Void a Payroll

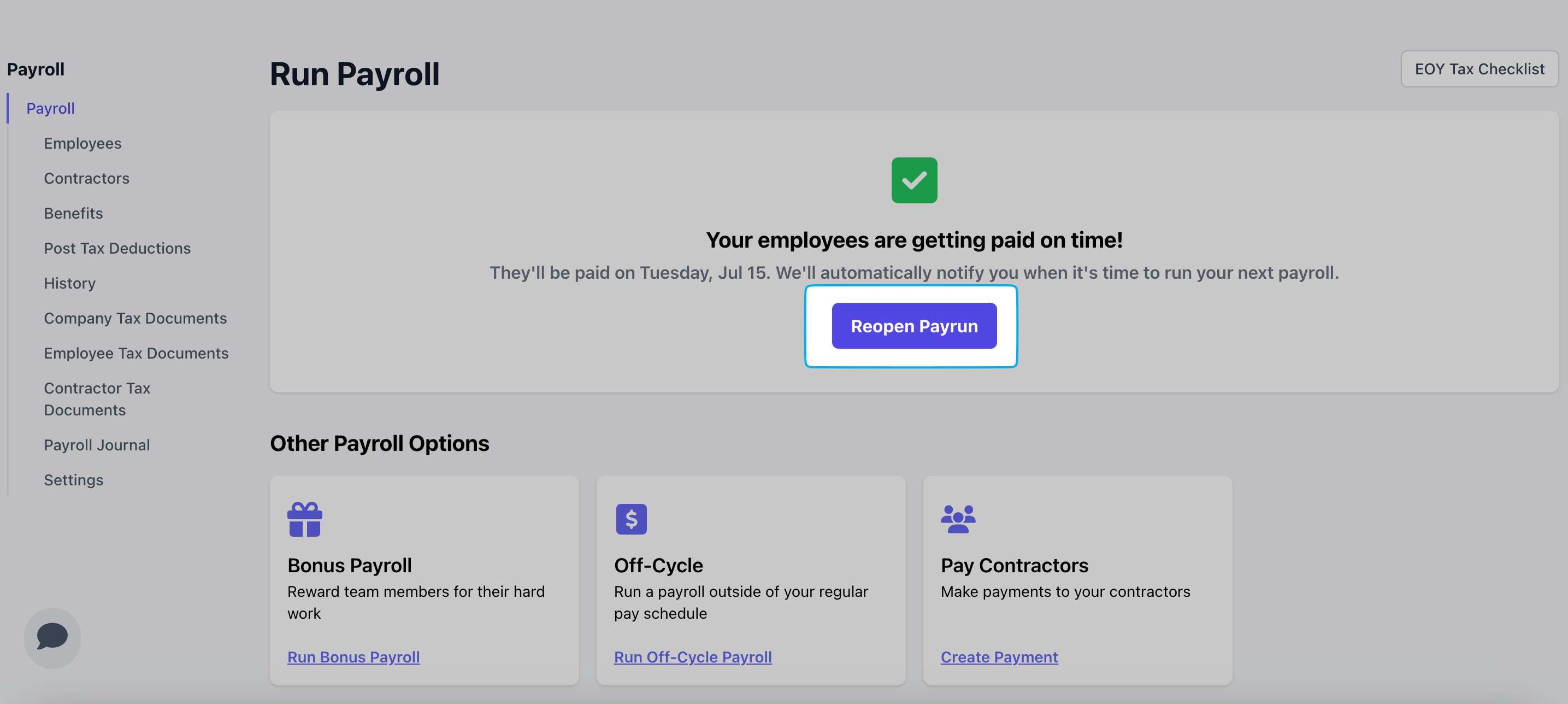

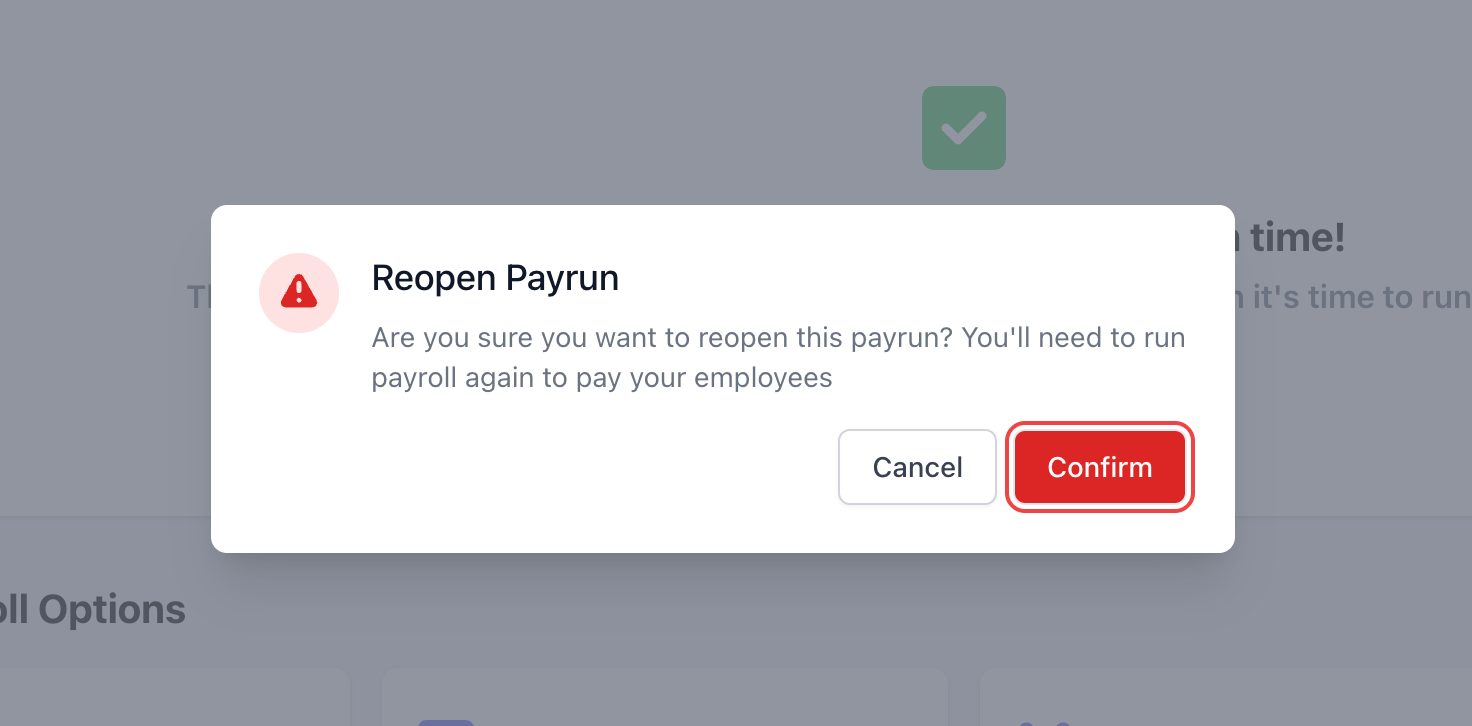

In the case that you’ve incorrectly ran a payroll, our team is here to help! Please see below for various case scenarios and subsequent troubleshooting steps.I've just ran a regular payroll in the last 30 minutes, but I need to make changes immediately.

