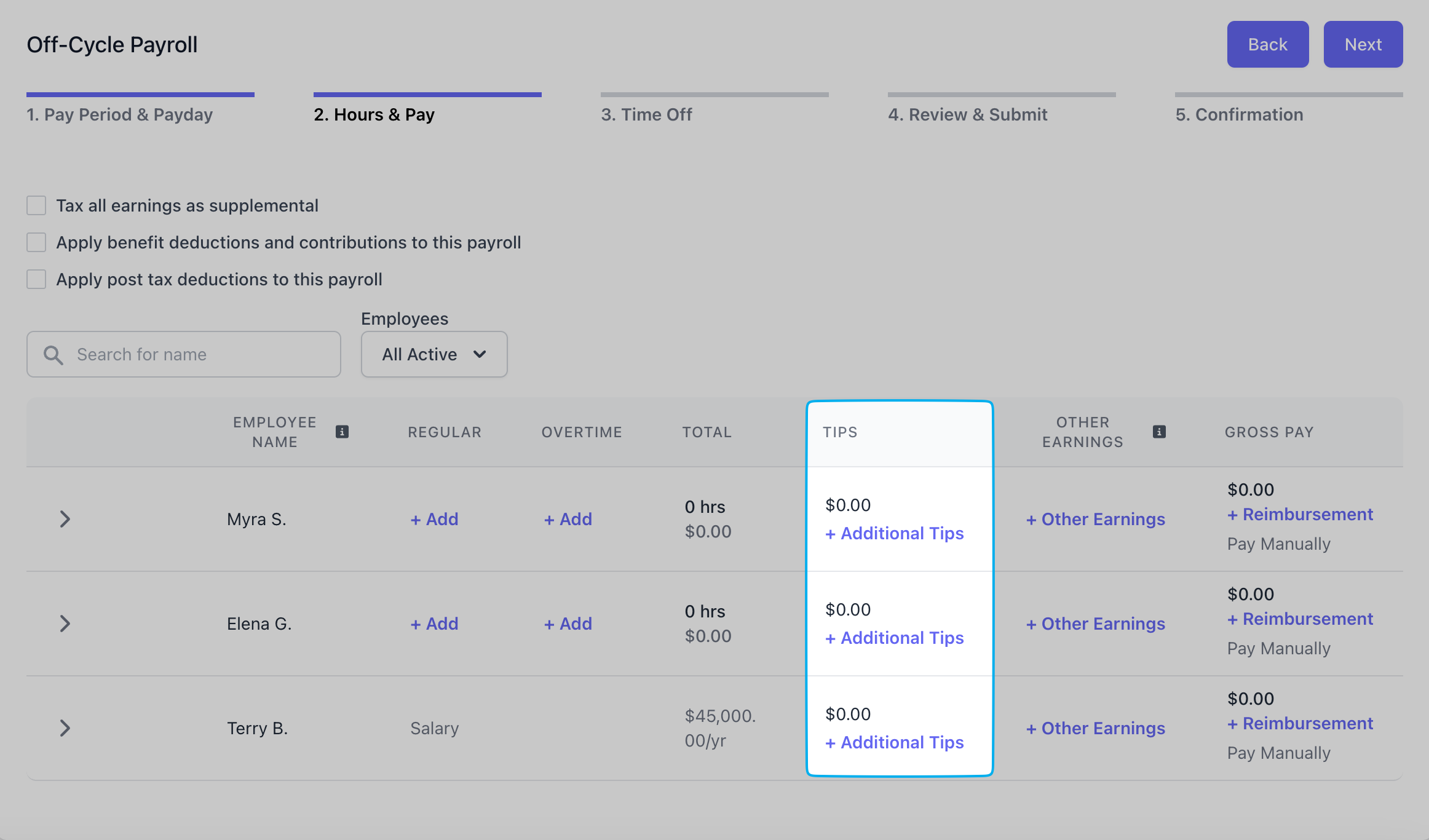

- Cash Tips: Tips that have already been paid in cash and are solely being reported for tax purposes (adding cash tips will not pay your employee additional tips)

- Paycheck Tips: Tips to be paid via this payroll

Click + Add next to an employee

Select Paycheck or Cash Tips

- Bonus: Extra compensation given on top of regular wages

- Commission: Pay earned based on the amount of sales or performance achieved

- Group Term Life: Employer-provided life insurance that offers coverage to employees for a set term

- Severance: A payment given to an employee when they are laid off or let go, typically based on tenure.

- Non Hourly Regular: A additionaly fixed amount paid to an employee, regardless of hours worked.

- Other Imputed: Other imputed income such as use of a company car or gym membership

- Tip Credit Adiustment: The difference between an employee’s tips and the minimum wage the employer must ensure they receive

- It’s not considered wages if properly documented

- Usually not taxed, as long as it meets IRS guidelines (e.g., part of an accountable plan)

Step 3 - Time Off

Step 3 - Time Off

Any approved time off will automatically allocate itself here. To add any additional paid time off or sick leave, click Add under each respective employee and column.

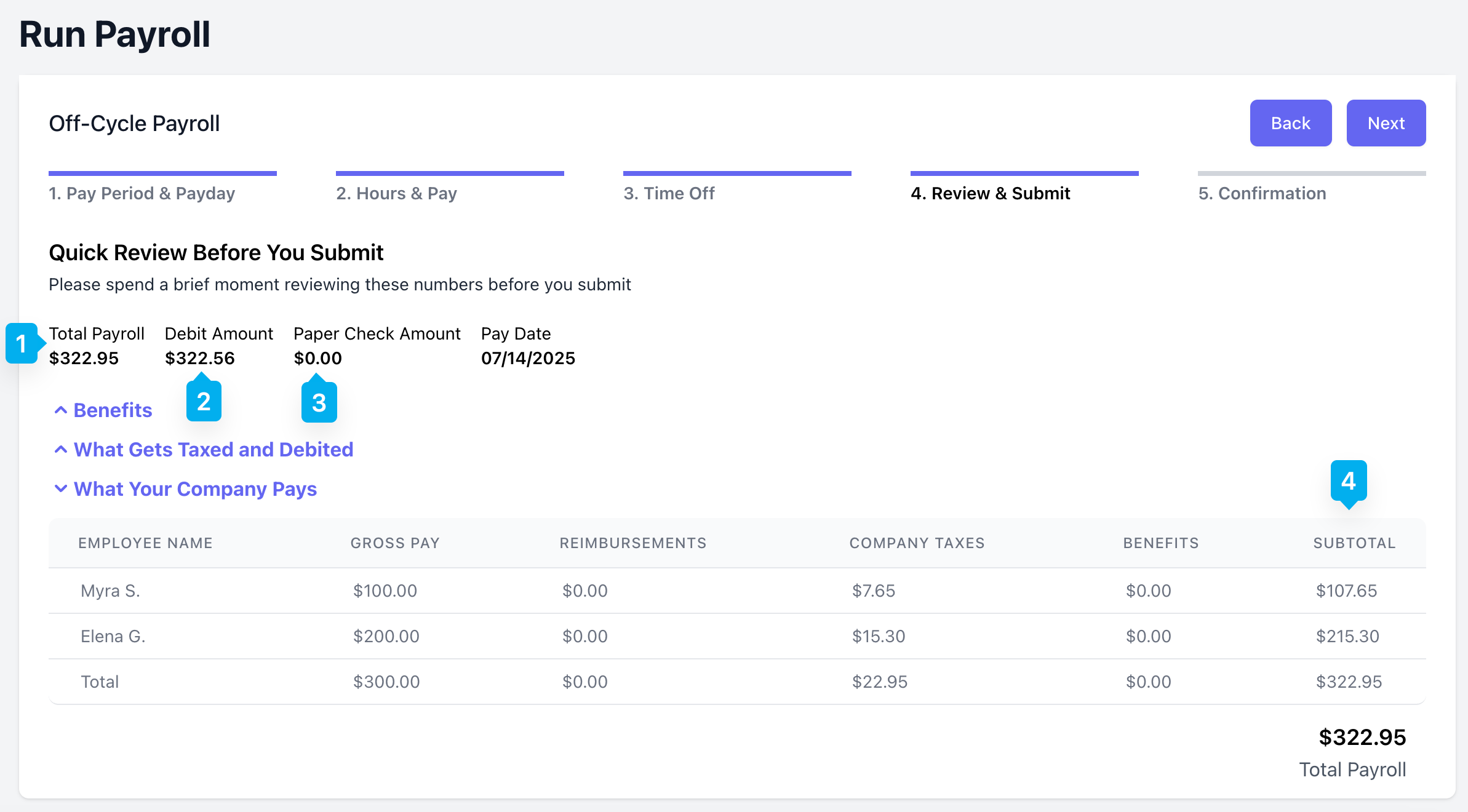

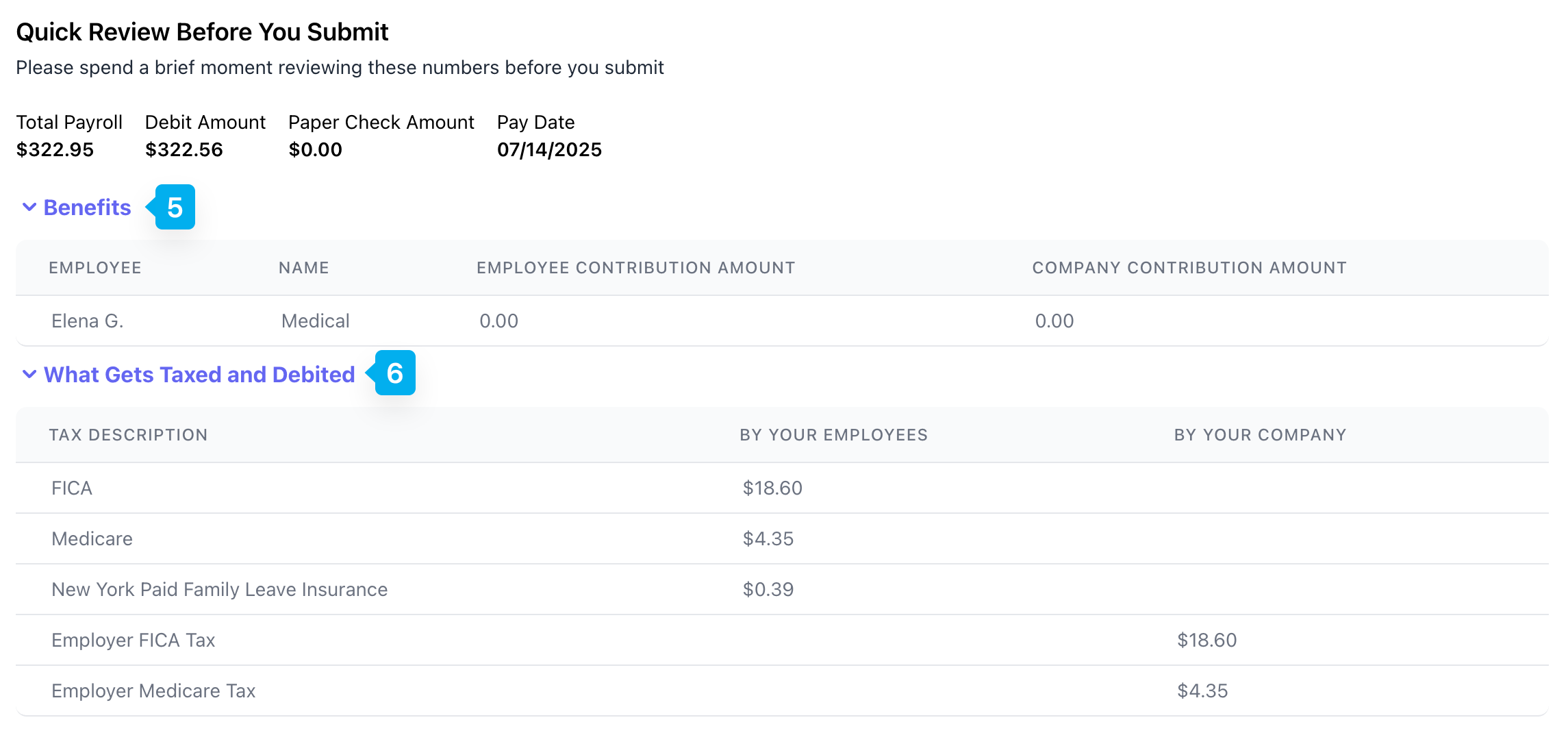

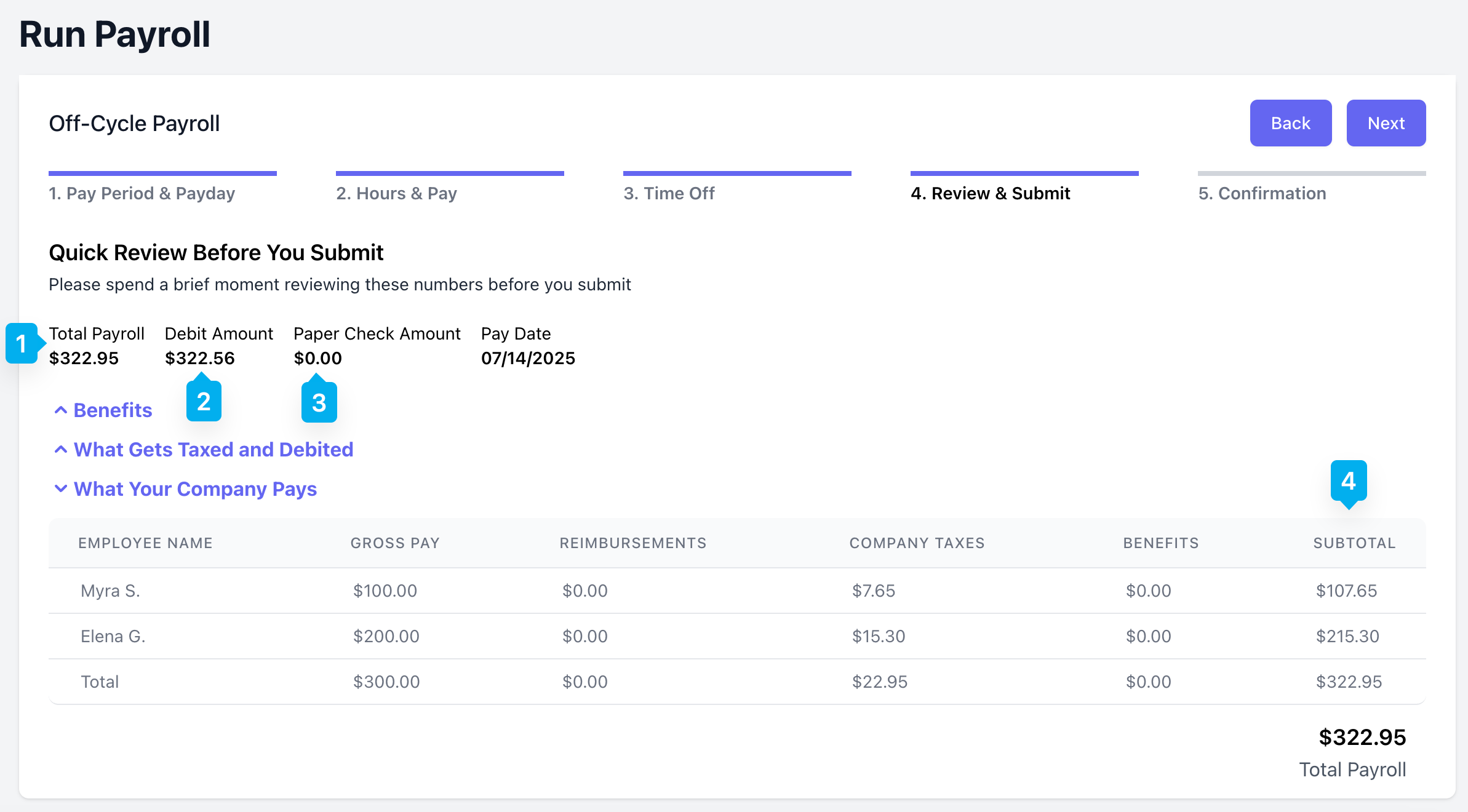

Step 4 - Review & Submit

Step 4 - Review & Submit

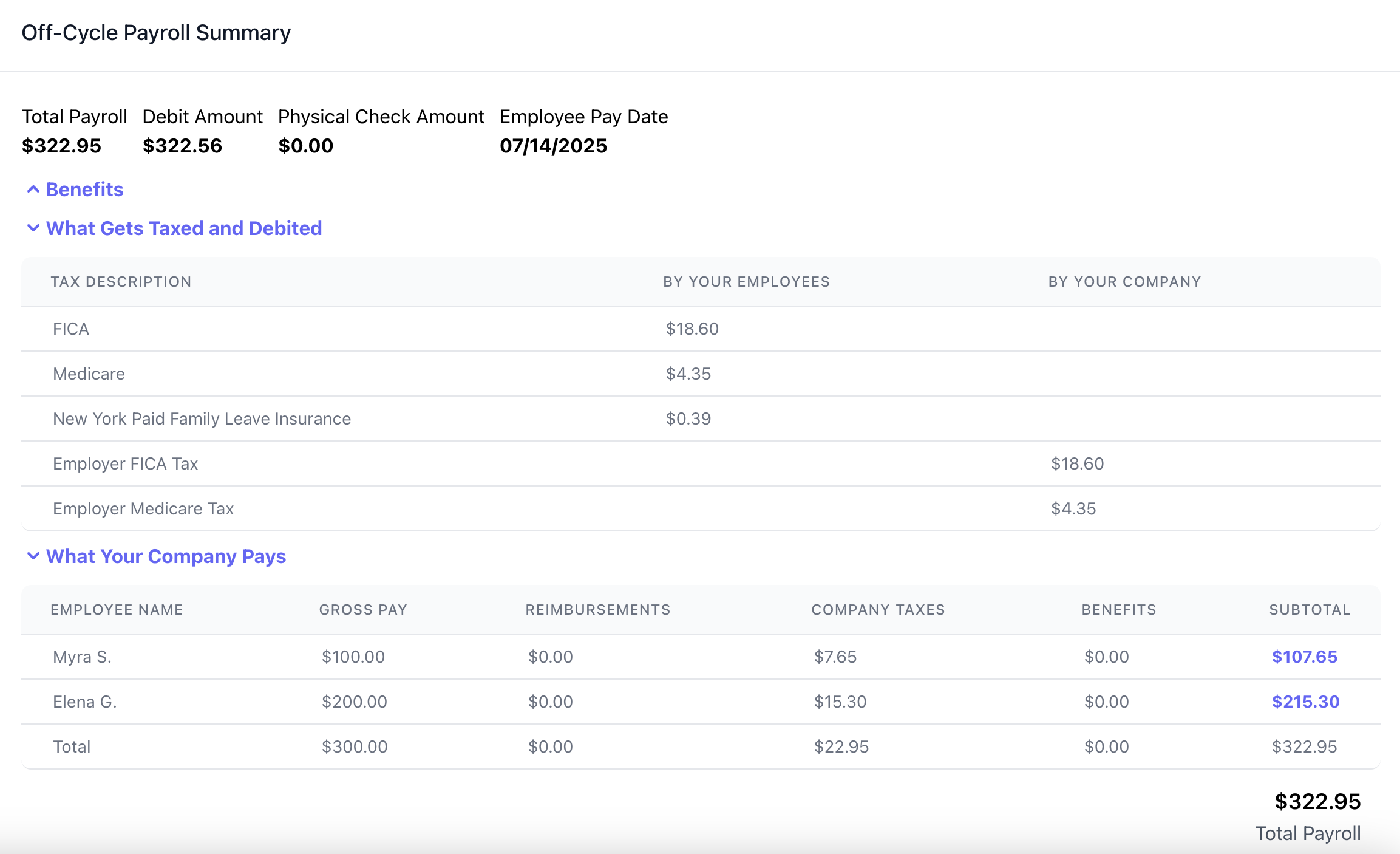

Total Payroll

Total cost of payroll for you, the employer.

Debit Amount

The amount of funds to be withdrawn from your bank account on file to fund this payroll.

Paper Check Amount

If any employees are to be paid manually, that amount will appear here

Subtotal

Subtotal that you, the employer, are paying for each employee. This is not the net pay the employee will receive.