I've just ran a regular payroll in the last 30 minutes, but I need to make changes immediately.

I ran either a regular or off-cycle payroll over 30 minutes ago, but I need to make changes or void it entirely.

I ran either a regular or off-cycle payroll over 30 minutes ago, but I need to make changes or void it entirely.

I've overpaid an employee in their last payroll and need to adjust their next payroll to reflect this.

I've overpaid an employee in their last payroll and need to adjust their next payroll to reflect this.

Running Payroll

I've missed my payroll deadline. What can I do?

I've missed my payroll deadline. What can I do?

How do bank holidays affect my payroll?

How do bank holidays affect my payroll?

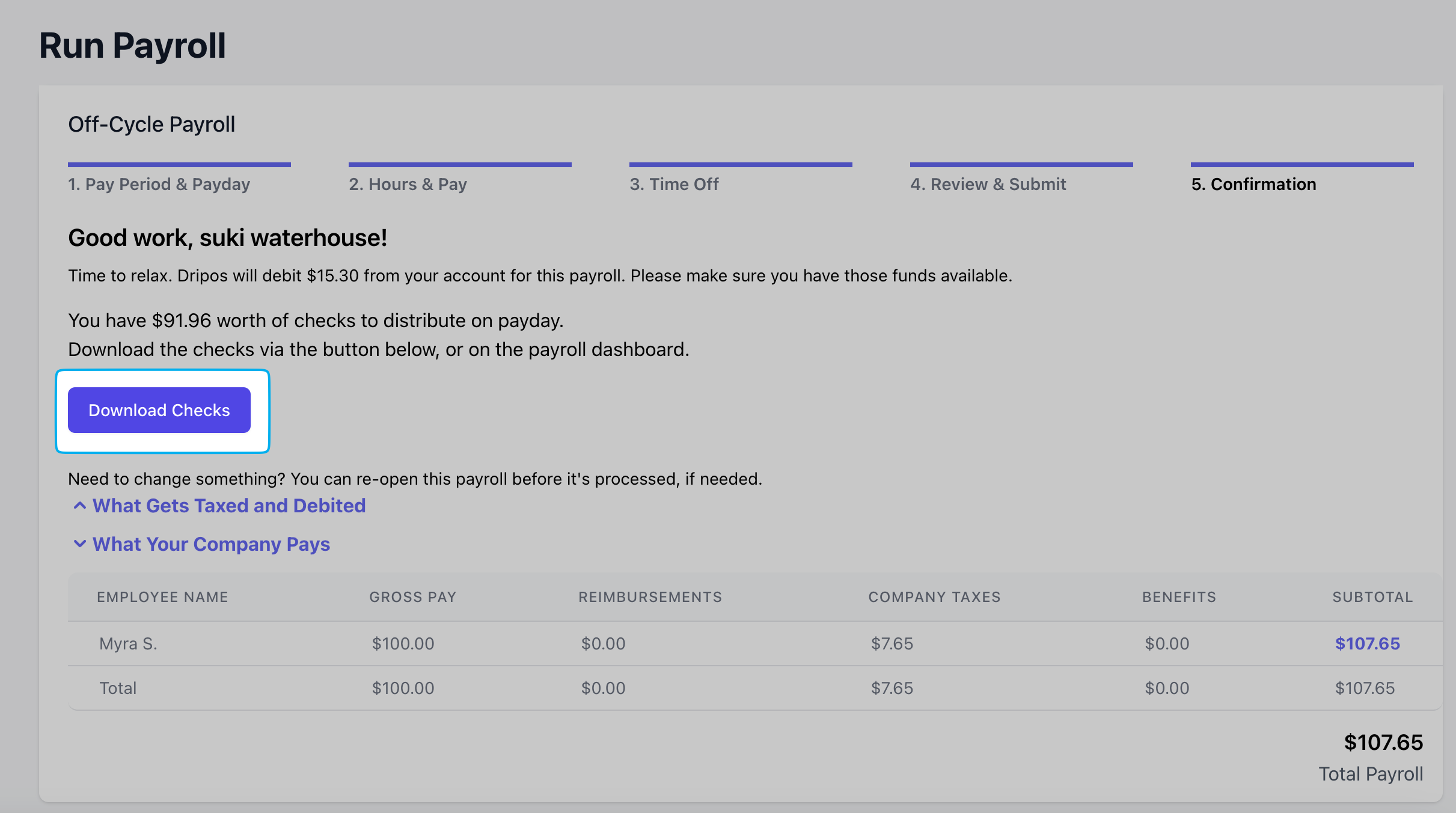

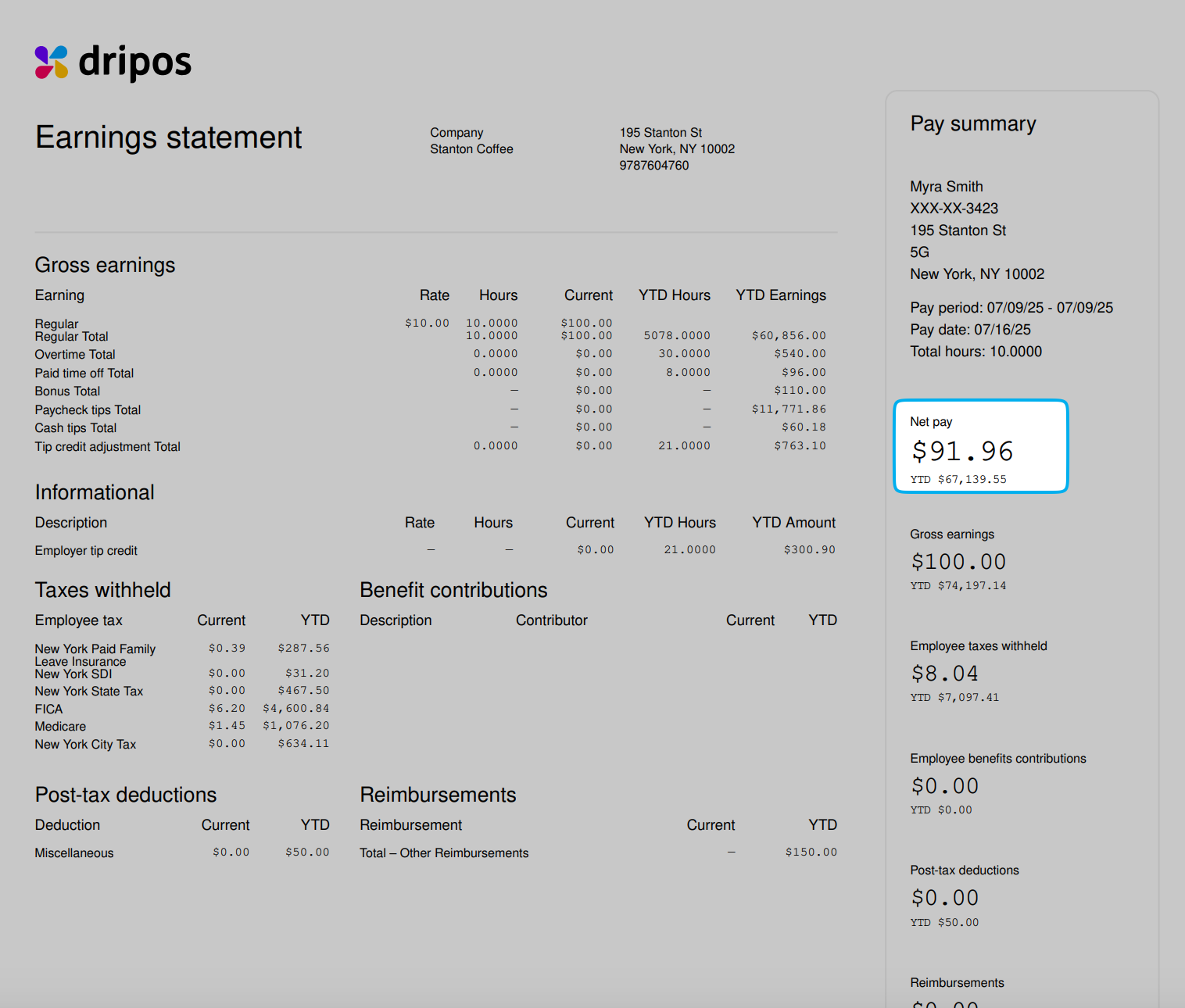

Does Dripos send checks to my employees if I pay them via manual check?

Does Dripos send checks to my employees if I pay them via manual check?

How fast will my employees receive their pay if sent via direct deposit?

How fast will my employees receive their pay if sent via direct deposit?