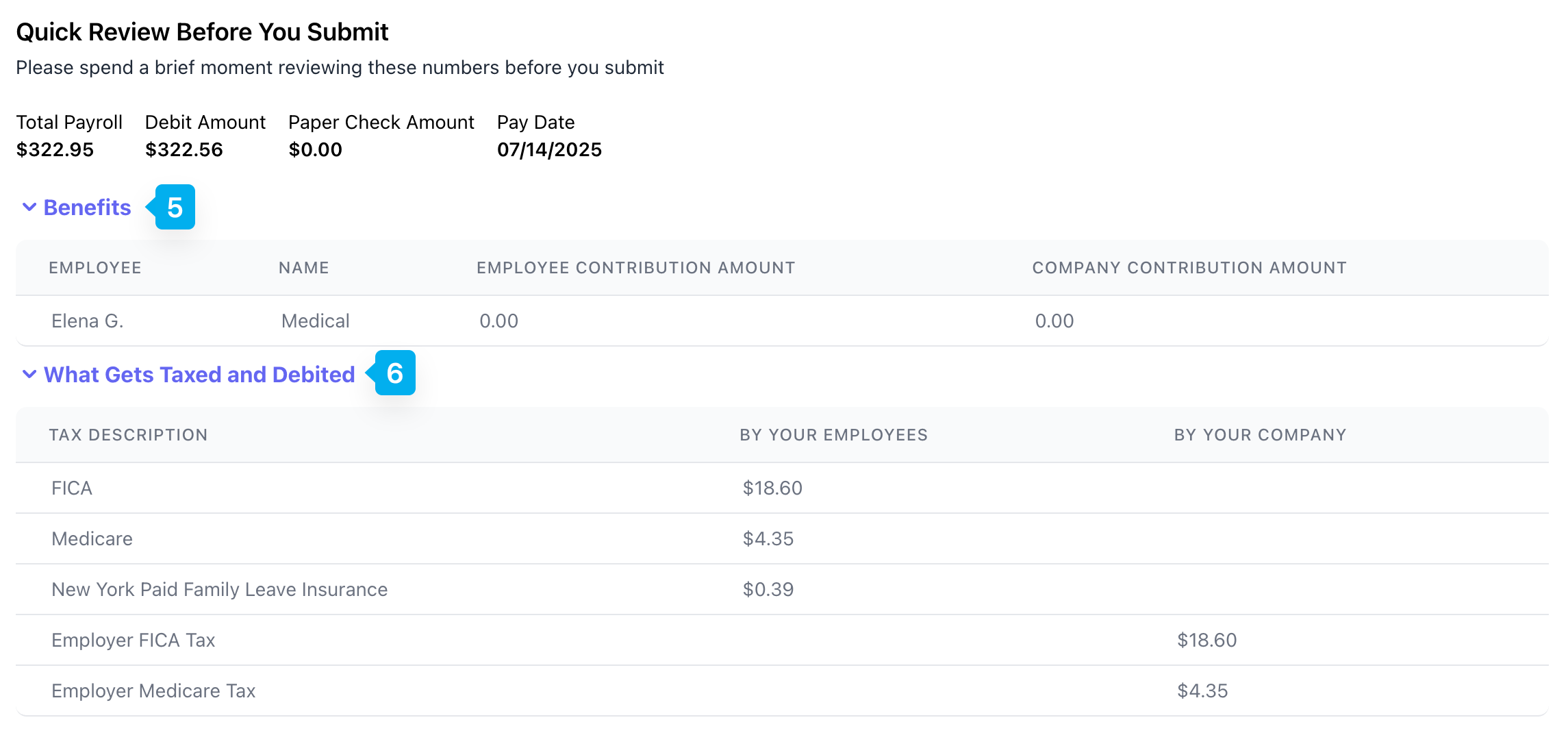

Benefits

Any benefits applied to employee pay will appear here. Learn more about employee benefits here.

What Gets Taxed and Debited

Listed will be the total amount of employee taxes to be withheld from employee paystubs, collectively.Additionally, the total amount of company taxes to be paid by the employer for this payroll will be listed here.