Payroll Employees

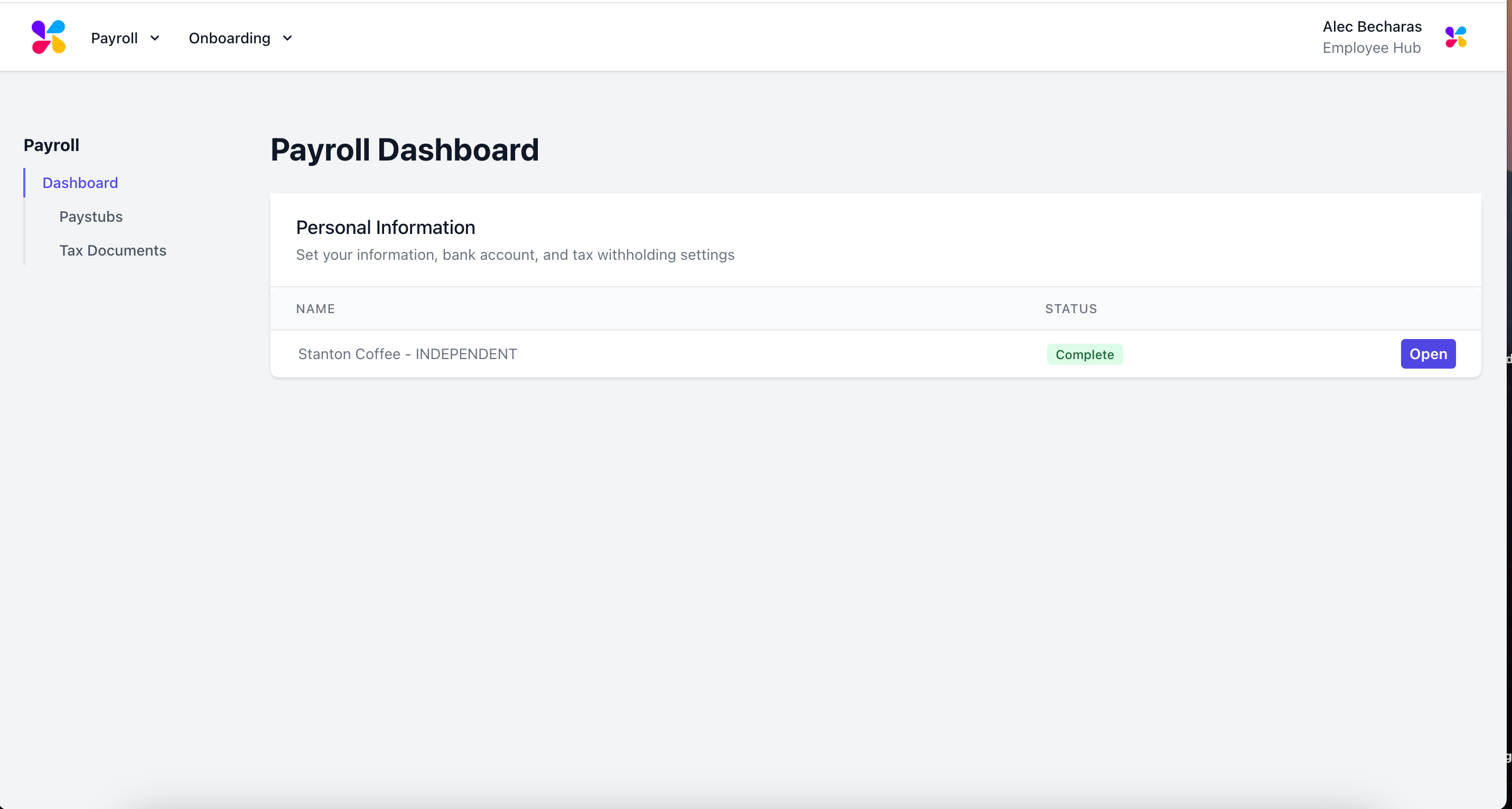

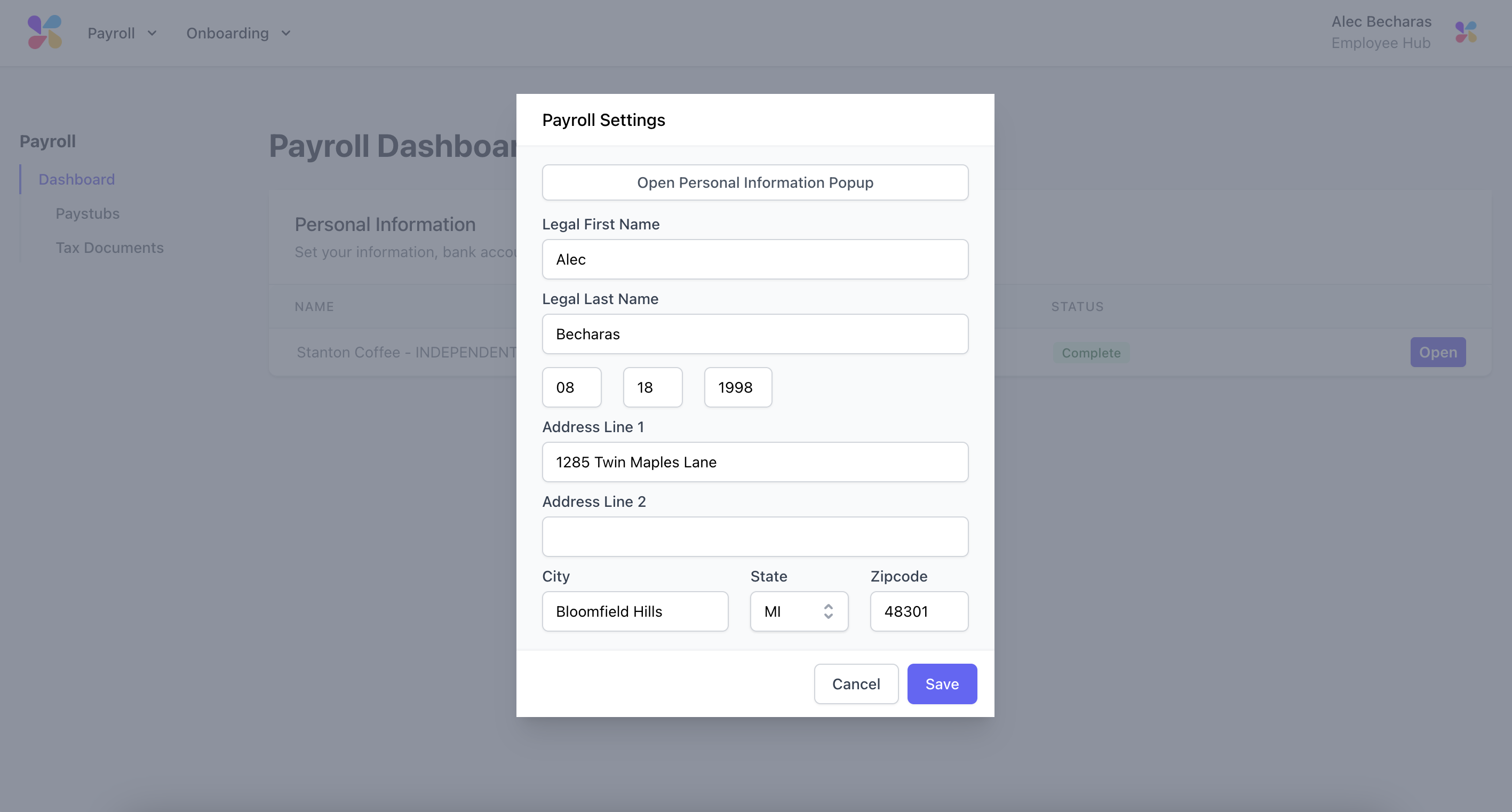

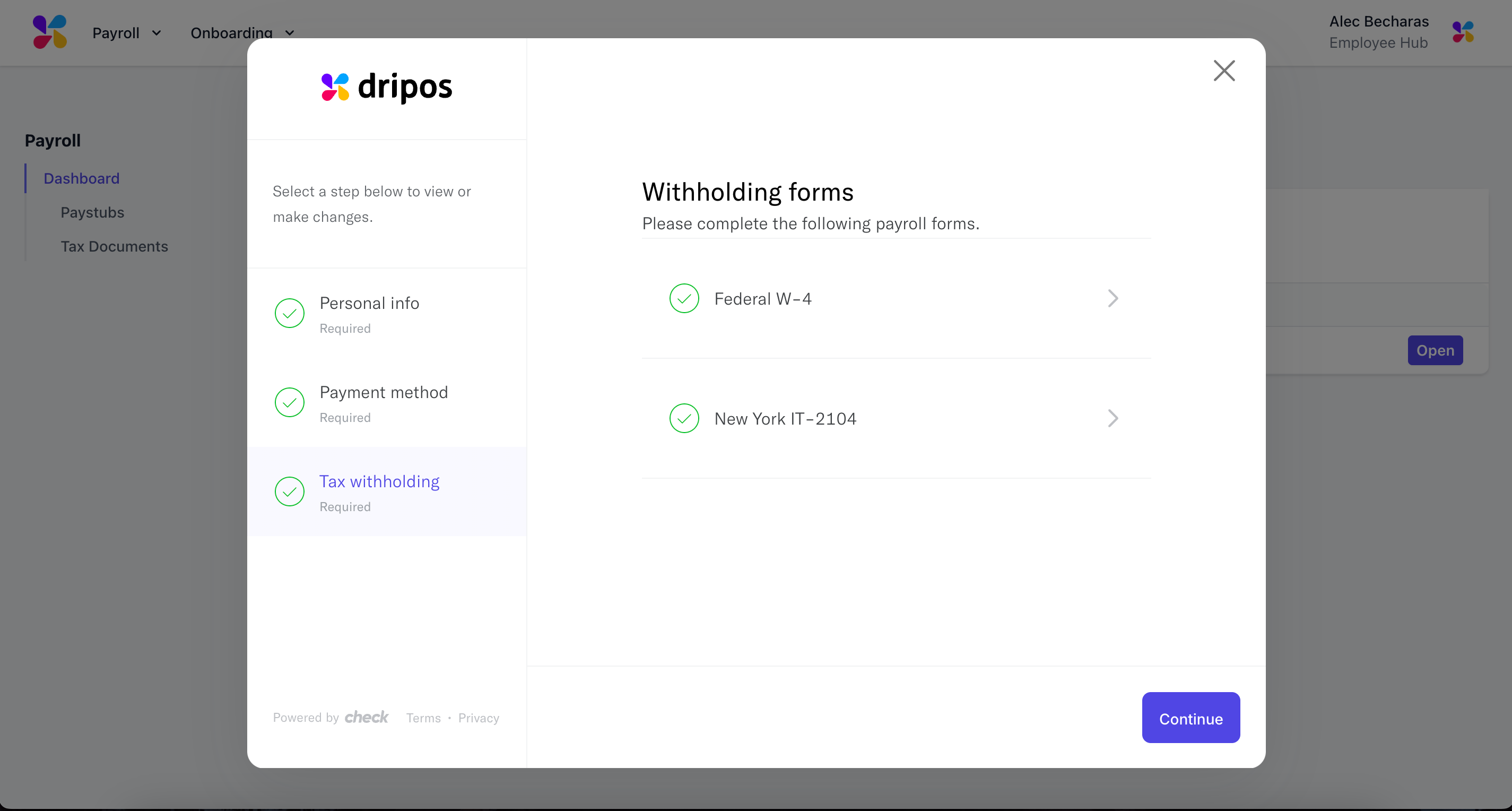

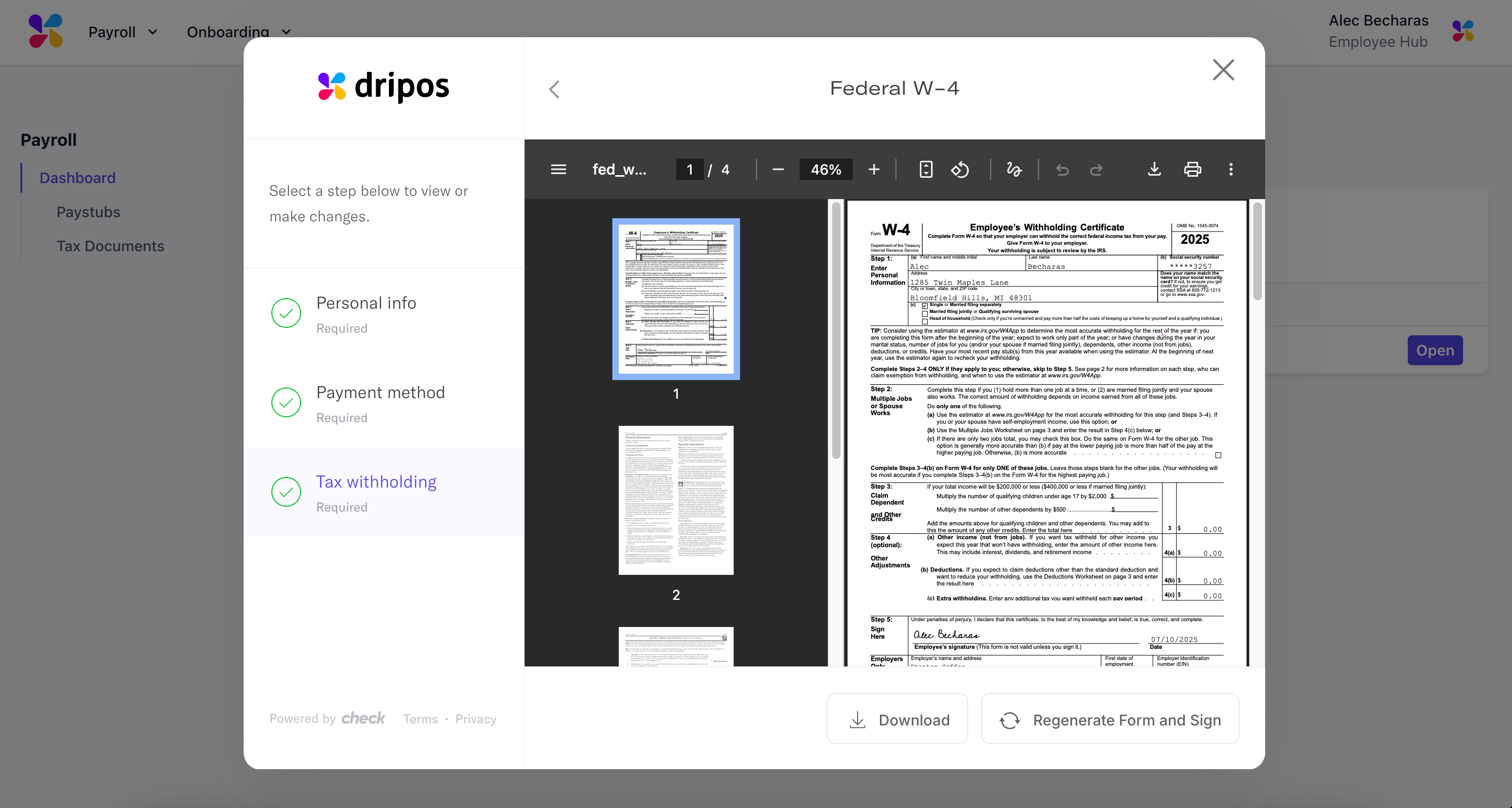

How can my employee make a change to their W4?

How can my employee make a change to their W4?