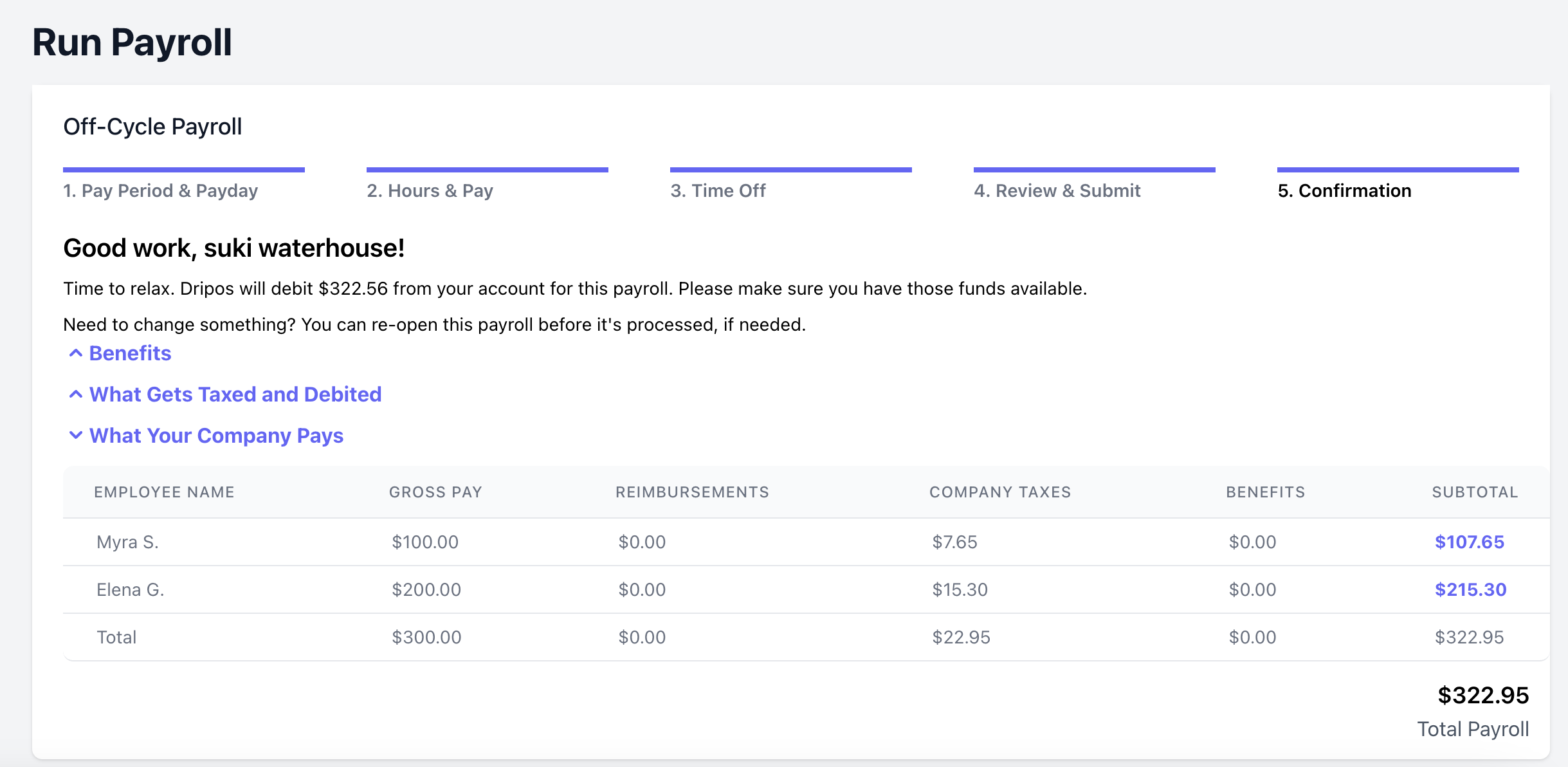

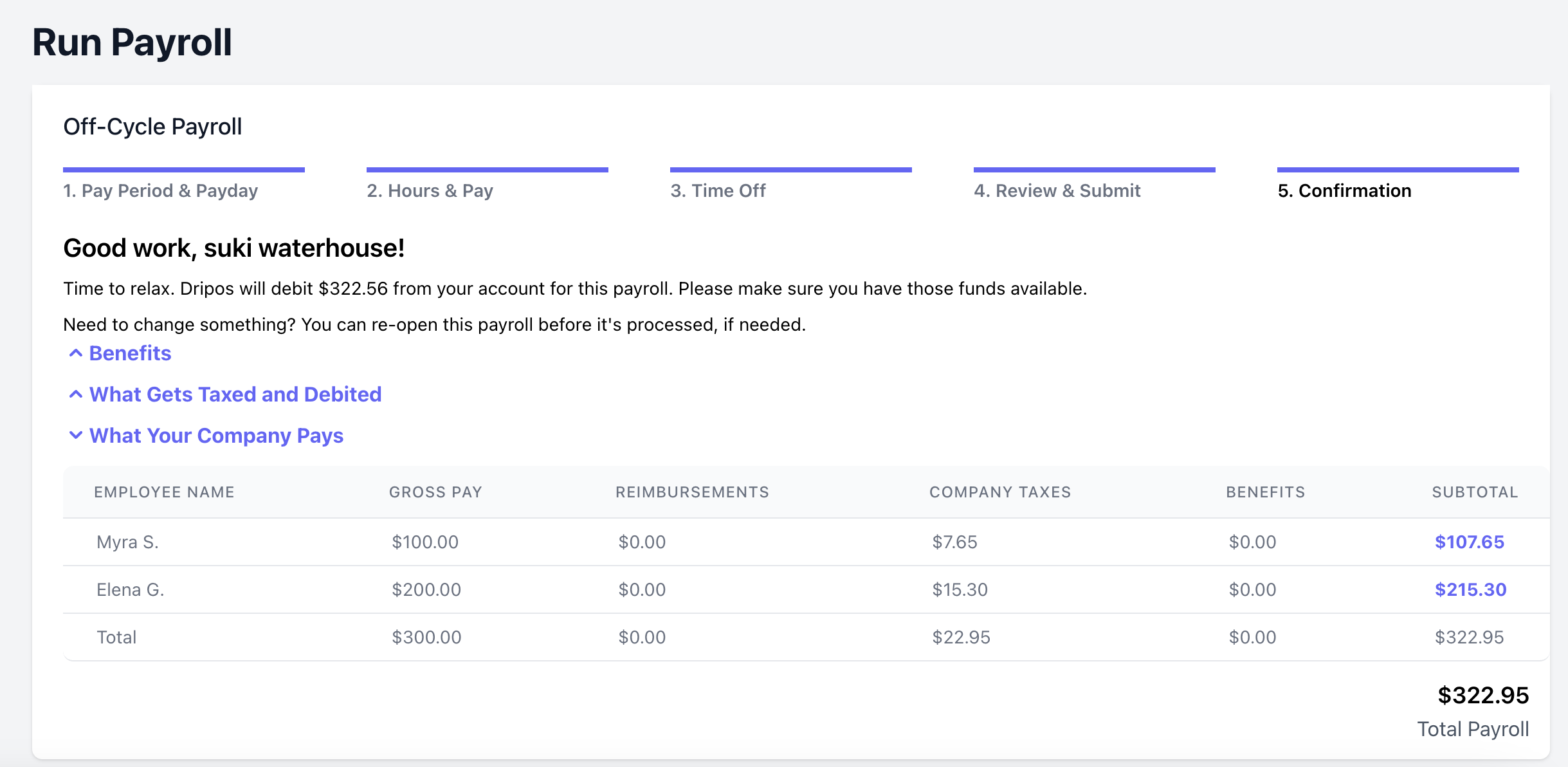

Step 5 - Confirmation

Step 5 - Confirmation

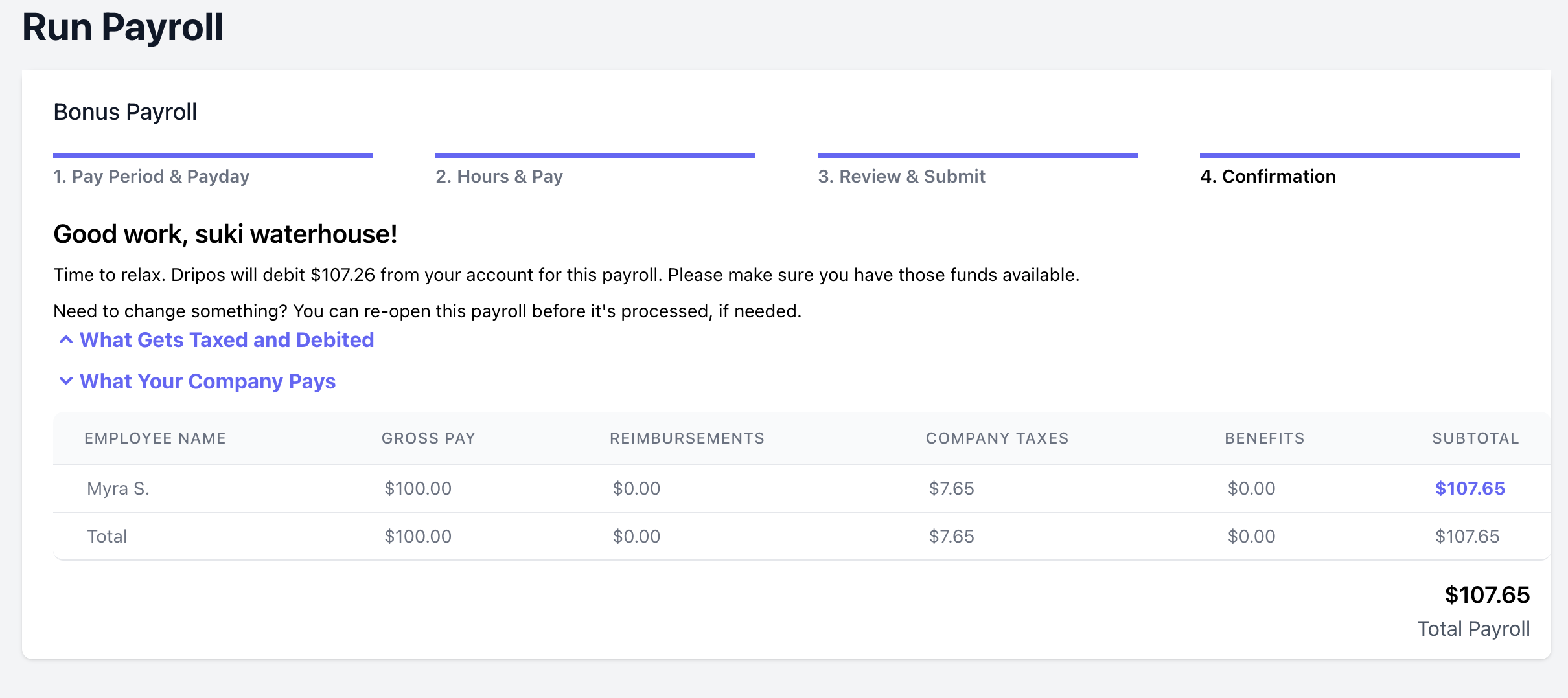

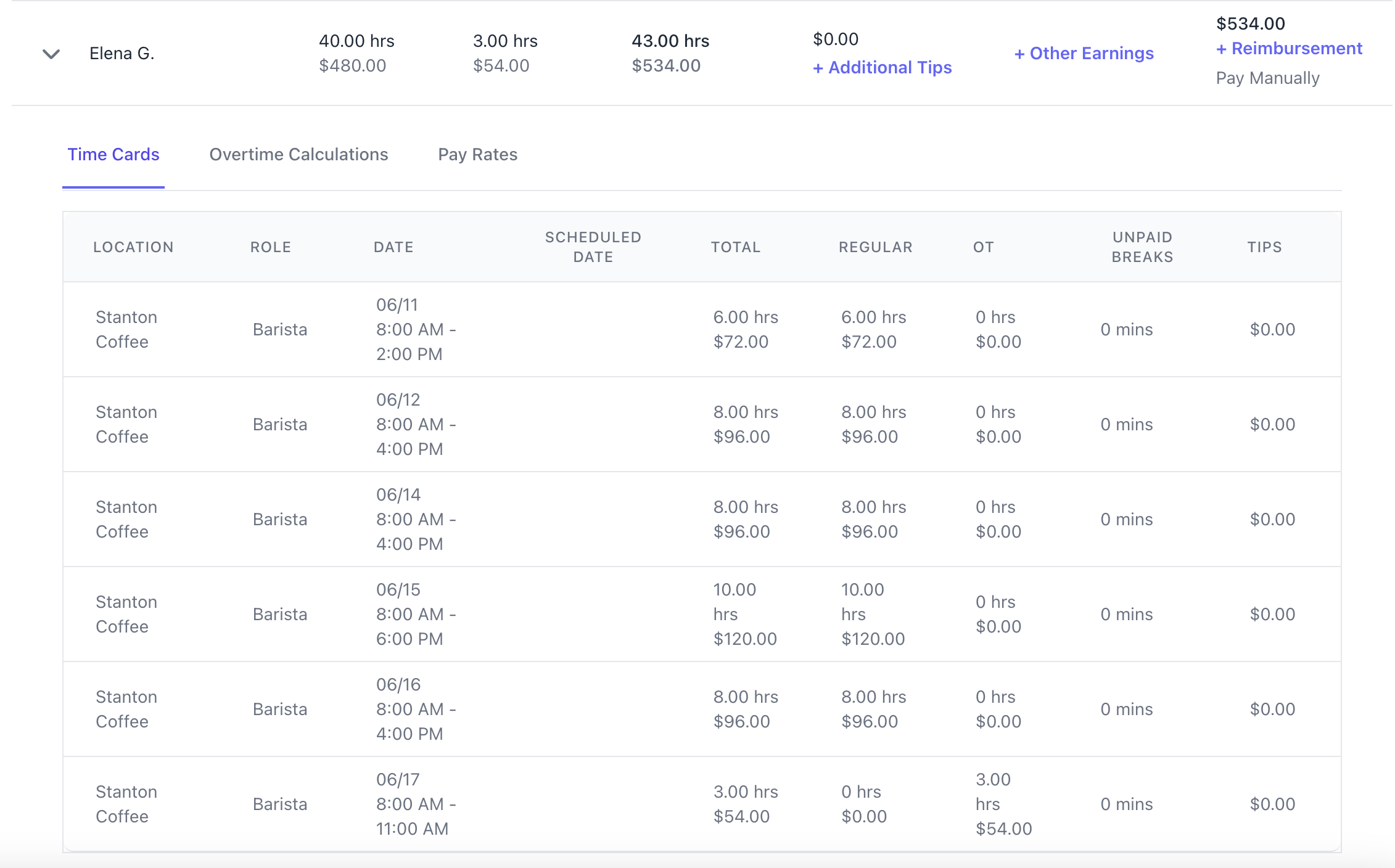

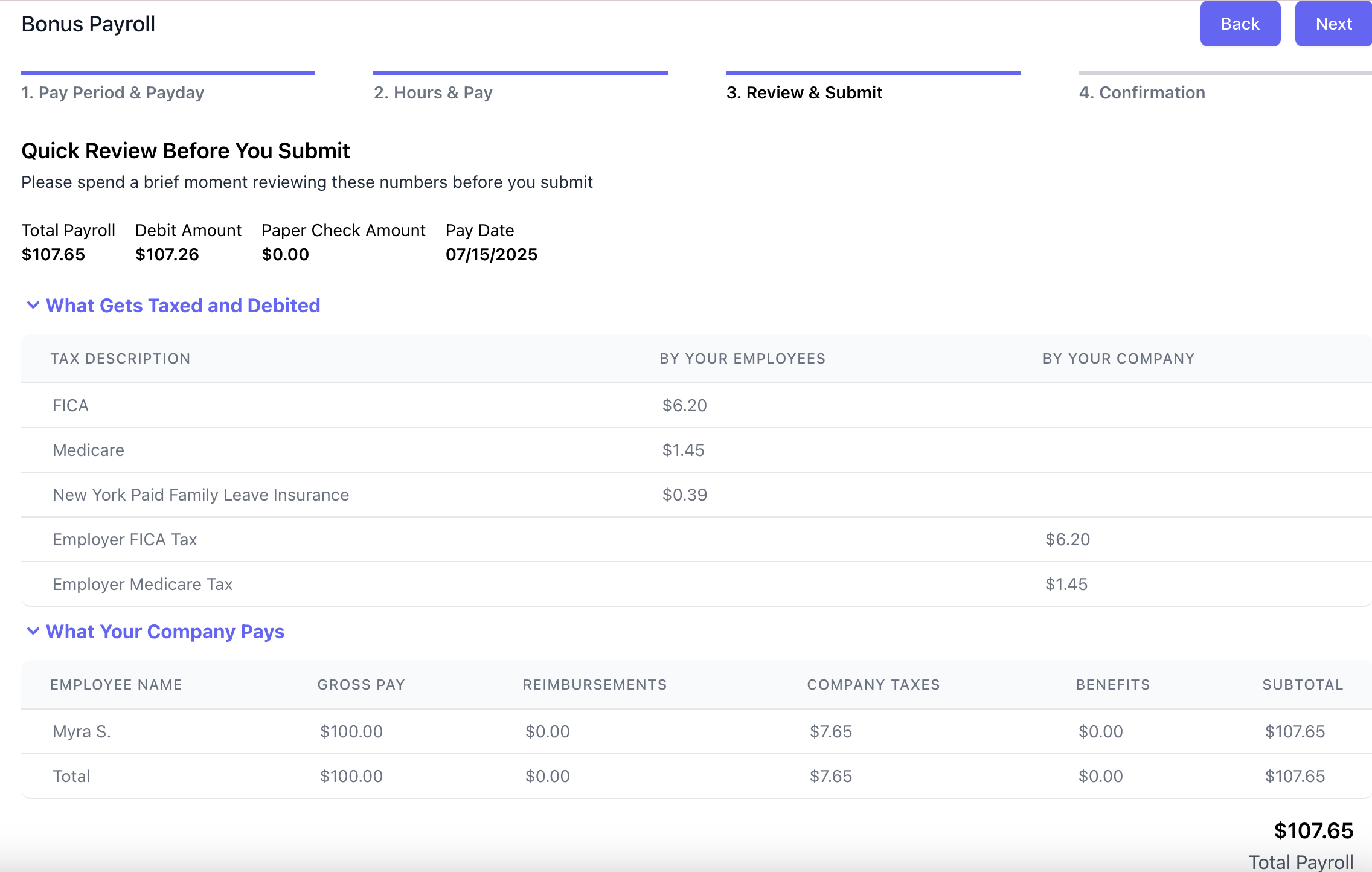

Bonus Payroll

Bonus payrolls can be ran at anytime from your payroll dashboard.

Step 1 - Pay Period & Payday

Step 1 - Pay Period & Payday

Method of Payment

Employee Preference: Employees will be paid using the payment method they have selected for regular payroll—either direct deposit or manual pay. Be sure each employee’s payment method is up to date to ensure timely delivery.Manual: Employees will be paid with a manual method. Employer is responsible for paying employees out of pocket.

Work Period

Select the date range you’d like to pay employees for. Any unpaid time cards within that range will automatically be included in this off-cycle payroll.

Payday

The next available payday within your processing timeline will automatically be selected. You may also choose a custom payday, but it must be after the next available pay date.