Log into Payroll Portal

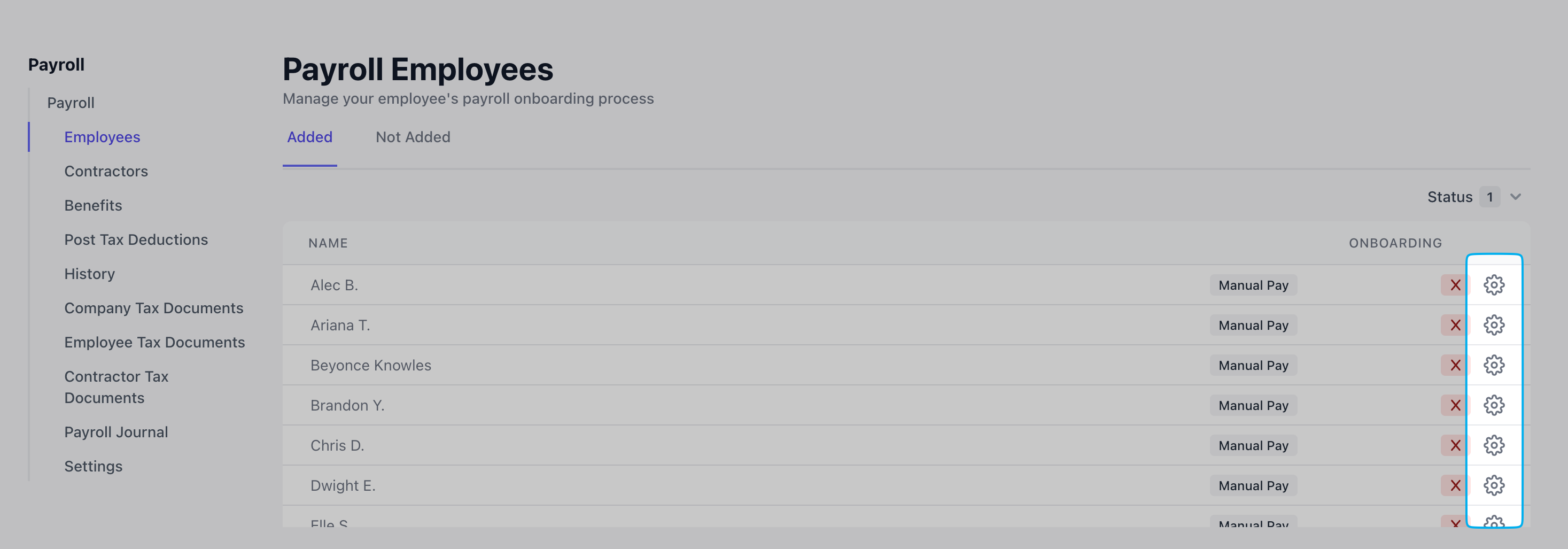

I am trying to send my employee their payroll onboarding link. Where can i find this?

I am trying to send my employee their payroll onboarding link. Where can i find this?

- Go to Finance → Payroll → Employees

- Locate the employee’s name and click the Gear icon next to it

- Choose Resend Payroll Onboarding Link → Save

Can my employee have their pay sent to two different bank accounts?

Can my employee have their pay sent to two different bank accounts?

Does Dripos file W-2 and 1099s on our behalf?

Does Dripos file W-2 and 1099s on our behalf?

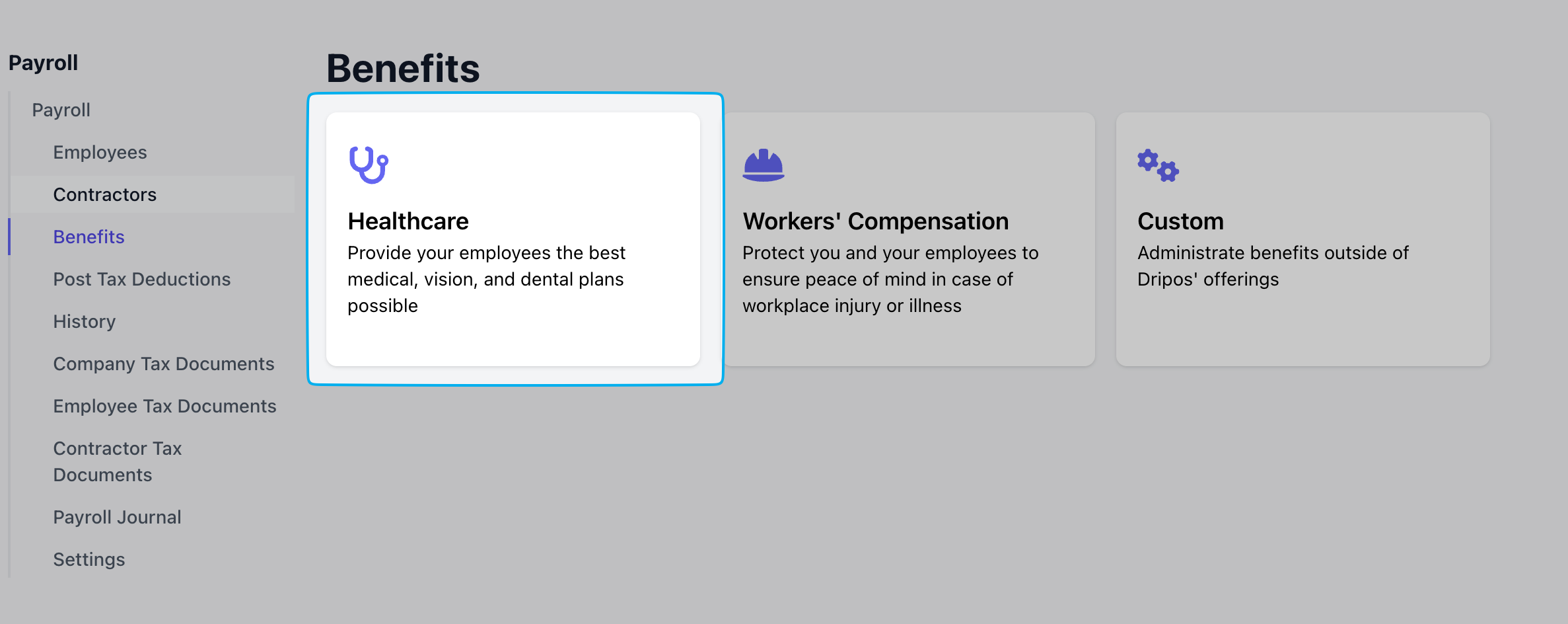

Does Dripos offer workers comp?

Does Dripos offer workers comp?

Does Dripos offer 401K or Roth options?

Does Dripos offer 401K or Roth options?

Can I offer Healthcare Insurance through Dripos to my employees?

Can I offer Healthcare Insurance through Dripos to my employees?

I've just terminated an employee, how do I go about paying their last payroll?

I've just terminated an employee, how do I go about paying their last payroll?

Payroll Taxes

Does Dripos file my payroll taxes?

Does Dripos file my payroll taxes?

What forms does Dripos file on my behalf?

What forms does Dripos file on my behalf?

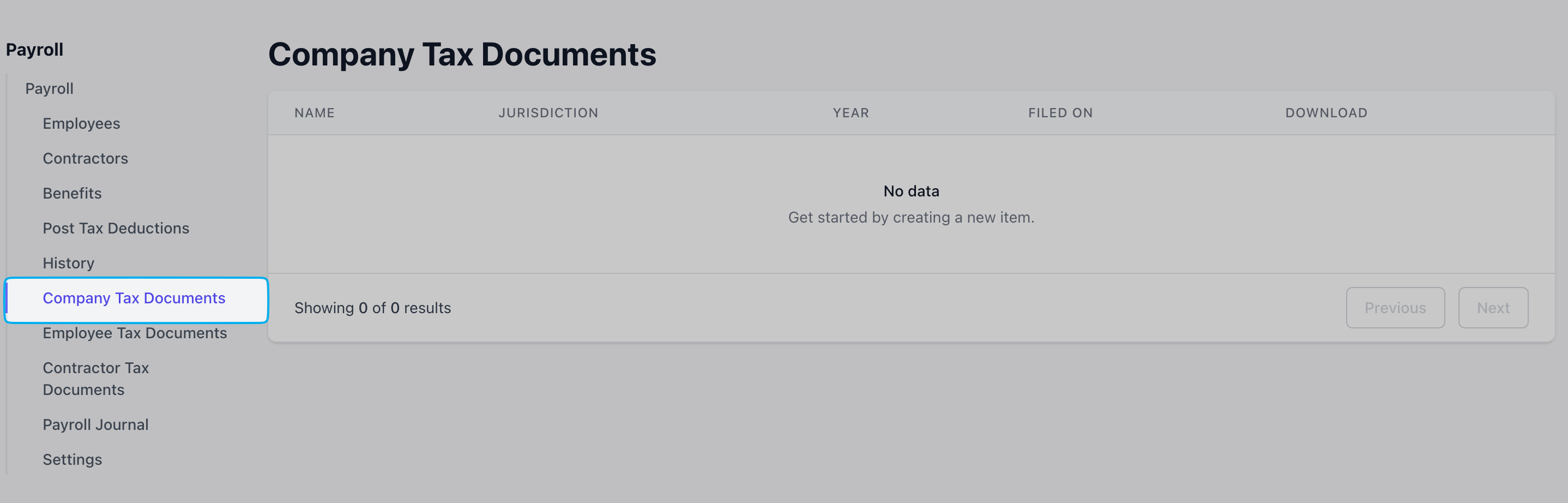

Where are my company tax documents that Dripos files?

Where are my company tax documents that Dripos files?

Manage Account

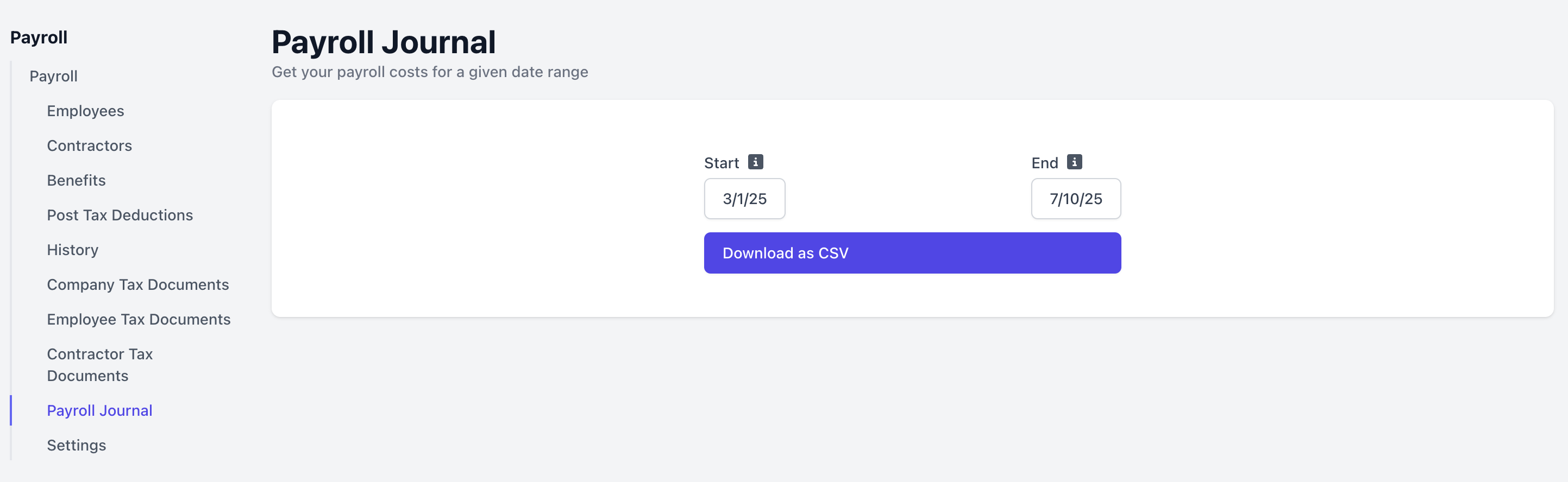

How can I export my entire payroll history?

How can I export my entire payroll history?