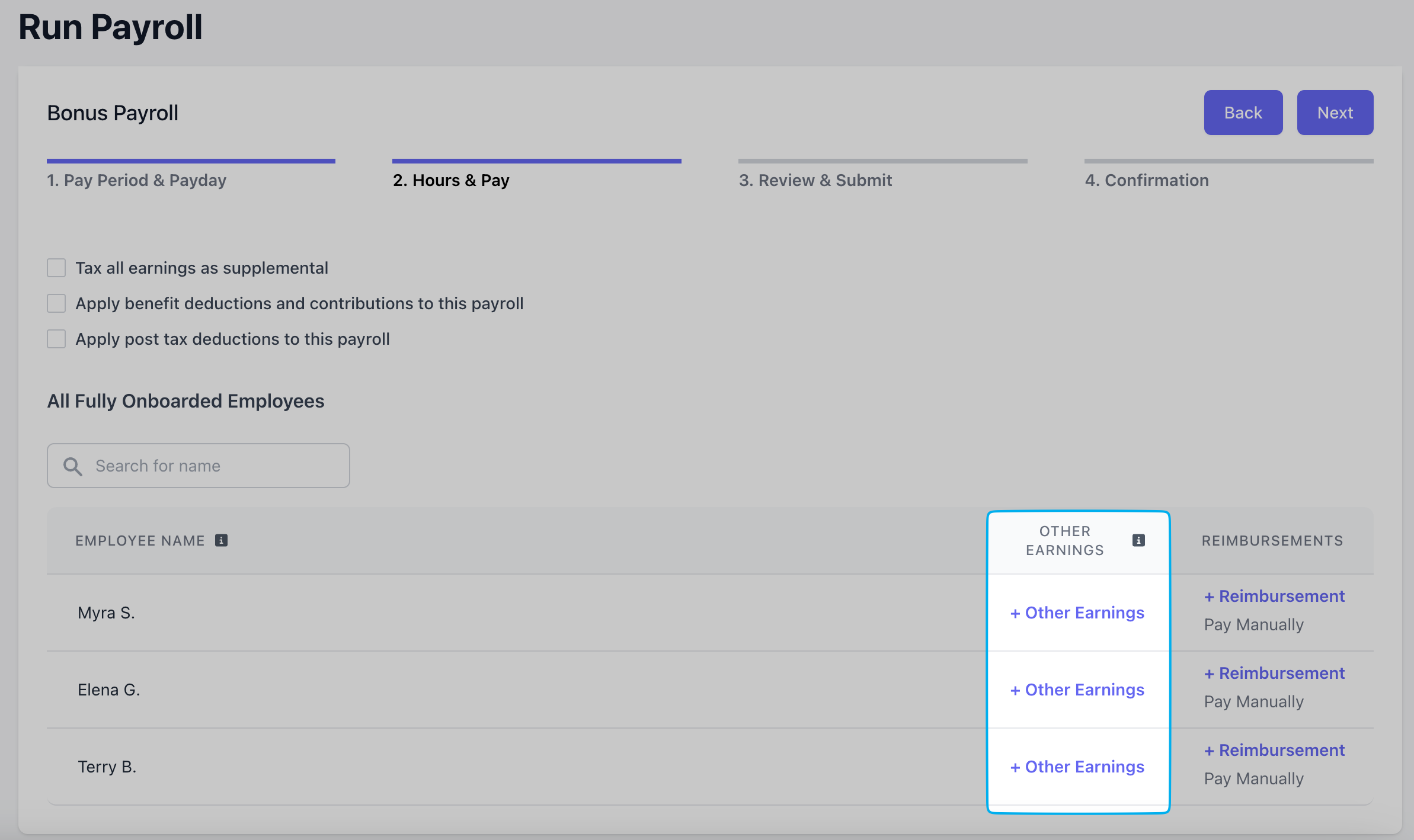

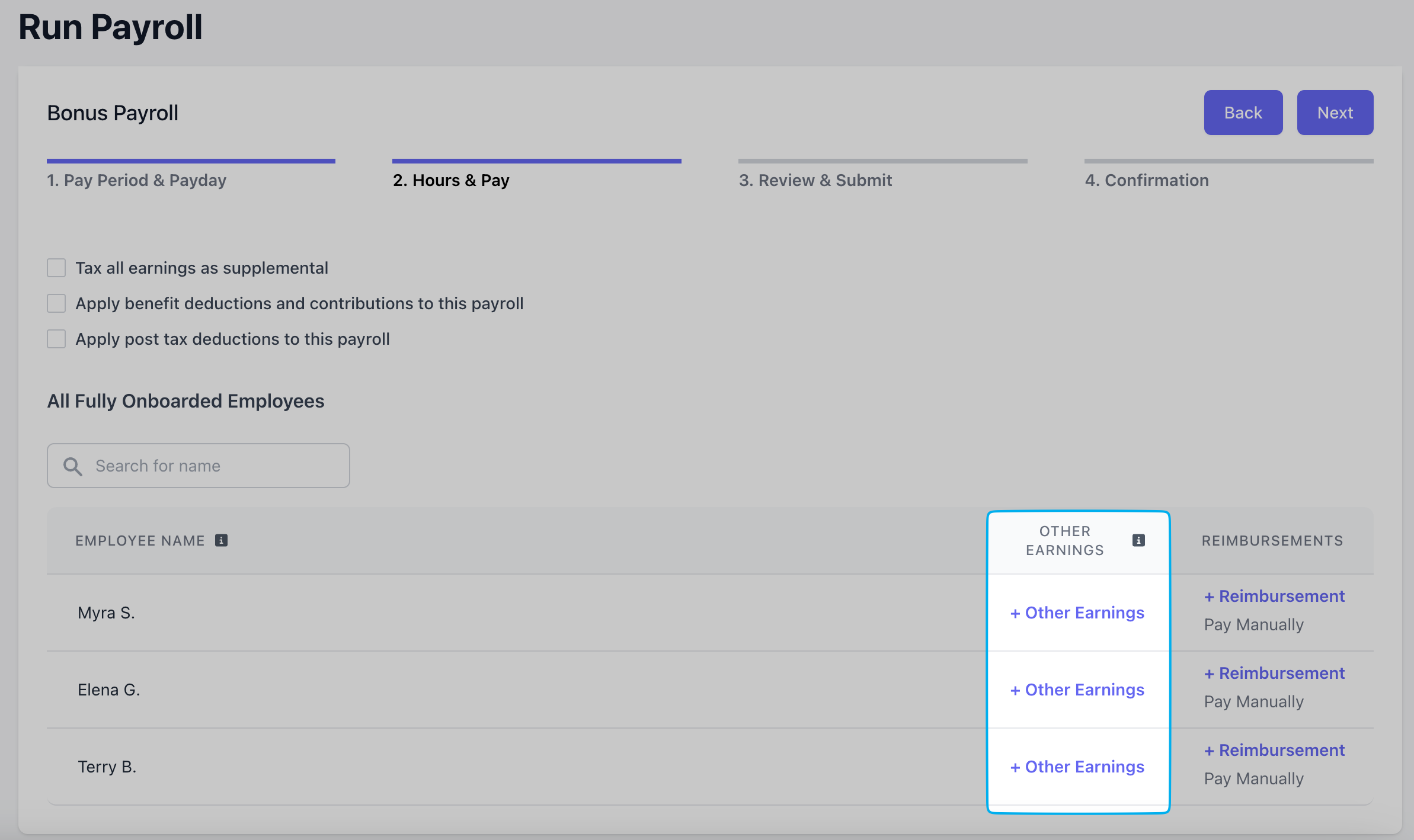

Step 2 - Hours & Pay

Step 2 - Hours & Pay

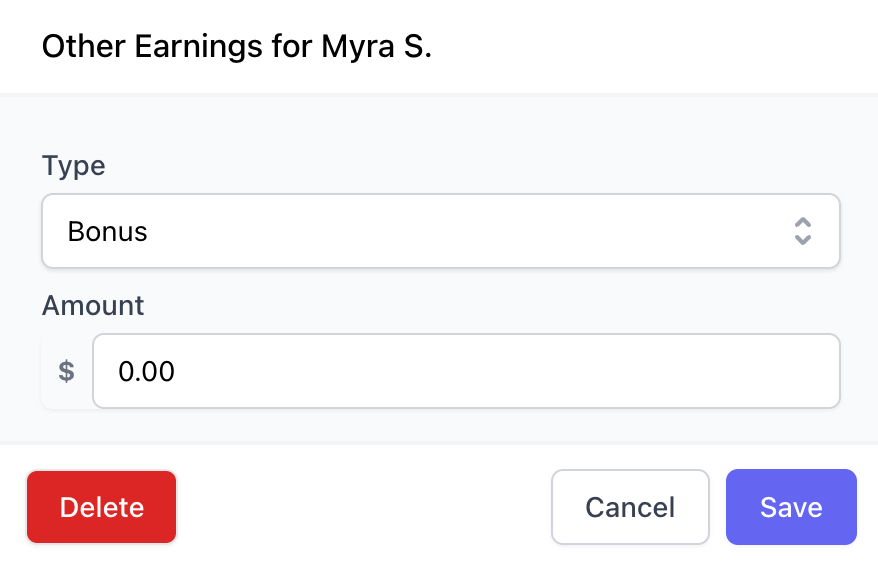

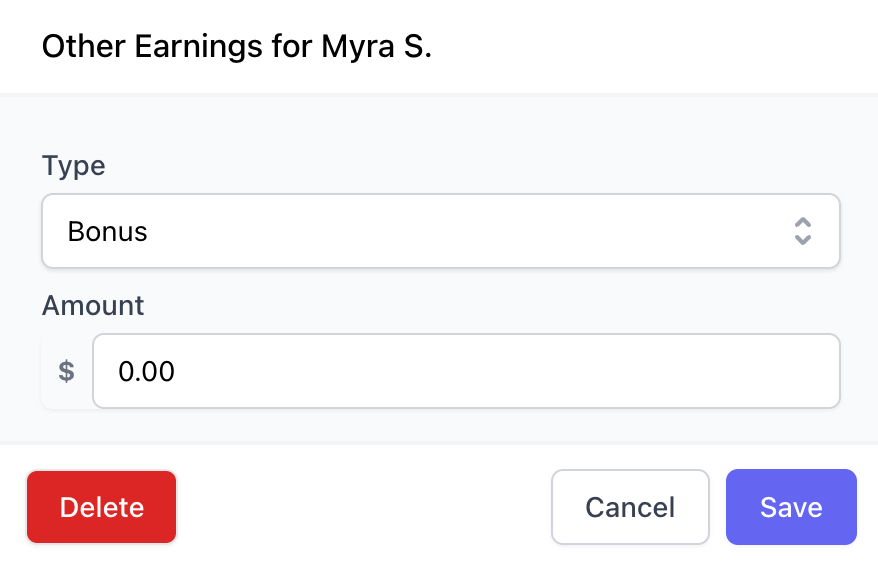

Add Other Earnings > select Bonus and input the desired amount

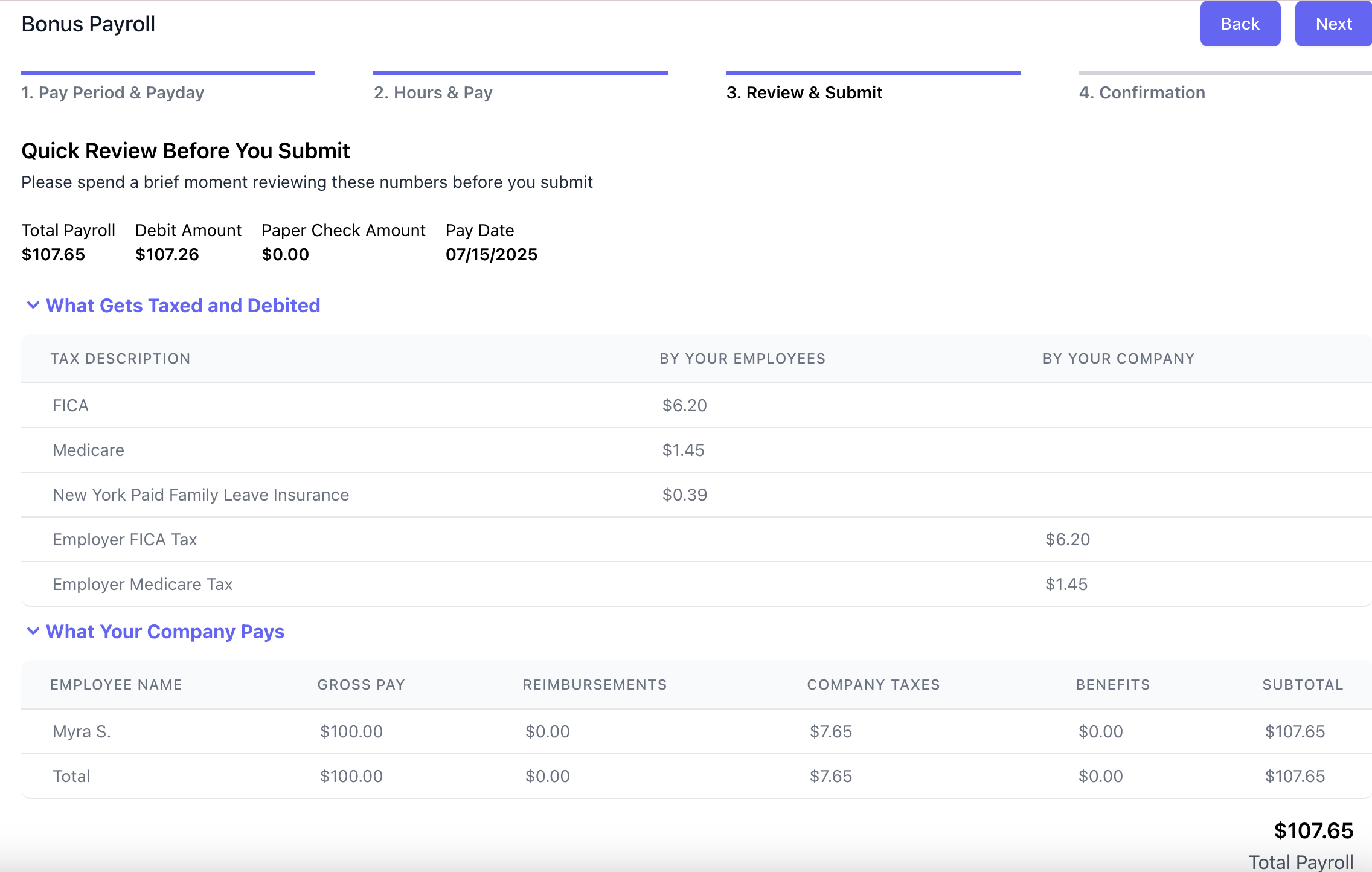

Step 3 - Review & Submit

Step 3 - Review & Submit

Review the company taxes and debit amount to apply to this bonus payroll.

Step 4 - Confirmation

Step 4 - Confirmation

Click on this final step to complete your payroll. A final confirmation page will appear letting you know that you’ve successfully ran payroll!