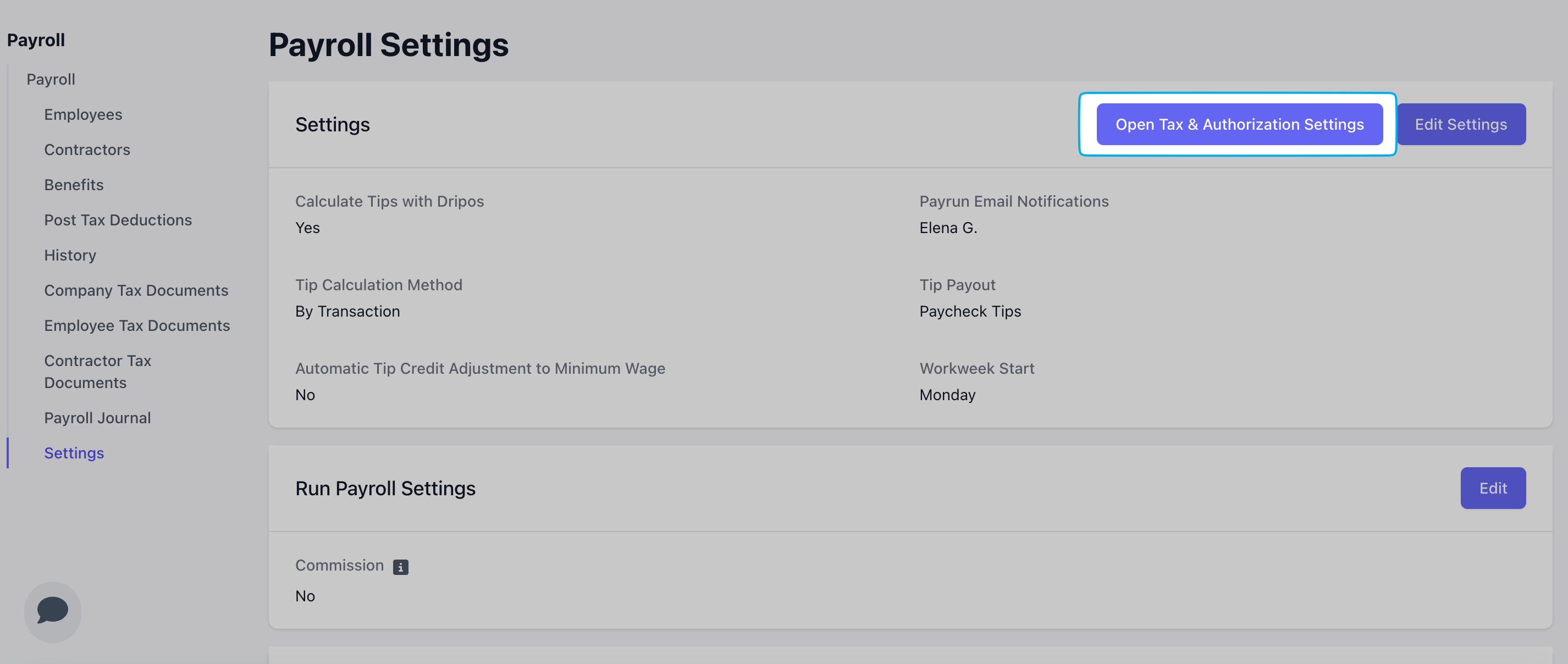

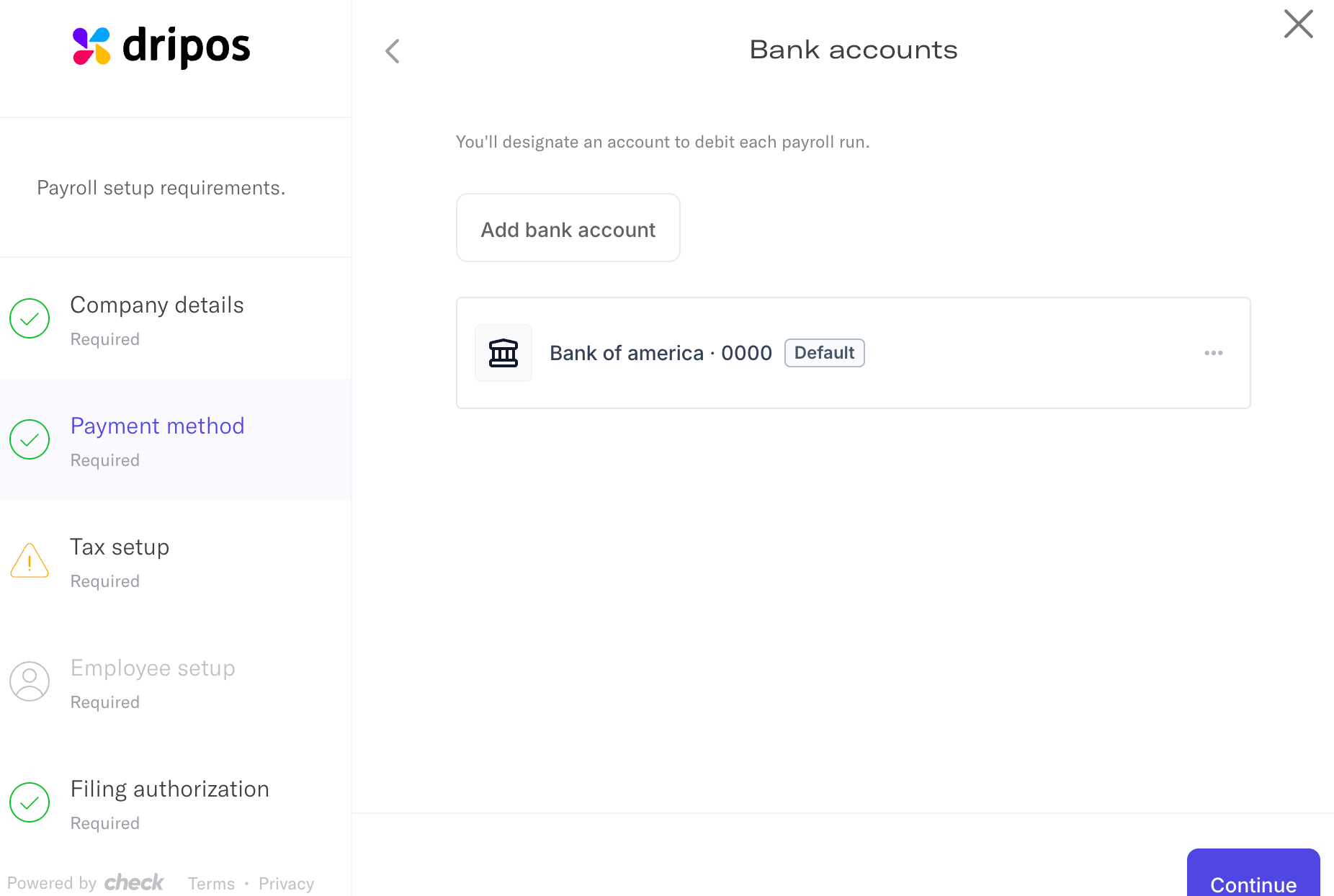

How do I change the bank account my payroll is debited from?

How do I change the bank account my payroll is debited from?